In December 2012, the Government Accountability Office (GAO) released a report on vehicle miles traveled (VMT) fees, a per-mile charge for a driver's use of highways. The GAO report summarizes the case for VMT fees, reviews pilot programs in the U.S., and describes international case studies. The report finds that VMT fees can be implemented fairly and can provide incentives for more efficient use of highway facilities through congestion pricing. Further, VMT fees can be structured to promote other policy goals, such as improved fuel economy.

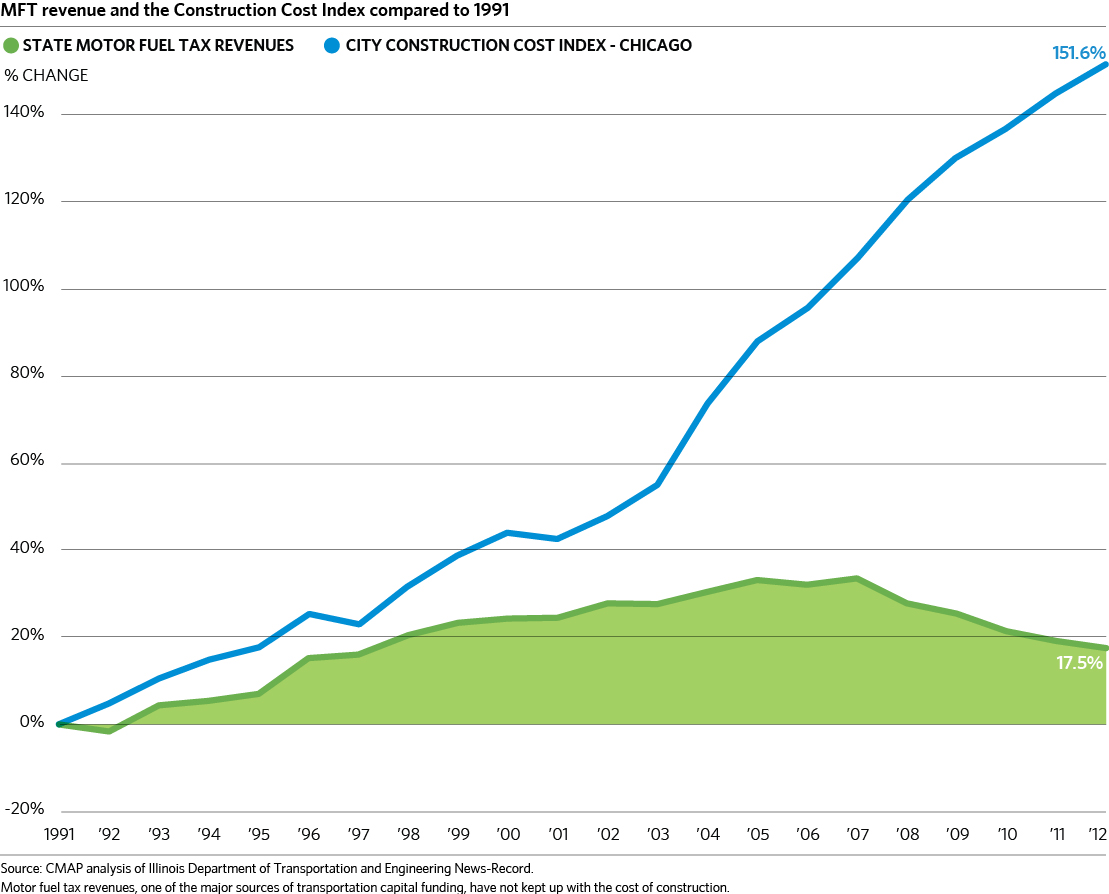

Many have offered VMT fees as a long-term, sustainable source of transportation revenue, including a national commission on transportation finance. The federal and state governments have largely relied on gas taxes to pay for transportation spending, but these revenue sources have increasingly fallen short of investment needs. Such taxes are levied on a per-gallon basis and have failed to keep pace with inflation and improvements to fuel economy. To illustrate, the construction cost index for the City of Chicago has increased over 150 percent since 1991, in contrast with state motor fuel tax revenues that only increased by 17.5 percent over the same time period. Moreover, hybrid and alternative fuel vehicles pay little to no gas taxes. In contrast, a VMT fee would be assessed on a vehicle's total travel, avoiding issues of fuel efficiency or vehicle technology and ensuring all road users pay to maintain the highway system.

Click image to enlarge.

The GAO considered three approaches to implement a VMT fee:

- The first would require a GPS-based system to track each vehicle's total travel, calculate the fee, and mail an invoice to the driver. This approach would allow for sophisticated pricing systems that could charge differential rates based on congestion levels or a driver's income. However, it would require large startup costs and mandating GPS devices in every vehicle could be seen as an invasion of drivers' privacy.

- The second would require wireless transponders in vehicles and fuel pumps to report odometer readings to a central billing office, allowing the VMT fee to be paid when refueling a vehicle. This approach eliminates the privacy concerns of a GPS-based approach but also requires significant startup costs and foregoes more sophisticated pricing systems. It would fail to ensure that hybrid and alternative fuel vehicles pay their share for highway maintenance and construction.

- The third approach would require drivers to purchase prepaid "miles" as indicated by a paper license mounted to a vehicle's windshield. This low-tech approach would benefit from its low startup costs, few privacy concerns, and ability to be implemented for all vehicles. However, it also would not permit sophisticated pricing and could be easily evaded by drivers.

The GAO considered three illustrative rates for a national VMT fee. According to the GAO's analysis, a 0.09¢/mile fee would be sufficient to replace current federal motor fuel tax revenues, a 1.5¢/mile fee would be adequate to cover current federal spending levels on transportation, and a 2.2¢/mile fee would "maintain existing conditions and performance." An illustrative passenger sedan that achieves 22 miles per gallon would pay $108, $168, and $246, respectively, each year under these VMT rates. That same car would currently pay $96 annually in federal gas taxes.

GO TO 2040 recognizes the current issues facing transportation funding in our region. The plan recommends an 8-cent increase in the state gas tax in the near term but acknowledges the need for a long-term replacement for the gas tax. The plan also encourages pursuing innovative financing strategies such as value capture and appropriate public-private partnerships.