In Illinois, municipalities and counties receive sales tax revenue based on the location of sales. This structure has resulted in the rise of an economic development incentive called a sales tax rebate, in which municipalities and counties agree to rebate a portion of sales tax revenue generated in a business development back to businesses and developers.

Sales tax rebates are one tool that municipalities use to attract retail development. Many municipalities (and counties under certain circumstances) also have an additional local sales tax. Either of these revenues can be rebated to a developer or business to incentivize the business to locate within a municipality. Use of any incentive, including sales tax rebates, has broad implications for the region's economy.

Previous analysis on sales tax rebates reported for an Illinois Department of Revenue (IDOR)

sales tax rebate agreement database revealed that these incentives are extremely prevalent in northeastern Illinois. This updated analysis shows increased prevalence. Continued analysis is important because these rebates support developments that have impacts beyond the municipalities in which they are located.

This Policy Update builds on CMAP's prior analysis by reviewing the updated sales tax rebate database and examining the location of the developments receiving sales tax rebates relative to municipal boundaries and other jurisdictions' roadways. Between 2013-15, the region's total sales tax rebates included in the database increased from 343 to 359. This is a result of some rebates expiring, some being retroactively added that were not entered in to the original database, and some that were recently implemented. The region's committed rebate total has grown from $433 million to $495.9 million. Mapping the updated data indicates that sales tax rebates are more prevalent on or near municipal boundaries as well as on state and county roads.

Overview of active sales tax rebates agreements

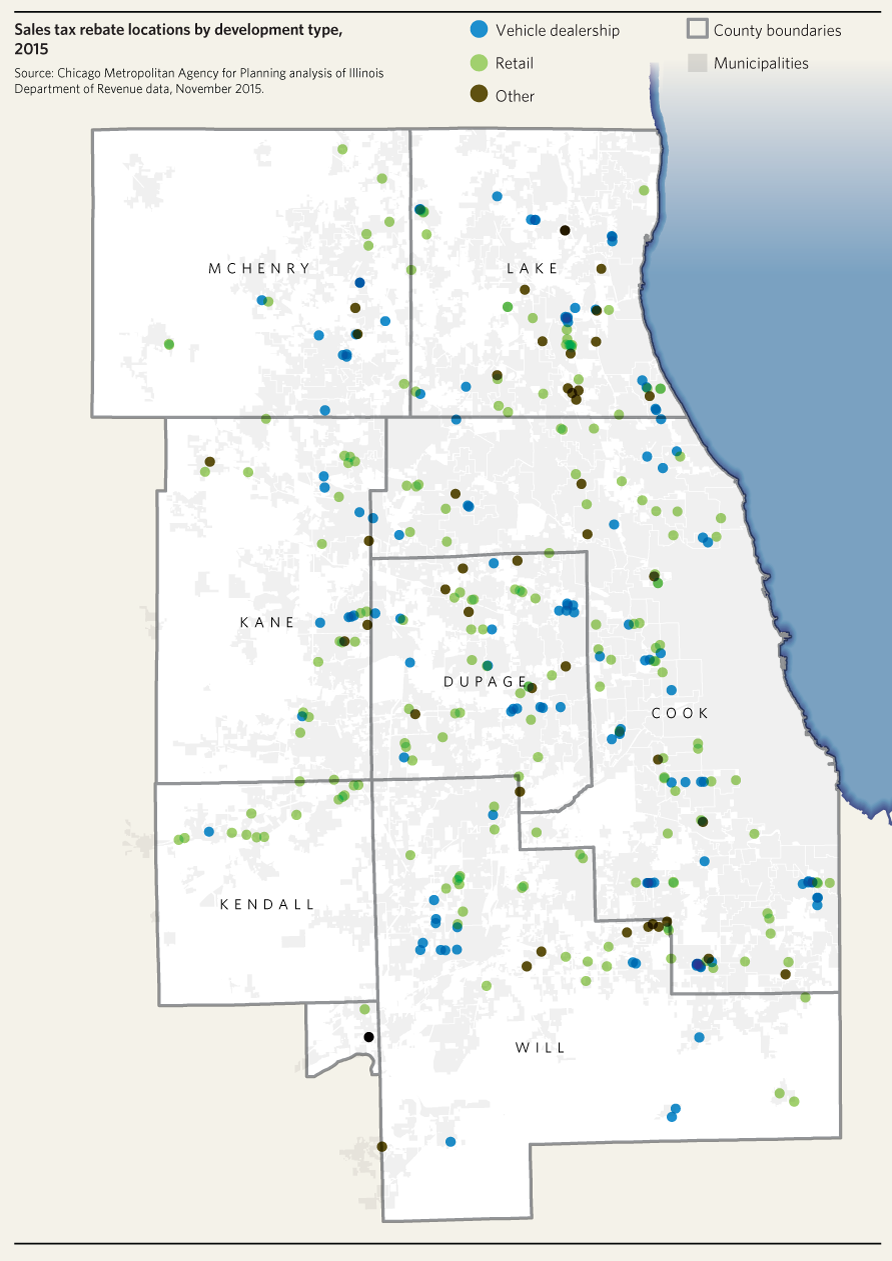

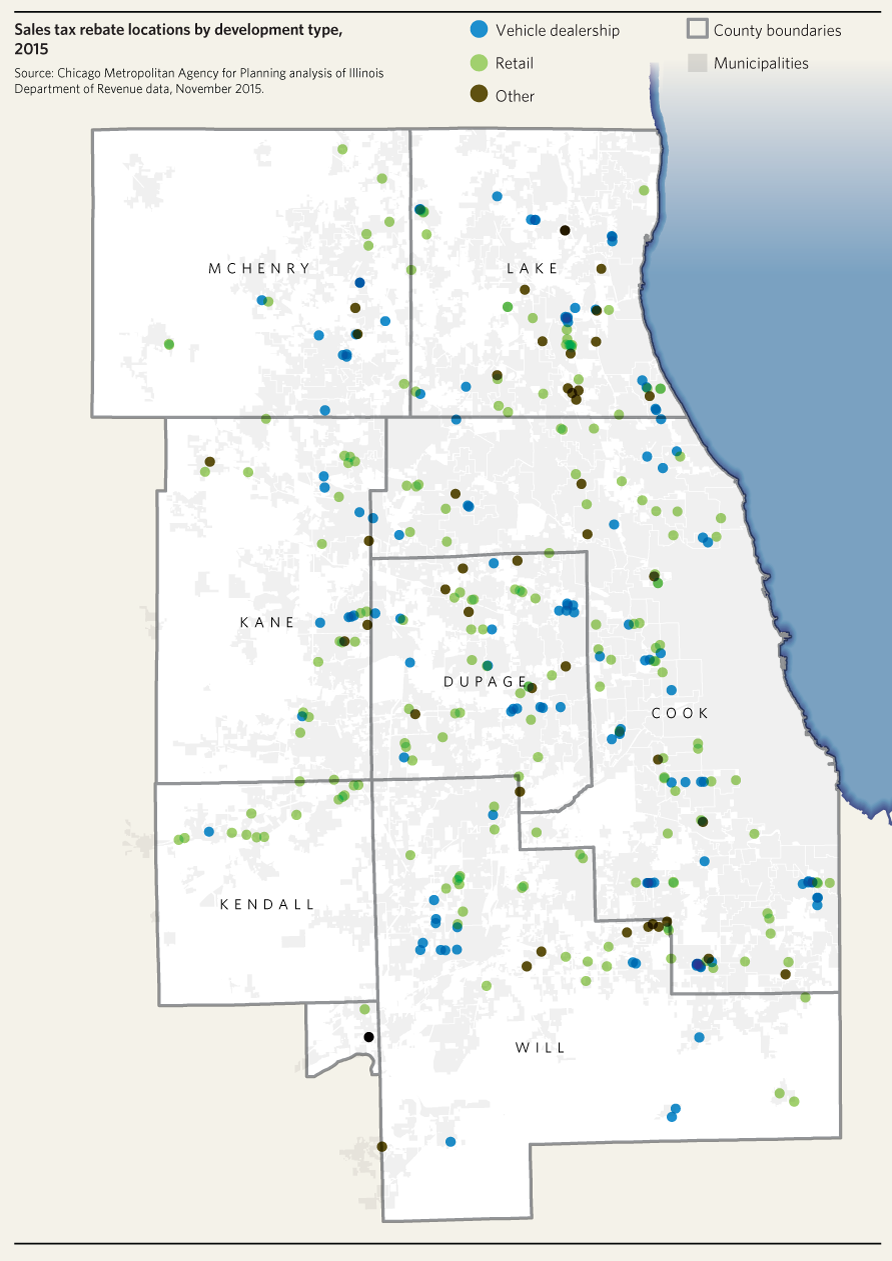

As of November 2015, there were 359 active sales tax rebate agreements between local governments in the region and businesses or developers. The agreements rebate state sales tax disbursements, home rule sales tax, and/or non-home rule sales tax revenues back to the business or developer. This analysis does not include sales tax sharing agreements between local governments, or other types of tax rebates, such as business district sales taxes. The November 2015 total is an increase from November 2013, when the region had 343 rebates meeting these criteria. Consistent with the prior analysis, most rebates went to shopping centers and retailers (184) and vehicle dealerships (127). Regardless of type, the developments and businesses receiving these agreements are well-disbursed throughout the region. The following map provides an overview of these rebates by development type.

Due to vague reporting requirements, the IDOR database does not consistently provide comprehensive details about the specific structure of sales tax rebate agreements -- the state statute only requires that counties and municipalities report information on the process for determining the amount of sales tax rebated. Sales tax rebates are typically structured to rebate a set proportion of sales tax revenues for a period of years or until a certain maximum rebate amount is met. By setting a limit on the number of years or the amount of money, or including a sales threshold, a local government can establish more control over the amount of sales tax revenues that accrue to the municipality or county. For example, a local government might agree that a business will receive 50 percent of state sales tax disbursements for 10 years that would otherwise have gone to the municipality, or up to $5 million. Some agreements specify that the retailer must meet a certain sales threshold before the local government will rebate the sales taxes. In some cases, both state and local sales tax revenue is rebated, while other agreements rebate just one or the other.

Looking at only rebate agreements that report a maximum limit, a total of $495.9 million of local sales tax revenues could be rebated to businesses and developers if the agreements' maximums are met. Of all agreements analyzed, 206 either have a maximum rebate amount listed in the database, or, in some cases, the maximum was known to CMAP through past research on sales tax rebates. This does not mean that the business or developer will receive the maximum amount listed, but rather it indicates a local government's commitment to provide the full funds if sales reach a certain threshold. Since a maximum is unknown or not in place for nearly half of the agreements, the total amount of sales tax revenues that local governments could disburse to business via rebates could therefore exceed $495.9 million. The rebates with the highest maximum amounts tended to be entire shopping center developments and auto dealerships. The following chart summarizes the distribution of maximum rebates among the 206 agreements where the maximum was known.

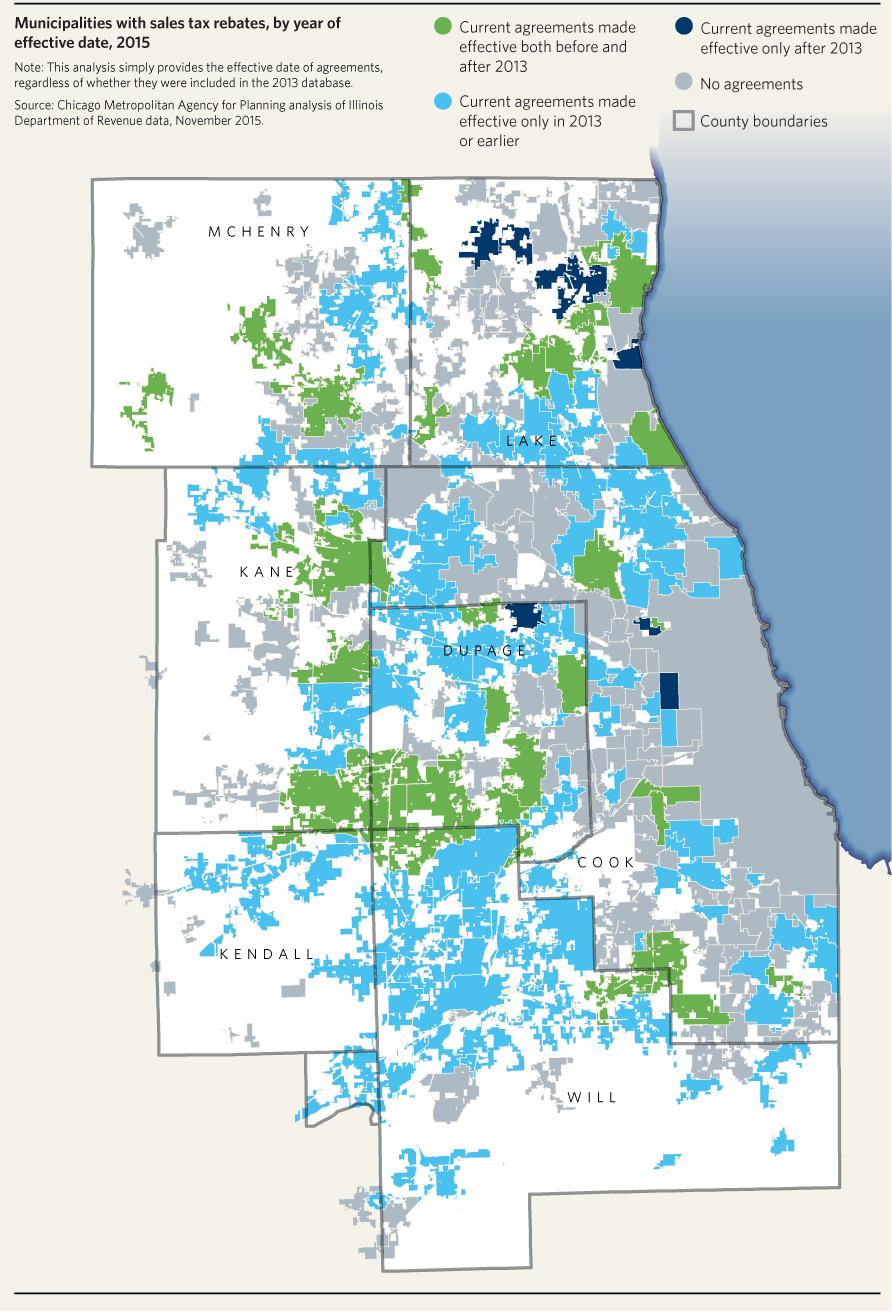

The number of local governments with active sales tax rebate agreements has not changed significantly since November 2013, when the IDOR database was previously analyzed. Similar to the prior analysis, 132 local governments (131 municipalities and one county) across northeastern Illinois have an active sales tax rebate agreement as of November 2015. Among the 36 municipalities in the region that had new sales tax rebates come into effect in 2014 or 2015, most already had other agreements in effect. As shown in the following map, just seven municipalities had new rebates come into effect since November 2013.

Effects on other jurisdictions

In Illinois, state sales tax revenue is disbursed to municipalities and counties based on where sales are made. For municipalities, the

revenues often exceed the cost of providing services and infrastructure to these developments. This means that retail has the potential to provide a

strong fiscal benefit to communities. According to

a recent study of Cook County development patterns, commercial and industrial parcels are more likely to be located near municipal boundaries in Cook County. A municipality's fiscal benefits may increase if retail developments are located on their municipal boundaries because more of the service and infrastructure costs may be borne by neighboring jurisdictions.

Not only are retail developments more likely to be located on municipal borders, this relationship may be even stronger for developments receiving sales tax rebates. CMAP analyzed the extent that developments receiving sales tax rebates are near municipal borders, and the likelihood of locating near a border varied by type of development. The City of Chicago was excluded because it has no sales tax rebate agreements. Across the CMAP region, 60 percent of the rebates were provided to developments located on or adjacent to a municipal border. In contrast, an estimated 47 percent of all retail businesses in suburban areas, with and without a rebate, are located on or adjacent to a municipal border. As shown in the following table, retail developments receiving sales tax rebates were more often located near borders than vehicle dealerships. Other types of developments receiving sales tax rebates were even more commonly located near borders. These businesses are often distribution offices that may generate significant truck traffic, and thus increased infrastructure costs.

Developments receiving sales tax rebates are also frequently located on or adjacent to non-local roads. The preponderance of retail locations on non-local roads may be due to the higher traffic volumes that many retailers require that are more typical of the state and county networks. The State and counties also receive sales tax revenue that would help offset their increased roadway-related costs due to new developments. However, these jurisdictions may not experience a net fiscal benefit if revenues do not support the costs of infrastructure for these developments, or if a cumulative volume of new development generates the need for accelerated expansion and replacement of existing facilities.

Among the 359 sales tax rebates in the region, 88 percent of the developments were located on or adjacent to state and/or county maintained roadways. The following chart illustrates developments receiving rebates by type of development and jurisdiction of adjacent roadways. In addition, the market area of a given retail development likely encompasses roadways maintained by a variety of jurisdictions.

What comes next

In coming months, CMAP will begin work on an assessment of the multijurisdictional transportation impacts of retail agglomerations. Transportation utilization and expenditures related to clusters of retail businesses will be analyzed to determine how transportation impacts are distributed across multiple jurisdictions, including the state, the county, the municipality, and adjacent municipalities and counties.