This is part of an ongoing series of policy updates monitoring residential, commercial, and industrial development trends in the CMAP region. GO TO 2040 recommends a set of policies to promote quality of life and economic prosperity across our region, including planning comprehensively for transportation and land use. This policy update series examines development trends and land use changes in the CMAP region. A subsequent Update looks at impacts of national industrial development trends on the region.

Understanding industrial trends is critical to helping communities plan comprehensively for land use and transportation and support an economically successful region. The Chicago region is a major center for freight and manufacturing. Specializations in these industries result in a substantial amount of industrial development. With almost 1.1 billion square feet of industrial building space, Chicago is one of the largest industrial real estate markets in the nation -- its total industrial square footage exceeds office and retail development combined. Because businesses that are important for the overall regional economy depend on industrial development, this asset contributes to the economic health of the region overall.

Industrial buildings can house a variety of business types, including freight, manufacturing, research and development, construction and trades, equipment repair, and other services. This policy update uses CMAP's 2010 Land Use Inventory (LUI) and CoStar real estate data to assess the location and type of industrial development in the region, as well as to identify regional and national trends. This gives stakeholders a better understanding of where development has taken place and how industrial development in the CMAP region compares to trends nationally.

Historically, the region's industrial stock developed primarily around transportation assets -- railroads, highways, and airports. The oldest industrial development is located in the region's core, with concentric expansion over time, particularly in the north and western areas of the region. CMAP analysis indicates that current industrial construction is focused on the edges of the region, particularly near intermodal facilities and interstates. While regional industrial vacancy rates are slightly above national totals, the overall trends are positive - industrial development in the region is increasing and vacancy rates are falling. In line with national trends, distribution space is the fastest-growing type of industrial development, but the region maintains a substantial base of manufacturing and other industrial space.

Location of industrial development and land in the CMAP region

Industrial parcels are found in every county, often located near transportation assets such as freight rail, highways, and airports. CMAP's Freight-Manufacturing Nexus report identified concentrations of freight and manufacturing employment, both major users of industrial building space, around areas with rich access to the region's transportation assets. For example, the study area for the O'Hare Subregional Freight-Manufacturing Drill-Down Report contains 15 percent of the region's industrial land compared to only 4 percent of the region's total land area. Industrial development is also concentrated along the I-55/Illinois-Michigan Canal corridor, particularly in Cook and Will Counties.

CMAP's LUI is a survey of land uses in the region based on county parcel data, supplemented with digital aerial photography, other governmental source, and private-sector sources. The LUI indicates where industrial parcels are located in the seven-county region and important characteristics of those parcels. Industrial parcels are defined as those used for flex, manufacturing, warehousing, and/or storage. The map below shows the location of both developed and vacant industrial parcels. Vacant parcels are designated as industrial by the county assessor but in fact are undeveloped. These may be planned industrial developments, sites where an industrial building has been demolished, outside storage, or areas adjacent to existing industrial development.

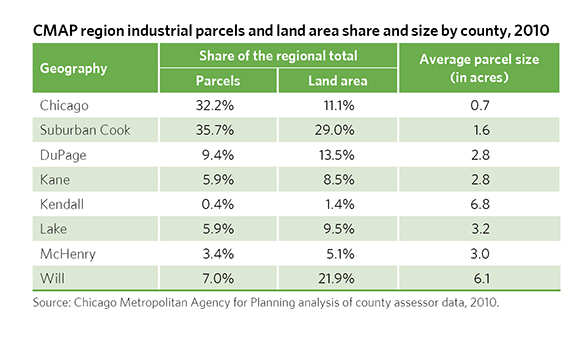

The share of industrial parcels and land area varies widely by county, showing how development patterns change over time. This variation highlights the smaller parcel sizes typical in suburban Cook and the City of Chicago compared to the rest of the region. Chicago's average industrial parcel size is about two-thirds of an acre, the smallest in the region. The Will County average is larger than 6 acres per industrial parcel. Smaller parcel sizes often translate into smaller industrial buildings. These smaller parcels can make land acquisition and redevelopment to modern industrial building formats more difficult than building in undeveloped areas.

The table below shows the share of the region's industrial parcels and land area by county. Cook County has two-thirds of the industrial parcels in the region but only 36 percent of the industrial land area. Comparatively, Will County has 22 percent of the industrial land in the region versus 7 percent of the parcels. Rentable building area (RBA) is the square footage in a building that can be rented to tenants, as opposed to common areas or equipment rooms. Two-thirds of the industrial parcels in Cook County contain buildings with an RBA of less than 100,000 square feet. Will and Kendall are the only two counties for which more industrial land is covered by larger buildings (RBAs larger than 100,000 square feet) than smaller buildings (RBAs less than 100,000 square feet).

CMAP region industrial development by county

In terms of total square footage, the CMAP region is one of the largest industrial markets in the nation, with approximately 1.1 billion square feet of industrial development. This total also makes the Chicago region the largest of the industrial markets that CoStar tracks. CoStar provides real estate development trend data for nonresidential and multifamily development in the CMAP region and nationwide. While CoStar does not provide data on all buildings in the region, the database is extensive and provides a picture of the type, age, and location of the region's industrial development. These measures also indicate how the demand for industrial development is changing throughout the region.

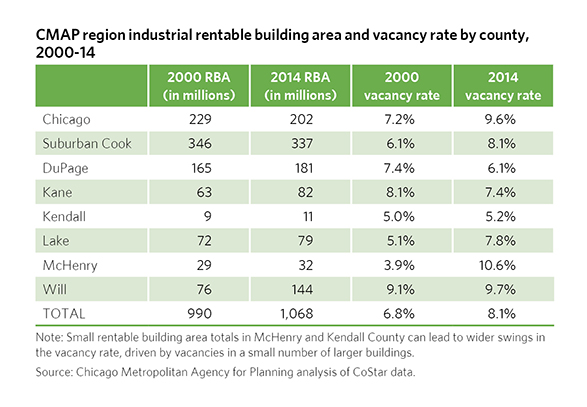

Suburban Cook County and the City of Chicago have the largest proportion of industrial RBA in the region, at 19 percent and 32 percent, respectively. Since 2000, industrial development has increased in all areas of the region except for suburban Cook County and the City of Chicago. Will County has the greatest increase of RBA, growing by 88 percent since 2000. This growth may in part be due to Will County's growing intermodal base, with an emerging concentration of freight-related facilities.

Suburban Cook County and the City of Chicago have the largest proportion of industrial RBA in the region, at 19 percent and 32 percent, respectively. Since 2000, industrial development has increased in all areas of the region except for suburban Cook County and the City of Chicago. Will County has the greatest increase of RBA, growing by 88 percent since 2000. This growth may in part be due to Will County's growing intermodal base, with an emerging concentration of freight-related facilities.

Overall, industrial development in the region is concentrated in a few locations. According to CMAP analysis, just 15 communities contain 50 percent of the region's industrial development. This is more concentrated than any other land use and is consistent with CMAP's analysis of the region's freight and manufacturing cluster employment, which indicates that employment in freight and manufacturing is highly concentrated around major transportation nodes. The map below reinforces this finding, indicating that industrial development is generally concentrated along the region's major trucking corridors, freight rail infrastructure, and the two major airports.

Vacancy rates indicate the proportion of building stock that is unoccupied and provide a measure of demand for the region's industrial building stock. Like developed square footage, industrial vacancy rates vary widely throughout the region. The overall industrial vacancy rate in the region as of December 2014 is 8.2 percent. This is slightly above the national rate of 7.5 percent and is better than the region's 2014 vacancy rates for office (14.1 percent) and retail (8.7 percent). Industrial vacancy rates may align with the decline in the region's manufacturing employment base, with increased vacancies over the last decade; only DuPage and Kane Counties have achieved lower vacancy rates than in 2000. However, vacancy rates in most areas of the region have been steadily declining since peaking in 2010-11. Higher vacancies in McHenry County appear to be driven by a few large buildings and have recently begun to decline. The regional decline in vacancy rates corresponds with a national decline.

Industrial development in the CMAP region by development type

Industrial development evolves over time to reflect the changing needs of growing industries, modern equipment and processes, and other economic trends. The following explores industrial development in the CMAP region by development type using CoStar building data aggregated to standard industrial building types, as entered by CoStar users. The table below provides RBA, age, and vacancy characteristics for typical industrial building types in the region.

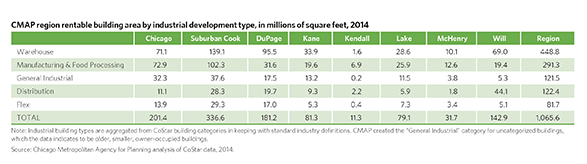

Warehouse development is the CMAP region's predominant industrial building stock, comprising 43 percent. This building type may house wholesale, storage, or smaller logistics users as well as some light manufacturing. In keeping with the region's strong manufacturing base, manufacturing and food processing is the next most prevalent building type. Distribution is third and is generally characterized by a larger building RBA, taller ceiling heights, and more loading docks to allow implementation of modern distribution techniques. Distribution is an evolving development type, and the term is often used synonymously with warehouses by many industry professionals, though the two are considered separately in this analysis.

As shown in the table below, these industrial building types are distributed throughout the region, with some distinct spatial patterns. Warehouse development has a strong presence in all areas of the region. Overall, Cook County has a plurality of all industrial building types except distribution. Manufacturing and food processing buildings are most concentrated in Cook County, with 25 percent of the region's stock within the City of Chicago and 35 percent in suburban Cook. DuPage County follows Cook County in having significant concentrations across all industrial building categories, with the majority of its RBA in warehouse buildings. Will County contains the largest RBA total for distribution, with 36 percent of regional RBA in this category. In addition, distribution square footage in Will County has doubled since 2004.

Click on image for larger version.

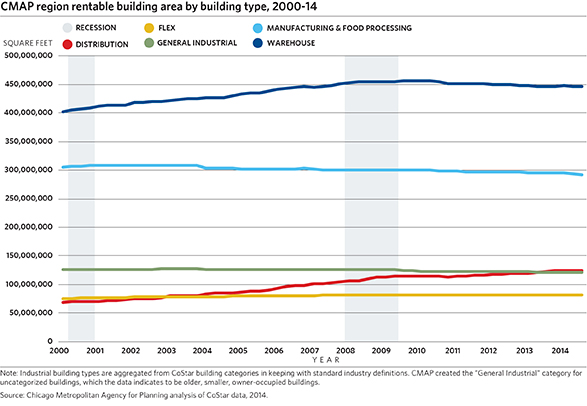

National trends in industrial development formats

New industrial development in the CMAP region since 2000 has trended toward larger buildings, with an increase in distribution and warehouse RBA and a decline in manufacturing and general industrial buildings. This may align with the growing importance of freight in the region's economy and a national and regional decline in manufacturing jobs. In addition, the development of larger buildings, with a focus on distribution space, reflects national industrial development trends. Similarly, manufacturing space has declined both nationally and regionally over the last decade. Instead, the focus of recent industrial construction has been on large-format distribution and warehouse space.

According to the Commercial Real Estate Development Association, 20 percent of the industrial square footage constructed since the recession has been in buildings over 1 million square feet, compared to 8 percent in the years preceding the recession. In the CMAP region, average square footage of a new distribution building has grown steadily from just over 100,000 SF in 2000 to 400,000 SF in 2014. But, these large structures represent a fraction of the total industrial real estate market, and may continue to do so. While large distribution buildings signify one adaptation to changing trends, the growth of ecommerce, changing supply chain and manufacturing technology, and new logistics management approaches may lead to demand for a variety of industrial building types.

Industrial development trends and GO TO 2040

GO TO 2040 recommends planning for development that supports regional economic success. Industrial development represents half of the region's non-residential building stock and has healthier vacancy rates than the region's office and retail development. Recent industrial development has occurred predominantly at the edges of our region, where significant undeveloped land is near rail and interstate infrastructure assets. However, these facilities are far from the region's freight and manufacturing workers, potentially decreasing connections between jobs and housing for the region's workers. Industrial developments closer to the region's existing population and infrastructure assets are often older buildings located on smaller parcels.

CMAP analysis of the freight and manufacturing clusters demonstrates the need to preserve and plan for the land uses that support the region's manufacturers, freight providers, and related industries. Proactive planning allows communities to leverage the value of their transportation assets and develop plans that support industrial uses. The development and redevelopment of industrial sites can be hampered by the smaller parcel sizes common in older areas. The CMAP Freight Drill-Down report in particular noted that land-use planning for freight across the CMAP region has not kept pace with the designation of land for other uses. While this analysis indicates that the region's industrial building stock is growing, continuing to plan for and preserve the region's industrial development, particularly in areas with access to major transportation resources, is critical to maintain the region's competitive advantage.