Roughly once every ten years, the State of Illinois provides a capital funding package for transportation and other infrastructure projects. The most recent packages, Jump Start and Illinois Jobs Now!, were both enacted in 2009 and are often referred to as a "$31 billion" package to support investment in transportation, schools, and other public facilities. About half of that total consists of traditional pay-as-you-go federal and state resources, along with federal stimulus money from the American Recovery and Reinvestment Act. The other half of the package consists of bonds. Bond financing is particularly important for the transportation component of the program, which includes about $5.5 billion in bond authorizations or appropriations for state highways and bridges and about $4 billion in bond authorizations or appropriations for transit, rail, and aviation projects. The enabling legislation for Illinois Jobs Now! established a new Capital Projects Fund to cover debt service for the majority of the transportation bonds, with the revenues to be provided by new taxes and fees.

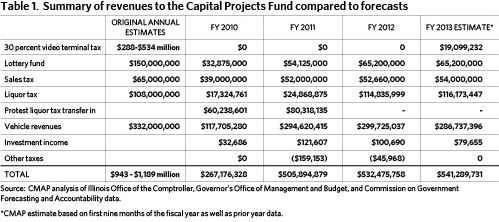

However, several of the new revenue sources, such as video gaming, have come up substantially below revenue projections. These sources were expected to generate about $1 billion annually but have only raised a little more than half that amount in recent years. Revenue shortfalls occurred for a number of reasons in part due to delayed implementation of video poker licensing until October 2012. In addition, many communities have passed local ordinances banning video poker games. The following table provides an overview of revenues by source.

This revenue shortfall jeopardizes the ability of the state capital program to fund projects. If balances are insufficient, the Capital Projects Fund's enabling legislation provides for transfers from the Road Fund to cover debt service payments for bonds issued before January 1, 2012. The Road Fund provides pay-as-you-go funding for highway and bridge projects, as well as operational funding for the Illinois Department of Transportation. According to the Commission on Government Forecasting and Accountability, over $27 million in transfers were made between fiscal year (FY) 2010 and the first half of FY 2012. However, these transfers must be repaid from the Capital Projects Fund to the Road Fund when the monies become available. Since it is unclear when the Capital Projects Fund will meet its original revenue projections, attempting to meet obligations with transfers from the Road Fund may not be a viable strategy.

Data from the Illinois Comptroller provides a sense of how this shortfall in revenues has affected the State's ability to issue bonds in support of Illinois Jobs Now! In Illinois, three bond funds support transportation investment: Transportation Series A for highways and bridges; Transportation Series B for transit, rail, and aviation; and Transportation Series D for roads and bridges. Debt service for Series A comes from the Road Fund, debt service for Series B comes from the General Fund (for Jump Start bonds) and new Capital Projects Fund (for Illinois Jobs Now! bonds), and debt service for Series D comes from the new Capital Projects Fund. The most recent data is available for FY 2011, with FY 2012 data expected to be released in June 2013.

As of June 2011, over 82 percent of the Transportation Series A bonds authorized by Jump Start for highways and bridges had been issued. In contrast, about 45 percent of the all Transportation Series B bonds authorized for transit, aviation, and rail -- including those from Jump Start and Illinois Jobs Now!, as well as previous capital programs -- had been issued. And about only 30 percent of the Transportation Series D bonds that Illinois Jobs Now! authorized for highways, local governments, and other transportation improvements had been issued.

Note that Illinois Jobs Now! was fully appropriated, but not fully authorized, in 2009. In other words, the Illinois General Assembly approved the overall level of spending for the program in 2009, but did not approve the full amount of bonds necessary to finance that spending. Those bond authorizations have been parceled out over the course of several years. Therefore, the high-level authorization figures do not match the total amounts appropriated under the program.

CMAP believes it is imperative for state policymakers to provide adequate financing for future state capital programs. GO TO 2040, the comprehensive regional plan for metropolitan Chicago, calls on the state to increase the motor fuel tax (MFT) by 8 cents per gallon and to index the MFT to inflation. The plan recognizes that gas taxes will eventually need to be replaced by more efficient user fees as more vehicles switch to fuel-efficient and alternative-fuel vehicles, but a short-term increase in the MFT would ensure adequate revenues for the next state capital program.