Recommendation

Develop tax policies that strengthen communities and the region

The region needs a tax system that provides ample opportunity for local governments to generate revenue that supports their plans, goals, and desired development patterns and their ability to adapt to changing local economic conditions. However, the State of Illinois has not taken steps to modernize the tax system for current technologies and economic patterns like online purchasing of goods, rising use of services instead of goods, increased intermodal development, and a growing preference for urban amenities throughout the region. Recent tax reform initiatives have been unable to overcome public concern that the tax burden is already too high. Any successful modernization effort must address this concern head on and make the case that a combination of improved approaches to provision of public services, changed taxes to respond to a modern economy, and appropriately tailored user fees can improve the services that taxpayers care about.

Under the current tax structure, communities without sales tax generating businesses or dense commercial development often have few revenue options sufficient to cover the cost of public services and infrastructure. However, as internet sales expand and consumers increase spending on services, many communities will no longer be able to rely on sales tax revenue to the same extent. Illinois has a narrow sales tax base focused on tangible goods and few services, which is out of sync with increasing market demand for consumer services. See the Fully fund the region’s transportation system recommendation in the Mobility chapter for a discussion of the potential to reform the sales tax to support the RTA sales tax as well as local governments. In addition, Illinois’ reliance on MFTs to fund the Illinois transportation system is becoming outmoded as vehicle efficiency improves and fuel consumption drops. Together, these changing mobility and purchasing patterns call for rethinking what revenues local governments receive to ensure the fiscal stability that local jurisdictions need to provide a strong quality of life.

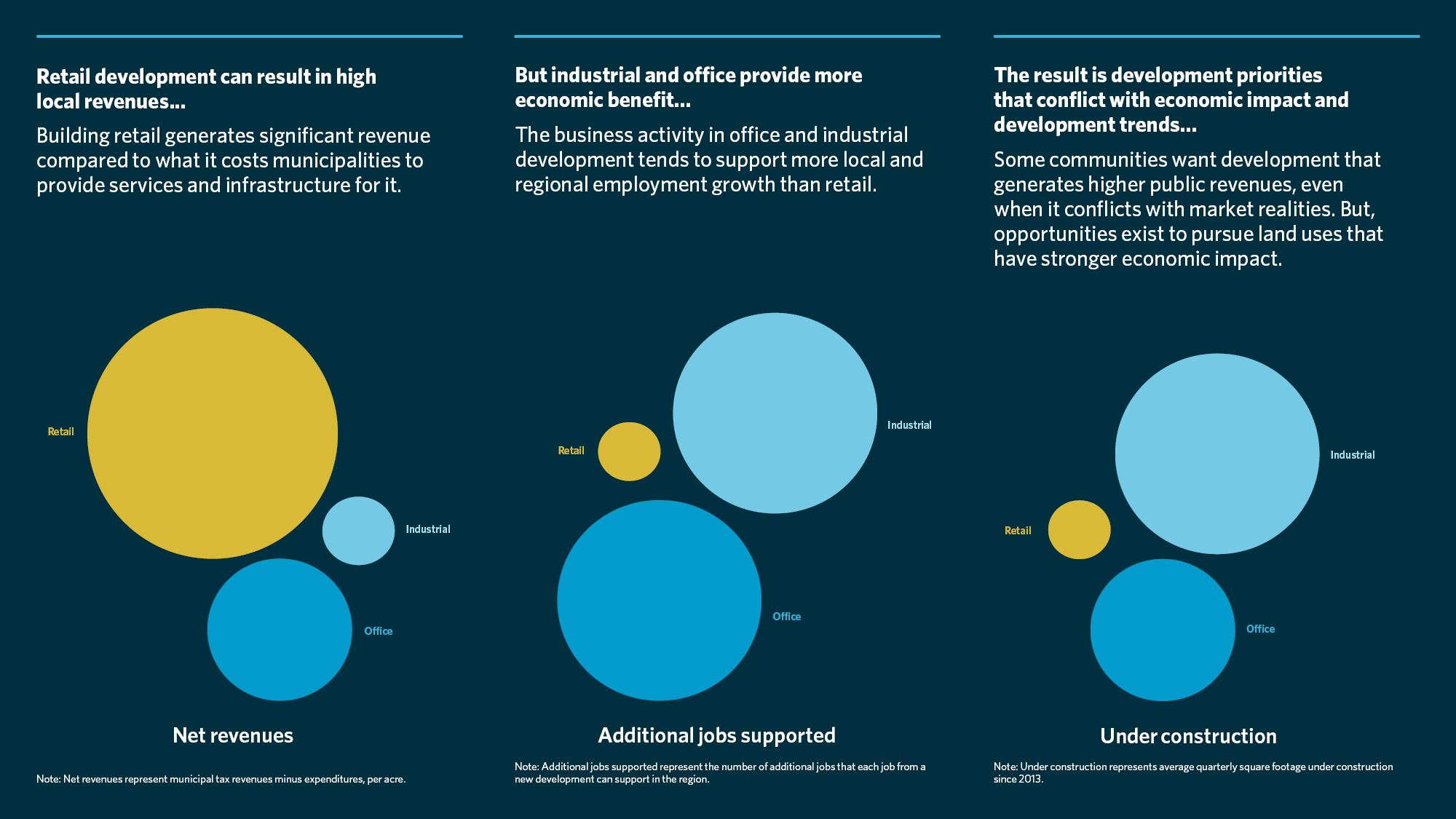

Retail vacancy in northeastern Illinois is already high relative to other regions, and competition for retail establishments may continue to grow. To further promote retail, some local governments limit space for development that does not generate sales taxes or other major revenues. For example, some communities exclude non-sales tax generating businesses from commercial areas. These choices reflect local preferences, but have large effects on the region’s built environment and ability to support economic activity at the regional scale. While often producing lower revenues, office and industrial development provide support for industries ranging from manufacturing, to goods movement, to business services, to corporate headquarters. Many communities aspire to promote these regionally beneficial industries, but current tax structures do not always offer options for municipalities to recoup the costs of these developments. For example, manufacturing facilities often produce little property tax revenue and generate truck traffic that imposes high wear and tear on local roads.

Strategies

Regionally, the current tax system does not always support the multijurisdictional nature of many industrial and office employment areas, which often cluster geographically and cross jurisdictional lines. The infrastructure that serves these centers can extend through many communities and is maintained by a complex web of jurisdictions. The region’s municipalities need additional tax structure and transportation funding options to support the service and infrastructure needs of these locally and regionally desired land uses. Additionally, the growing prevalence of internet sales may increase truck traffic on the entire roadway system, including roads serving warehousing and distribution businesses, and residential customers receiving deliveries.

Tax policies have a broad impact on the ability of local jurisdictions to provide services and keep infrastructure in a state of good repair. Individual municipal revenues depend on land use mix, size of the tax base, and state and local tax structure. Local policies on and willingness to match fees and taxes to service costs also play a role. For example, DuPage County consistently implements user fees such as development impact fees and a county-wide MFT. Costs grow from a combination of interrelated factors: locally defined needs, the amount and condition of infrastructure, and long-term debt and obligations.

Local governments do have options to better support their communities through local action, particularly through imposing user fees to support specific services and infrastructure. Since 2013, for example, Downers Grove has generated revenue for stormwater improvements by imposing a fee weighted toward properties that have the greatest impact on that system.

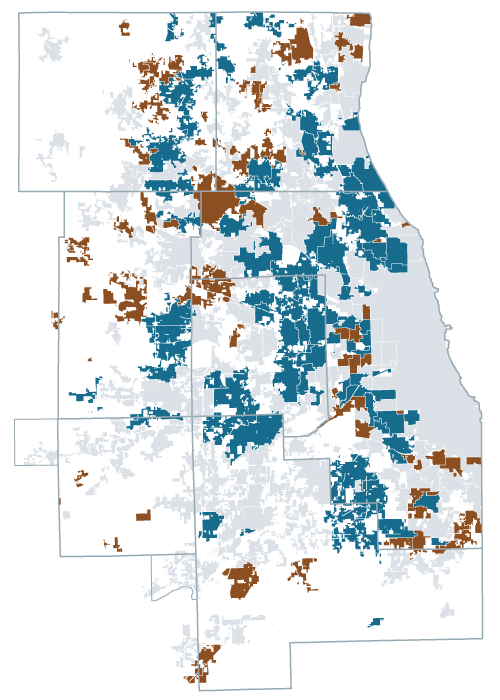

ON TO 2050 sets a target for reducing the number of municipalities that receive comparatively low levels of state revenues. State statutory criteria for revenue disbursements, like sales or motor fuel taxes, can create wide divergence in revenues among municipalities. State criteria to distribute funds to local governments vary from population, to retail sales, to lane miles, to other factors. These criteria do not take into account municipalities that may have a very low tax base compared to costs for basic services, nor do they account for infrastructure condition. In addition, the state’s own financial situation has caused local governments to experience reduced funding and increased uncertainty. Consistently provided state funds, such as the Local Government Distributive Fund, play a crucial role in local government budgets, but the State has not modernized its tax system nor developed a long-term plan to pay for its obligations. The following map illustrates the differences in state revenues distributed to municipalities in 2015. ON TO 2050 envisions that all municipalities will receive these state funds at levels greater than 80 percent of the regional median level by 2050.

- At least 20 percent less than the median (74)

- Within 20 percent of the median (119)

- At least 20 percent more than the median (92)

Communities with a low tax base and limited options for increasing revenue often face a sustained or recurring cycle of disinvestment. Many areas with lower tax disbursements overlap with EDAs, which perpetuates inequities and reduces opportunities for people and places to thrive. Achieving regional growth that includes EDAs may hinge on their residents and businesses having access to programs and services that many communities sometimes take for granted. Communities where revenues are low relative to their needs may struggle to fund municipal operations and infrastructure without imposing high tax rates, which further discourage commercial and residential development and cause the local tax base to grow more slowly than the cost of public services. This cycle of disinvestment is self-reinforcing and also drives the adoption of high tax rates that can be a significant burden on low income residents. Greater investment in these communities is integral to improving their fiscal health, and the prosperity of the region overall.

In Cook County, property tax classification is an additional factor that drives up commercial and industrial property tax rates, hurting disinvested communities in particular. This may discourage business investment in Cook County in favor of opportunities elsewhere. By using a higher assessment ratio for businesses than residences, this system allocates a higher share of the property tax burden to businesses -- a policy that does not exist in the collar counties -- deterring reinvestment and hindering resulting growth in the property tax base. In many communities, high commercial and industrial tax rates present a barrier to attracting development, even when infrastructure and infill opportunities are plentiful. By reforming its classification system, Cook County could grow the tax base over time and reduce the tax burden on residents, mitigating potential increased residential rates.

This recommendation appears in the Governance and Community chapters.

The following describes strategies and associated actions to implement this recommendation.

Develop new funding solutions to support the multijurisdictional nature of development and infrastructure

The state and region should evaluate and pursue revenue sources, infrastructure cost sharing, realignment of existing revenues, and tax policy shifts that take into account the multijurisdictional nature of retail, office, and industrial development. Movement of goods and people that supports the region’s economy must efficiently traverse multiple municipal boundaries and transportation networks. Yet many impediments could be surmounted, for example, through dedicated funding for local truck routes, prioritizing funding for improving commute options, increased local contributions for some infrastructure expansions, and other options. This work should build on CMAP's and partners' growing understanding of asset management, fiscal impacts, and subregional and regional markets to identify innovative revenue solutions or better align existing revenues to support infrastructure needs.

Modernize tax policies to sustain communities of all types

CMAP should continue to facilitate a regional perspective on the interaction of tax policy, land use, the economy, and successful communities. Assistance for local jurisdictions to improve planning processes and coordination can help, but it does not address systemic issues that affect communities’ ability to adapt to changing consumer preferences, technology, and mobility. Via policy changes addressing multiple revenue sources and identifying options to support office and industrial development, a reformed tax system could reduce market distortions and better support desired development and goals of the region’s communities, even in the face of a changing retail landscape. Reforms should be undertaken through a deliberative process in partnership with local governments, ensuring that communities are not negatively impacted.

Expand the sales tax base to additional services in a manner that helps communities create a more balanced land use mix, improves horizontal equity, minimizes economic distortions, and mitigates the cascading nature of sales taxes.

The State of Illinois

Phase out the property tax classification system to reduce commercial and industrial properties' current burden, which deters development and creates pressure for higher taxes overall.

Cook County

Reform state revenue disbursement criteria, addressing multiple revenue sources, to reduce wide divergences across municipalities, allow each municipality to support its own desired mix of land uses, and adapt to changing development patterns.

The State of Illinois

Coordinate with partners to promote tax policy changes to support better land use outcomes, including to conduct public education as well as legislative outreach.

CMAP

Engage in fiscally sustainable practices to ensure a stable business climate and guarantee the reliability of state support to the region, including for local governments, transit agencies, and nonprofit service providers.

The State of Illinois

Local governments should implement user fees

User fees and full cost pricing can help communities recoup the cost of providing road, parking, water, sewer, and other infrastructure. User fees should build on asset management, capital improvement planning, and other initiatives to ensure that infrastructure spending is a high priority to meet local needs and provide the strongest benefits. For example, some communities are addressing the increasing costs of stormwater management with dedicated taxes, stormwater utility fees, or special service areas, sometimes leveraging technical assistance from CMAP or other groups. Similarly, a number of communities have used CMAP’s LTA program to plan for and price their parking garages and metered spaces, making more effective use of tangible and fiscal assets.

All public utilities should adopt full cost pricing so they can sustainably fund operations and ongoing maintenance. While some local governments may choose to discount some services to meet local priorities, instead matching revenues to the cost of services will help the region’s communities achieve stable funding and greater resilience. These initiatives should provide options that account for the affordability needs of lower income residents.

Develop stormwater utility fees to assess the true cost of stormwater infrastructure and improve flood control infrastructure.

Local governments

Implement user fees to fund transportation infrastructure improvements, such as local MFTs or fees to address freight needs.

Local governments

Approve statute changes that allow non-home rule governments to impose additional types of user fees.

State of Illinois

Assess infrastructure costs to calibrate fees and taxes on development, parking, water, sewer, and other needs, both to cover current expenses and to create stable funding for the long term.

Local governments

Consider consolidating services with a neighboring community to reduce overall costs and provide options for low income residents, when faced with significant affordability barriers to full cost pricing of water and other utilities.

Local governments

Increase the motor fuel tax and replace with a road usage charge

Of the many states that have enhanced their transportation revenues in recent years, most enacted a MFT increase. The State of Illinois should increase its MFT by at least 15 cents in the near term and index the overall rate to an inflationary measure to offset the long decline in purchasing power of the current 19-cent rate that has been in effect since 1990. Similarly, the federal gas tax, set at 18.4 cents per gallon in 1993, should be increased and indexed to an inflationary measure, improving solvency of the federal Highway Trust Fund without requiring non-transportation revenue infusions.

However, the MFT no longer reflects the way people travel or the many types of vehicles on the road. Fuel efficiency has increased, which erodes revenue despite its environmental and consumer benefits, and projections suggest electric vehicles will become a much larger part of the fleet. Over the long term, then, the state and the federal government should replace their MFTs with a user fee that taxes actual use of the system, as with a per-mile road usage charge. Drivers already pay per mile under the current MFT, but the rate just varies based on the vehicle’s fuel economy. For replacing the Illinois MFT, charging 2 cents per mile and indexing it to an inflationary measure would provide a sufficient, stable revenue source. Any change should be accompanied by testing and analysis to ensure that a road usage charge is implemented and invested fairly.

This revenue source would benefit from a streamlined national solution that allows each state to collect mileage-based user fees from out-of-state drivers. In implementing a new revenue source, the state should also take the opportunity to lower the burden on lower income drivers by integrating measures not available in the current MFT structure. This strategy also appears in the Mobility chapter under the recommendation to Fully fund the region’s transportation system.

Increase the MFT by at least 15 cents per gallon and index the overall rate to an inflationary measure.

The State of Illinois

Begin necessary steps, including implementing pilot projects, to replace the MFT with a road usage charge of at least 2 cents per mile indexed to an inflationary measure.

The State of Illinois

Increase the federal gas tax rate, index it to an inflationary measure, and in the long term replace it with a per-mile road usage charge.

The federal government

Work with states to develop a national solution to implementing road usage charges at the state level.

The federal government