As the Illinois Jobs Now! state capital program comes to a close, some transportation and business leaders have led discussions to identify revenues for a new capital program. In May 2013, the Transportation for Illinois Coalition (TFIC) proposed to eliminate the state motor fuel tax (MFT) and remove motor fuel from the 6.25-percent state sales tax base, which would then be replaced with an 18-percent wholesale tax on motor fuel. The proposal includes a hold-harmless provision that would return an amount equivalent to the revenues from the existing 6.25-percent state sales tax to the general revenue fund. After accounting for this hold-harmless provision, the proposal amounts to an effective 11.75-percent motor fuel sales tax rate for transportation. Further, TFIC proposes increasing both vehicle registration fees and certificate-of-title fees by $10 annually. Together, the wholesale tax and new fees would bring in a total of $1 billion in new revenues annually for the transportation system, as estimated by TFIC.

With these new revenues, TFIC proposes spending 80 percent of the new revenues on roads, bridges, the CREATE freight rail program, and airports. The remaining 20 percent of new funds would be dedicated to transit and rail improvements. Of the new revenues raised, 60 percent would be spent annually through a pay-as-you-go program and 40 percent would be dedicated to support a bond program. Further, the TFIC proposal would streamline the flow of transportation funds in Illinois, although no specifics are yet available; the proposal also does not discuss the allocation of existing transportation revenues. This Policy Update analyzes the proposed MFT sales tax swap, focusing on the substantial impacts of volatility in fuel prices on revenue yields and equity.

Volatility

TFIC argues that an MFT-wholesale tax swap would address the MFT's vulnerability to inflation, because sales tax revenues would rise with prices while MFT revenues remain constant per gallon. Earlier this year, Virginia became the first state to implement an MFT-motor fuel sales tax swap.

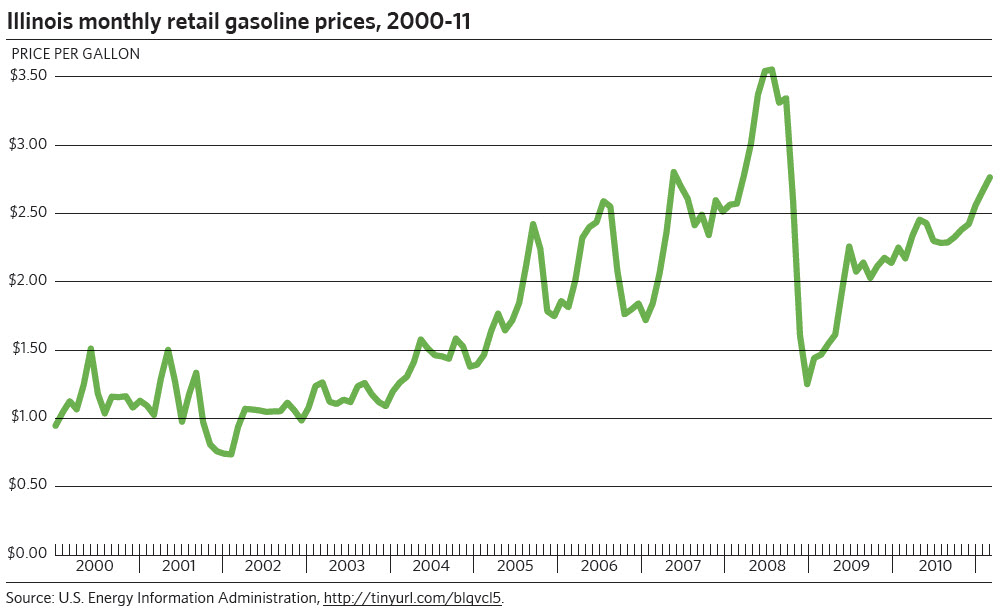

Gas prices have risen over time, and, under the proposed swap, wholesale tax revenues would have risen in tandem. However, the price of gasoline is unstable, changing from day-to-day and week-to-week. This volatility has been especially pronounced over the past decade due to political instability in oil-producing regions, large natural disasters, and major shifts in larger economic activity. The following chart shows the average retail price of a gallon of gasoline in Illinois from 2000-11. During that period, prices ranged from as little as $0.74/gallon in early 2002 to as high as $3.55/gallon in the summer of 2008, representing a nearly five-fold increase in price between those two extremes.

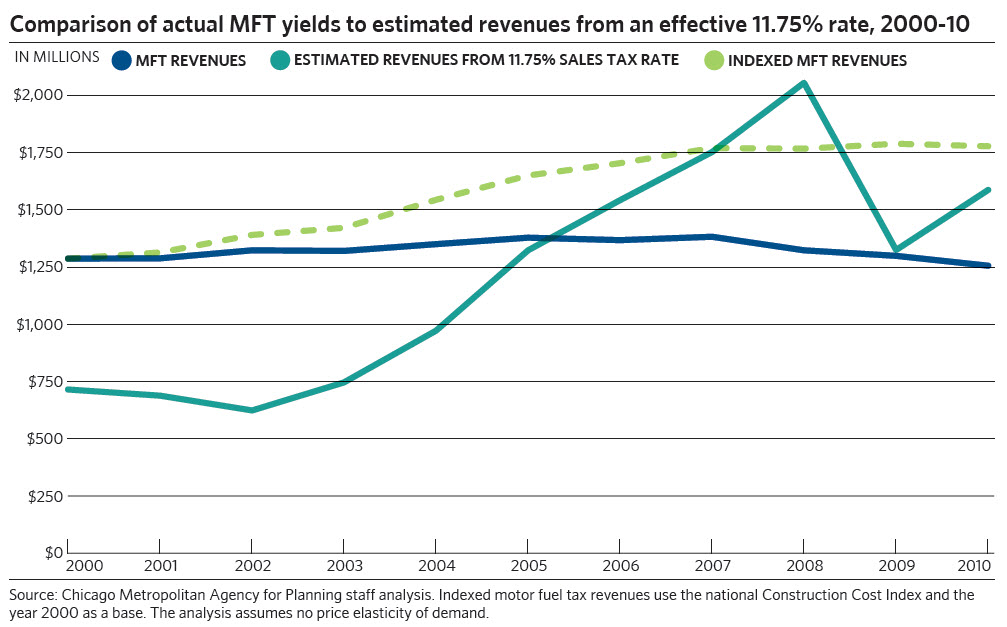

The following chart compares revenue estimates from an effective 11.75-percent motor fuel sales tax rate to the actual revenues from the state MFT, as well as the estimated revenues from an MFT that was indexed to inflation in construction costs beginning in 2000. GO TO 2040 calls for an 8-cent increase in the state MFT, indexed to inflation.

The actual MFT revenues demonstrate a fairly consistent revenue yield (about $1 billion) between 2000 and 2010, and the indexed MFT would have initially experienced a gradual increase in revenues, with receipts leveling off after 2007. In contrast to both the MFT and indexed MFT, revenues from the TFIC-proposed sales tax-based sources would have varied considerably during between 2000 and 2010. The effective 11.75-percent motor fuel sales tax rate, for example, would have brought in $2.1 billion in 2008, but only $625 million in 2002 -- a more than 200 percent change in only six years. Furthermore, it would have raised $2.1 billion in revenues 2008 but only $1.3 billion in 2009, representing a decline of about 35 percent in only one year.

Transportation projects can be long and expensive. Complex, multiyear projects depend on stable, predictable revenue sources to be adequately financed and completed on time. Additionally, some programs of projects must be completed in a logical sequence to minimize traffic disruption, take advantage of economies of scale, and meet engineering requirements. A revenue stream largely driven by the price of gas could undermine the State's ability to properly plan for its capital improvements. Furthermore, a highly volatile revenue source may prove to be less attractive to investors, limiting the State's ability to issue bonds off a motor fuel sales tax.

Equity

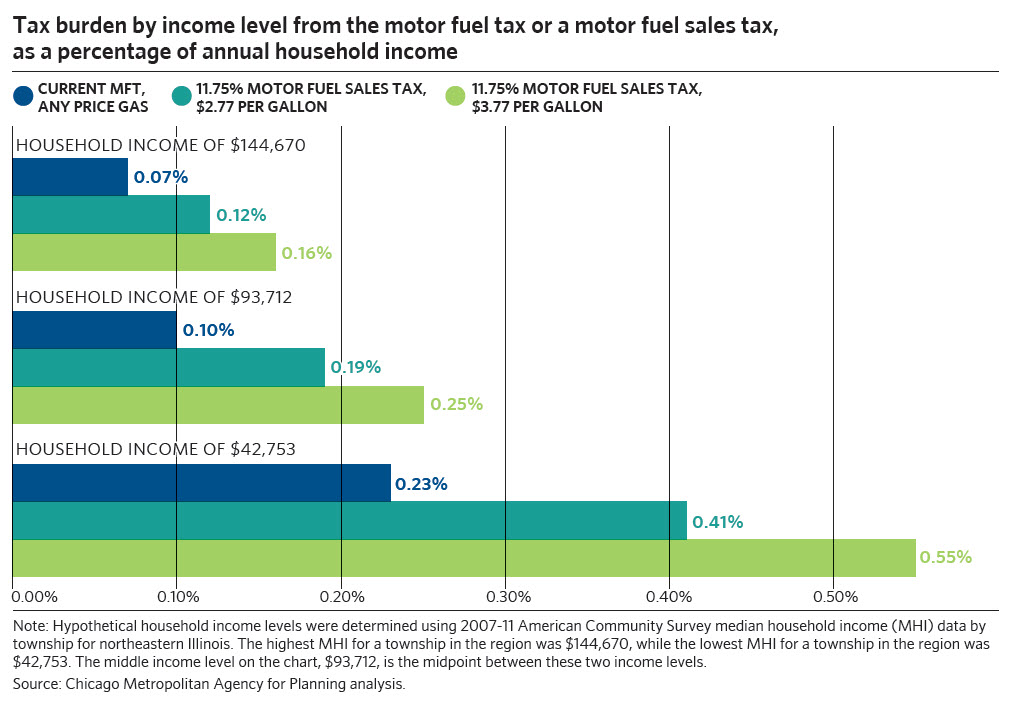

In terms of equity, the per-gallon MFT is already considered somewhat "regressive," since low-income households typically spend a larger percentage of their income on gas relative to higher income households. Sales taxes are also typically regressive, which would be further exacerbated by large upward fluctuations in fuel prices. The following chart shows the proportion of household income that would be spent on the current MFT versus an 11.75-percent motor fuel sales tax rate. The proposed motor fuel sales tax is then shown under two different base gas prices, before taxes: $2.77 and $3.77. The burden is compared among lower ($42,753), middle ($93,712), and higher income ($144,670) households.

Each bar on the chart represents a given tax and income level for a household driving 12,000 miles per year in a lower fuel economy vehicle that gets 23.6 miles per gallon on average. The proportion levels may be higher or lower depending on actual levels of driving and vehicle fuel economy.

Currently, a household with income of $42,753 pays up to 0.23 percent of their annual income toward the current state MFT, while a household with income of $144,670 would only pay up to 0.07 percent annually. This dynamic remains the same regardless of the price of gas, since the current MFT is imposed on a per-gallon basis.

However, under a proposed 11.75-percent motor fuel sales tax rate and assuming a base gas price of $2.77, households with income of $42,753 would pay up to 0.41 percent of their income (a 0.19 percentage point increase over the current MFT). Meanwhile, a household with income of $144,670 would pay 0.12 percent of their income (only a 0.05 percentage point increase over the current MFT). These differences become more marked as gas prices rise to $3.77. In this scenario, a household with income of $42,753 would pay 0.55 percent of their income (a 0.32 percentage point increase over the current MFT), while a household with income of $144,670 would pay 0.16 percent of their income (only a 0.09 percentage point increase over the current MFT).

If the 19-cent MFT were indexed annually to an inflationary measure, households would experience a greater tax burden over time compared to the current MFT. However, unlike the proposed motor fuel sales tax in which regressivity always increases with the price of gas, the regressivity of an inflation-indexed MFT would only increase if income levels did not keep pace with inflation.

In sum, while the existing per-gallon MFT is already a regressive tax, an 11.75-percent sales tax rate on fuel is almost guaranteed be more regressive, and this dynamic will intensify as fuel prices rise. The only scenario (not shown on the chart) in which a sales tax on gas would be less regressive than the current MFT is if fuel prices were to fall to a level much lower than today. Specifically, a base price of $1.43 per gallon would result in the same level of regressivity for both taxes, and below this point a sales tax on gas would actually be less regressive than a per-gallon MFT. Of course, Illinois fuel prices have generally been far above base prices of $1.43 per gallon in recent years, and fuel prices tend to be higher in the Chicago area than the State as a whole.

Conclusion

TFIC proposes an overhaul of how Illinois pays for transportation projects. CMAP supports this kind of robust statewide discussion, and many aspects of the TFIC proposal are consistent with the principles adopted on May 1, 2013, by the CMAP Board to guide the development of a new state capital program. CMAP supports new user-fee generated revenues, a movement toward more performance-based funding, and the provision of dedicated capital funding for transit.

CMAP's analysis of this proposed tax swap shows that the volatility of a motor fuel sales tax could be substantial, making it difficult for implementing agencies to effectively plan for transportation investments. This volatility would also mean that the burden on lower income households could change substantially depending on the price of gas. Nevertheless, gas prices have generally risen over time, so revenues from a motor fuel sales tax may track inflation better than the traditional MFT. It is also important to note that using gasoline consumption as the basis for taxation, whether for the traditional MFT or a motor fuel sales tax proposal, will become increasingly less tenable over the long term as fuel economy continues to improve. CMAP's analysis of the recently-announced federal Corporate Average Fuel Economy (CAFE) standards suggests that MFT receipts could decline by one third by 2040 compared to original forecasts.

CMAP is encouraged that serious discussions are underway about the need to invest in our transportation infrastructure. The TFIC proposal recommends only one initial scenario -- a major tax swap -- as a method for raising more revenue. Another scenario could simply be to raise and index the existing MFT, as GO TO 2040 recommends. CMAP also believes it is essential to implement performance-based funding for transportation -- a transparent, accountable, and merit-based approach to prioritizing projects, as described at www.cmap.illinois.gov/performance-based-funding/. CMAP encourages the state's policymakers to broaden the conversation to address these issues and will monitor these activities closely in coming weeks as the legislative season unfolds.