Prior to the recession, new single-family development occurred on the region's outer edges and new multifamily permits were concentrated in the City of Chicago. Overall, the number of permitted new residential units in metropolitan Chicago continues to recover from recessionary lows, and the number of single-family permits within already-established areas grew during and immediately following the recession. However, with the exception of 2012, development of multifamily housing has been increasingly concentrated in Chicago. This effectively limits housing choice for suburban residents. GO TO 2040 recommends providing a balanced supply of housing types throughout the region, offering housing choice for the region's residents at all stages of life. This Housing Policy Update examines residential building permit trends in metropolitan Chicago through the third quarter of 2013.

This analysis focuses on building permit data provided by the U.S. Census. Data is available for single-family structures -- including townhomes -- and for multifamily buildings with two or more units. However, the building permit data does not provide information regarding whether these units are for rent or for sale. Instead, this Housing Policy Update focuses on where new single-family and multifamily development is occurring in the region. For more information on tenure patterns, see prior Updates on single-family tenure changes and rental multifamily housing development trends.

Total Residential Permits on the Rise

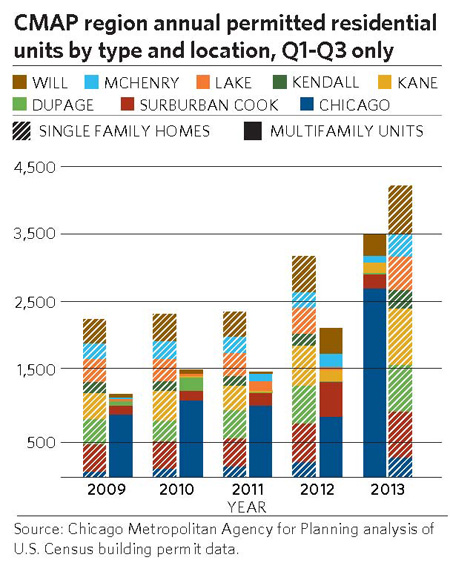

Through the third quarter of 2013, residential building permits were already on par with the full-year total for 2012. Single-family building permits through the third quarter of 2013 were 32 percent higher than in the same quarter of 2012. Over the same time period, multifamily permits rose by 63 percent compared to the third quarter of 2012. Increases for both residential development types have moderated since the first half of 2013, when single-family permits were up by 40 percent and multifamily permits had nearly doubled as compared to the first half of 2012.

Click for larger image.The region also continues to experience increased parity between permitted multifamily and single-family units. Prior to the recession, multifamily units generally comprised 25 percent to 35 percent of total permitted units. Since the recession, new multifamily units have generally been 40 percent to 50 percent of total permitted units. As the region continues to recover from the recession, it is likely that the balance will shift back to single-family permits.

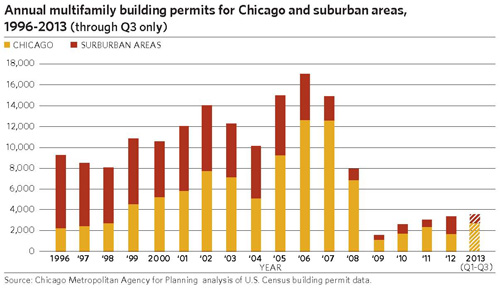

Multifamily Permits Shift Back to Chicago

In 2013, multifamily permitting totals were largely driven by strong growth in the City of Chicago. This is in contrast to 2012, when suburban jurisdictions issued approximately half of the region's multifamily permits. Through the third quarter of 2013, permitted multifamily units in Chicago were 213 percent above permits at the same time in 2012, and they were also greater than Chicago's total annual permitted multifamily units for 2009-12. In contrast, multifamily permits in suburban areas are 39 percent below their equivalent 2012 levels. While multifamily permitting is somewhat irregular due to the large number of units in any one development, this represents a significant shift of multifamily development back into the City of Chicago in 2013.

While suburban portions of the region issued a steady 5,000 to 7,000 multifamily permits annually prior to 2005, Chicago's total increased in most years. After 2005, multifamily permitting declined in suburban areas and continued to grow in Chicago. Between 2005 and the third quarter of 2013, Chicago issued permits for 74 percent of the region's multifamily units.

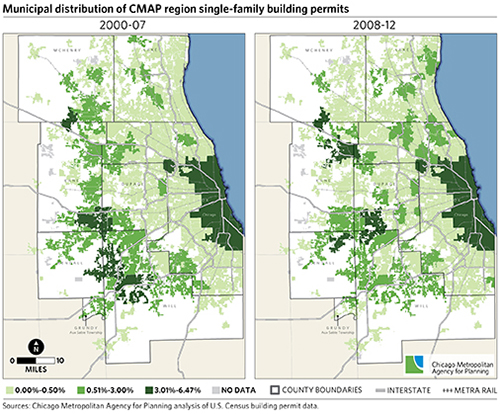

Click for larger image.More Single-Family Permits Following the Recession are in Already-Developed Areas

Overall, single-family permitting from 2009-12 was more concentrated in already-established communities compared to prior to the recession, when permits were concentrated in growing outer and southwestern communities. The following maps highlight the trends for both time periods. In these maps, the darkest green municipalities each contain at least 3 percent of the region's single-family permits for the time period shown. The medium green areas have between 0.51 percent and 3.0 percent of the region's permits. In the 2008-12 time period, a number of the region's more mature communities transitioned to a darker green, meaning a higher proportion of the region's single-family permits were issued in already-developed areas. The communities experiencing the most gains generally overlap with higher income townships in the region. This may indicate a combination of better access to credit for higher income buyers and housing location preference for these areas.

Click for larger image.Single-family permits through the third quarter of 2013 saw a re-emergence of pre-recession trends, with some outer municipalities like New Lenox, Oswego, and Pingree Grove increasing their proportions of the region's new single-family housing permits compared to 2008-12 trends. Similarly, over the same time period percentage increases in single-family permits compared to the third quarter of 2012 have been largest in Kendall, Kane, and McHenry Counties, which experienced 54 percent, 42 percent, and 41 percent increases, respectively. In raw numbers, Kane, Will, and DuPage Counties experienced the largest increases in single-family permits.

Click for larger image.Housing Change and GO TO 2040

Local governments play an important role in implementing the livability principles of GO TO 2040, particularly with regard to creating local land use ordinances and approving new development that supports livable communities. GO TO 2040 recommends that municipalities encourage development that provides housing choice for the region's residents. A balanced supply of housing types and owner- and renter-occupied housing is critical to the success of the region. Housing choice can support a more economically viable region by promoting better access to jobs, reducing commute times and congestion, and providing access to key services and amenities.

Multifamily development, whether for sale or for rent, is an important component of providing housing options. However, with the exception of 2012, the regional trend has been increasingly tilted toward development of multifamily residential units primarily within the City of Chicago. This can effectively limit housing choice for the suburban residents. Although this development pattern is driven in part by market considerations, municipalities can encourage multifamily development by revising land use ordinances and policies that might currently limit the potential for multifamily development.

Single-family homes comprise the majority of the region's housing stock and also provide an important housing option for the region's residents. Single-family housing can be developed at a range of densities and can be located within new subdivisions or on infill and redevelopment sites in existing areas. Prior to the recession, single-family development was concentrated at the edges of the region. In 2013, this trend is again emerging. While GO TO 2040 recognizes that the region will experience some expansion, the plan recommends that most development should occur within already-developed areas and utilize existing infrastructure assets. While the region experienced more infill development from 2005-09 compared to earlier in the decade, development of new housing at the edge of the region's developed areas undermines this trend.

GO TO 2040 recognizes that the region's diverse community types are a strength and does not recommend increasing density for its own sake. Instead, the plan recommends that municipalities plan for livability by pursuing opportunities for more compact, walkable, and mixed-use development and by providing a range of housing options. Livability can often be supported by denser, mixed-use development. Local interpretations of livability principles should consider community character when determining appropriate densities, types of mixed-use development, specific methods for affordable housing provision, and so on.

Finally, CMAP supports communities in planning for housing through the Homes for a Changing Region program. This process enables municipal leaders to chart future demand and supply trends for housing in their communities and to develop long-term housing policy plans that help create a balanced mix of housing, serve current and future populations, and enhance livability.