CMAP's regional economic indicators microsite features key measures of metropolitan Chicago's economy and, where applicable, compares these measures to peer metropolitan areas. The microsite and accompanying Policy Update series are a resource for economic development professionals, planners, and others who seek to understand the complex factors that shape our region's competitiveness in the global economy. The second of a two-part series that explores new methods for identifying industry clusters, this update explores the region's local industry clusters, while the first update explored the region's traded industry clusters.

Metropolitan Chicago is home to a multi-faceted economy that has numerous areas of economic strength that are often characterized by patterns of closely related industries or industry clusters. Research shows that the existence of these clusters leads to a number of economic benefits that facilitate growth and that identifying and supporting industry clusters helps spur additional regional economic growth. Launched in July 2014, the U.S. Cluster Mapping project provides researchers and economic developers with a data-driven methodology for identifying and classifying industry clusters. A key conclusion drawn by cluster researchers is that the economic impacts of clustering vary from cluster to cluster. Traded industry clusters, which produce goods and services that are consumed nationally and globally, tend to experience accelerating output as cluster size increases. Local clusters -- which produce goods and services that are consumed by businesses and consumers within the same region -- experience different development patterns.

The previous Policy Update in this series of two explored the region's traded industry clusters. This Policy Update is CMAP's first look at local industry clusters. It examines the role of local clusters in the region's economy, the ways they serve consumers and other businesses, and the implications for economic development. This analysis will contribute to the development of the region's next long range comprehensive plan, building on the foundation established by GO TO 2040. Examining the Chicago area's local industry clusters from this new perspective lets CMAP build upon prior cluster research to better understand the region's economy and opportunities for growth.

The role of local clusters in regional economies

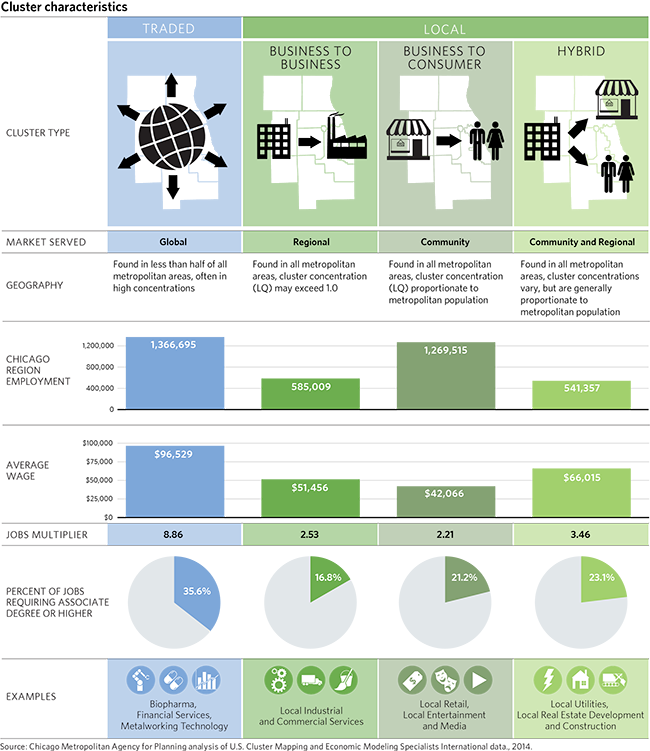

Although local industry clusters do not provide the regional economic growth potential that their traded counterparts do, they still play an important role in the Chicago area's economy. Local clusters account for 63 percent of jobs in the CMAP region and make up the underlying infrastructure that supports the development of traded industry clusters. Local clusters fall into three broad categories based on the type of market and geography they serve. Business-to-business (B2B) clusters, such as industrial and commercial products and services, provide goods and services to businesses across the region. Business-to-consumer (B2C) clusters, such as local retail or local health services, serve consumers within a community. Some local clusters (local utilities, financial services, real estate, and community and civic organizations) serve both businesses and consumers and cannot be easily classified as either B2B or B2C. These are known as "hybrid" clusters. A full list of the Chicago region's local industry clusters can be found here.

In aggregate, local industry clusters have less economic impact than traded clusters. The average local cluster job pays slightly more than half the wage of the average traded cluster job and has a lower jobs multiplier. For example, adding one local cluster job to the region's economy, on average, leads to the creation of an estimated two additional supporting jobs, while adding one traded cluster job to the region's economy results in the creation of an estimated eight supporting jobs. (Expand or download a PDF of the following traded and local clusters chart.)

Metropolitan Chicago's local clusters

Economic analysis shows that growth of local industry clusters tends to be limited by the population of the local market that they serve, and their employment concentrations across regions are consistent. For example, the concentration of health care providers or local retailers does not vary significantly among metropolitan areas. B2B and hybrid clusters are also generally found at consistent concentrations across regions. Serving both local residents and providing products and services to traded clusters, however, allows B2B and hybrid clusters to exist at higher levels of concentration than B2C clusters.

The region's fastest growing B2C cluster is health services, which grew by 22 percent between 2001-14 as demand for health care rose both nationwide and in the region. Three-quarters of the 79,000 health care jobs added in the region during that period had entry-level education requirements of an associate degree or less, making the cluster a significant source of entry-level jobs that provide upward mobility. CMAP's previous policy update on STEM occupations highlighted the robust growth of health care occupations in the metropolitan area.

The region is home to two B2B clusters and one hybrid cluster with significantly greater than average regional employment concentrations: local commercial services, local industrial products and services, and local financial services. The region's local commercial services cluster, which has a location quotient of 1.37, comprises companies that provide outsourced business services, such as temporary staffing, legal and accounting services, or building services. Nearly half of the jobs in the region's local commercial service cluster are temporary staffing jobs, followed by legal service providers, janitorial workers, and security guards. The services provided by these businesses often cater to traded cluster businesses that outsource tasks that are not among their core competencies, and it is not uncommon for large metropolitan areas to have above-average concentrations of local commercial service providers.

The region also enjoys an above average concentration of employment in local industrial products and services, with a regional location quotient of 1.14. Metropolitan areas with large manufacturing clusters, such as Detroit, Houston, or Los Angeles, tend to have high concentrations of industrial product and service providers. Within the Chicago region, this high concentration is due to the prominence of local machine shops, which play a key role in supporting traded manufacturing activity. Local machine shops are businesses that receive unfinished parts or raw materials from manufacturers and use machines to shape, cut, and form these materials before returning them to manufacturers. Machine shops provide additional capacity to manufacturers during periods of high demand. These shops must have strong engineering capabilities and must operate efficiently in order to succeed in this fragmented and highly competitive market. The region's concentration of traded fabricated metals manufacturing industries creates high demand for local machine shop services.

Local financial services, a hybrid cluster, is also concentrated in the region with location quotient of 1.25. This cluster includes businesses such as commercial banks, credit unions, collections agencies, tax preparers, and insurance firms, and serves both consumers and businesses. Over half of the jobs in Chicago's local financial services cluster are in commercial banking. The region is the headquarter location for a number of large commercial banks, including BMO Harris, MB Financial, and Northern Trust Banks. These banks, along with numerous regional banks, help form the base of the region's financial infrastructure that supports metropolitan Chicago's traded business services cluster in addition to providing services to individual customers.

Looking forward

It is important for policymakers and economic developers to understand the intricacies of local and traded clusters when planning for economic growth. Although traded and local clusters serve different customers and markets, these cluster types share an important economic relationship. Businesses in traded clusters can bring economic growth and prosperity but require the economic foundations that local B2B and hybrid clusters provide. By virtue of their nature, the growth of traded industry businesses facilitates the growth of local B2B clusters.

Each industry cluster type -- traded, local B2B, local B2C, and hybrid -- has a discrete function in the regional economy that drives economic development decisions, land use, and infrastructure needs. Traded clusters, for example, require infrastructure that connects our region on a global scale, while local B2B clusters depend on a transportation system that moves goods efficiently within the region. Further exploration of the region's traded and local industry clusters will help policy makers plan for these needs. On a regional scale, a balance of each cluster should be sought in order to facilitate economic growth.

Through its tax policy and land use work, CMAP has analyzed regional policies that influence business attraction and development. GO TO 2040 examined the challenge of balancing development decisions to meet local needs and grow the region's economy. CMAP staff have analyzed the fiscal and economic impact of development decisions, as measured by revenues and job multipliers across retail, office, and industrial developments, and the tradeoff between incentivizing local-serving retail development versus region-supporting business types. Moving forward, CMAP will continue to explore traded and local clusters in metropolitan Chicago to inform stakeholders about the composition of the region's economy.