Newly passed fuel economy standards that will help reduce oil consumption will negatively affect the amount of motor fuel tax (MFT) revenues available to fund transportation projects in the future, highlighting the need for better ways to fund improvements.

On August 28, 2012, the National Highway Traffic Safety Administration (NHTSA) issued a rule finalizing higher fuel economy standards for passenger vehicles and light duty trucks. Corporate Average Fuel Economy (CAFE) standards in this rule, together with projected U.S. Environmental Protection Agency (U.S. EPA) standards for carbon dioxide emissions, set the stage for a reduction in carbon dioxide emissions equivalent to 54.5 miles per gallon (MPG) for passenger cars by model year 2025.

This fuel economy standard builds on a 2010 rule that raised CAFE standards to an equivalent of 35.5 MPG by model year 2016. That rule affected vehicles in model years 2012-16, while the more recent 2012 rule sets final standards for vehicles in model years 2017-21. The 2012 rule also estimates standards for vehicles in model years 2022-25. The CAFE standards were first enacted by Congress in 1975 to reduce the nation's energy consumption by increasing the fuel efficiency of cars and light trucks. In its press release announcing the final 2012 rule, NHTSA estimated that the tighter CAFE standards would reduce U.S. oil consumption by 12 billion barrels and save drivers $1.7 trillion in fuel costs in total.

While stricter CAFE standards should provide national and household cost savings and air quality benefits, reducing fuel consumption under the current tax structure will reduce revenues dedicated to transportation. The MFT has been the centerpiece of federal and state transportation funding for decades. Moreover, MFTs are not indexed to inflation and have lost substantial purchasing power over time. Political leaders at both the federal and state levels have been reluctant to raise these taxes; the federal MFT was last raised in 1993 and the Illinois motor fuels tax was last raised in 1990.

Receipts from both the federal and state gas tax constitute nearly one quarter of GO TO 2040's financial plan for transportation, which forecasts a total investment of $385 billion for our region's transportation investments between 2011 and 2040. Based largely on historical receipts over the last 20 years, the GO TO 2040 forecast estimates that state MFT revenues will grow at an annual rate of 1 to 1.4 percent, which is below the rates of inflation and of expected growth in construction costs. As a near-term solution to this funding problem, GO TO 2040 recommends that the state MFT be increased by eight cents and indexed to inflation, using the consumer price index, construction cost index, or a transportation materials cost index to do so. GO TO 2040 also recommends that the federal MFT be raised and indexed to inflation.

Potential Impacts to State MFT Revenues

Over the long term, the adjusted CAFE standards may have a serious impact on the ability of federal, state, and local governments to fund transportation. To illustrate, GO TO 2040 estimates $23 billion in state MFT revenues at the current tax rate between the years 2013 and 2040. This includes funding for state projects as well as disbursements to counties, townships, and municipalities in northeastern Illinois. Given the tighter fuel economy standards announced over the past two years, CMAP's preliminary estimate is that these receipts may decline over 36 percent within this same time period. This figure assumes no increase in the tax rate and is based on a number of preliminary CMAP assumptions about the changing characteristics of the vehicle fleet resulting from the new fuel standards.

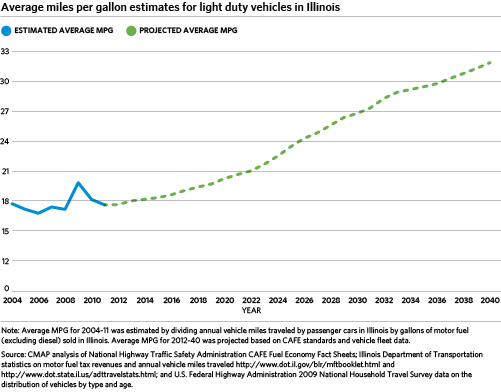

The chart below illustrates CMAP's current estimates of the change in average MPG over the 2013-40 period for light duty vehicles due to the new CAFE standards. To develop these estimates, CMAP staff considered the new MPG equivalent requirements and targets as described in the new NHTSA rule, reduced those fuel economies by 20 percent to better reflect on-road performance, and applied those fuel economies to an estimated mix of passenger cars and light trucks in the vehicle fleet. The vehicle fleet was further disaggregated by age, with appropriate fuel economies assigned to the different age groups for passenger cars and light trucks. Finally, average fuel economies were adjusted to reflect estimates of fuel economy specific to Illinois in 2011. In addition, modest increases in fuel economy for heavy duty vehicles (e.g., trucks and buses) were also assumed to occur during the time period, although this work is not reflected in the chart below.

Without implementing GO TO 2040's recommendations to raise and index the MFT in the short term and replace it in the long term, the MFT will continue to lose purchasing power, and higher fuel economy standards will only accelerate this decline. GO TO 2040 also encourages the region to adopt innovative transportation revenue sources such as congestion pricing and to also consider a tax on total vehicle-miles traveled (VMT) as a long-term replacement for the MFT. These funding sources preserve the "user pays" principle in transportation finance and hold better promise for long-term fiscal sustainability.