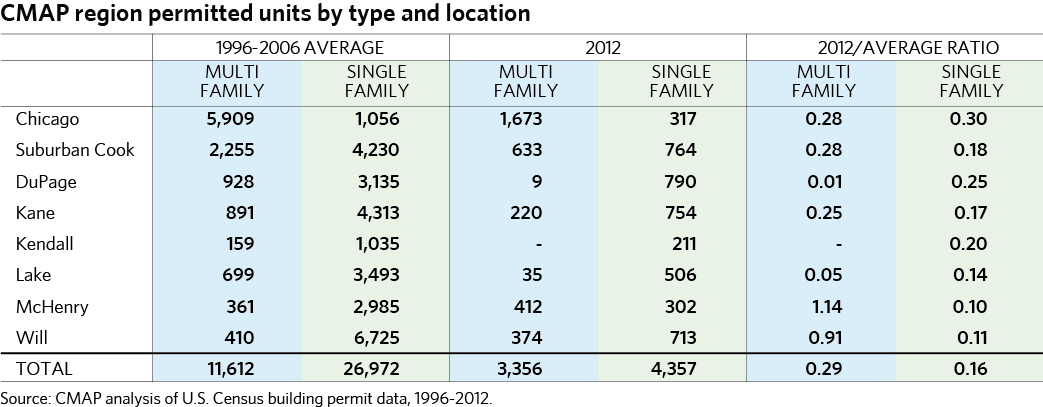

While annual permitted units are still at historic lows in northeastern Illinois, the region saw increases from post-recession lows in 2012. In some cases, annual permitted units in the region matched 2008 levels. There have also been unique shifts in the location and type of development -- in particular, suburban areas garnered a substantially larger share of the region's multifamily permits than has been the case historically. Additionally, Chicago, suburban Cook County, and DuPage County continued to increase their combined share of the region's permitted single-family units, a trend that began in 2004. These trends follow the tenets of GO TO 2040, which supports reinvesting in existing communities and providing a range of housing options. GO TO 2040 also recognizes that the implementation of these principles will vary across the region, requiring sensitivity to the unique context of each community.

While annual permitted units are still at historic lows in northeastern Illinois, the region saw increases from post-recession lows in 2012. In some cases, annual permitted units in the region matched 2008 levels. There have also been unique shifts in the location and type of development -- in particular, suburban areas garnered a substantially larger share of the region's multifamily permits than has been the case historically. Additionally, Chicago, suburban Cook County, and DuPage County continued to increase their combined share of the region's permitted single-family units, a trend that began in 2004. These trends follow the tenets of GO TO 2040, which supports reinvesting in existing communities and providing a range of housing options. GO TO 2040 also recognizes that the implementation of these principles will vary across the region, requiring sensitivity to the unique context of each community.

Trends in Total Permit Counts

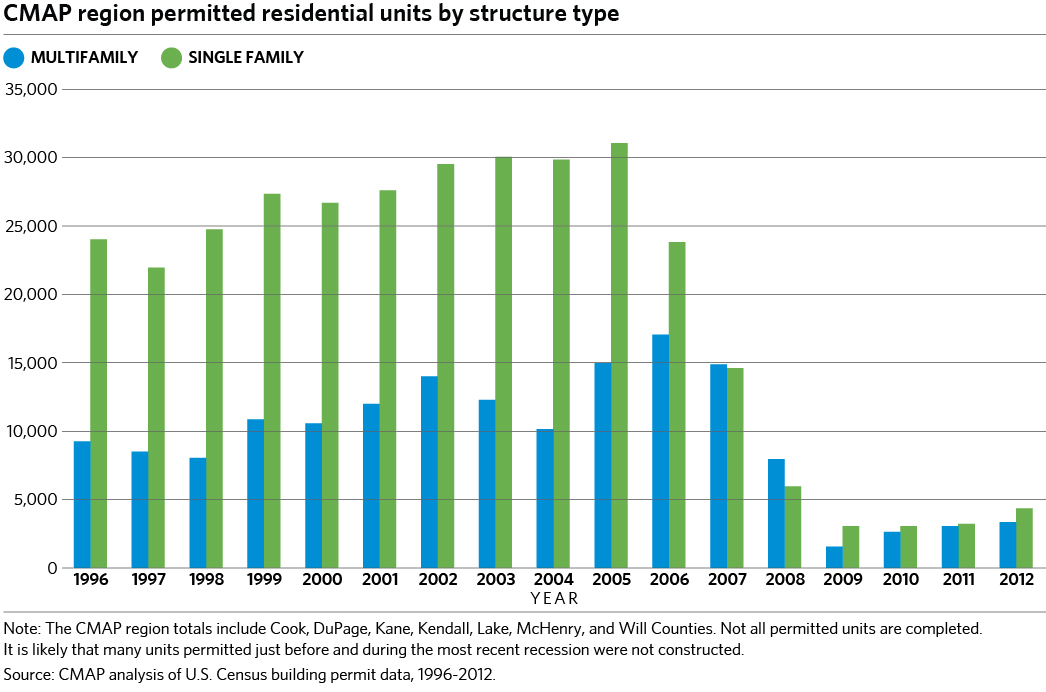

From 2011 to 2012, total permitted units in the region increased by 23 percent. This overall increase was unevenly divided between single-family and multifamily units -- between 2011 and 2012, single-family permits increased by 35 percent, while multifamily permits increased by 10 percent. However, 2012 was the first year since the recession began in which single-family permits increased at a greater rate than permitted multifamily units. The number of permitted units has increased every year since 2009, though the amount of units permitted in 2012 was still below historical averages. The figure below shows the annual single-family and multifamily permit totals for each year since 1996. Please note that this data does not differentiate between rental or for-sale units. Additionally, single-family totals include townhomes.

Click for larger image.

Permitted single-family units have traditionally exceeded permitted multifamily units in the region, with the exception of 2007 and 2008. As a result, while permitted single-family unit totals were greater than multifamily unit totals in 2012, single-family unit development is further below its pre-recession averages. This follows a national trend of faster recovery in the multifamily sector. For both demographic and economic reasons, many people are choosing renting over buying.

This trend is pronounced in McHenry and Will. In 2012, the two counties were permitting new single-family units at approximately 10 percent of their historic averages. In contrast, their rates of new multifamily units matched or exceeded the two counties' respective pre-recession averages. But these high 2012 permitting rates may not constitute a trend that carries over into subsequent years, because a small number of large rental developments in McHenry and Will contributed to the one-year increase in multifamily permitting. However, multifamily rental proposals have increased in suburban areas over the last year, and some portion of these projects will continue to move forward.

Click for larger image.

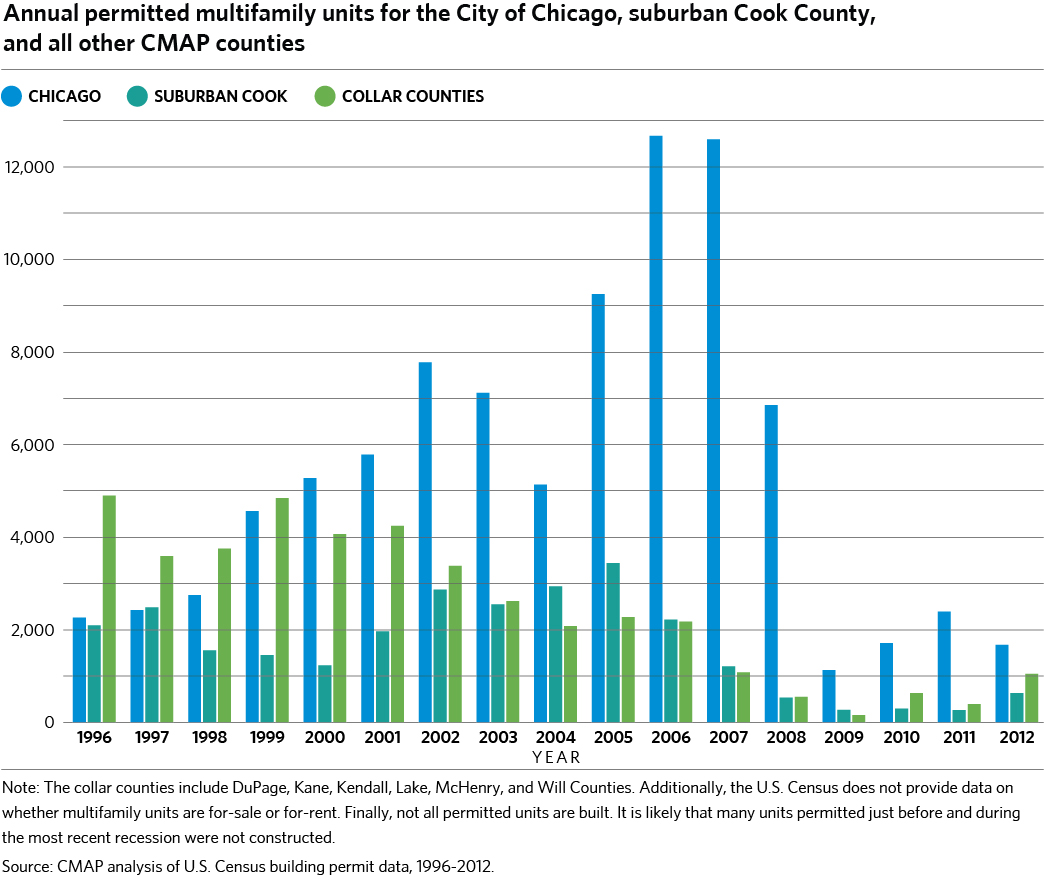

Multifamily Permits

GO TO 2040 encourages the region's municipalities to offer housing options for all residents. During 2012, the region experienced a significant shift toward this goal as permits increased for multifamily units in the region's suburbs. Prior to 2000, the region's suburbs outside Cook County permitted the majority of the region's new multifamily housing. However, this balance shifted to the extent that, during the housing boom and bust, 60 to 85 percent of the region's permitted multifamily units were in Chicago. To provide a range of housing options broadly, multifamily development should occur throughout the region, rather than being concentrated within Chicago. However, market considerations, resident concerns, and zoning regulations have often limited the potential for multifamily development in suburban areas.

But this dynamic shifted significantly last year. In 2012, the City of Chicago generated just under 50 percent of the region's permitted multifamily residential units, its lowest level since 2001. Instead, a mix of large and small projects in the region's suburban areas pushed suburban multifamily permitted units to their highest counts since 2007. Additionally, suburban Cook County permitted more than twice as many multifamily units in 2012 as it did in 2009, 2010, or 2011. In contrast, multifamily permits in the City of Chicago fell significantly in 2012, reaching a low in the third quarter. However, permits jumped in the fourth quarter, when nearly as many permits were issued in Chicago as had been issued in the preceding three quarters. Overall, rental data shows that vacancies are down and rents are up in many of the region's suburban areas, likely indicating market demand for more rental housing.

While the region experienced a 10-percent increase in multifamily permits from 2011 to 2012, this change lagged the national increase of 47 percent over the same time period. Furthermore, the Chicago Metropolitan Statistical Area (MSA) ranked 43rd nationally in multifamily units per capita among the 51 MSAs with populations above one million, according to CMAP analysis. The Chicago MSA was also 21st in total units permitted, whereas it has historically been in the top 10 MSAs.

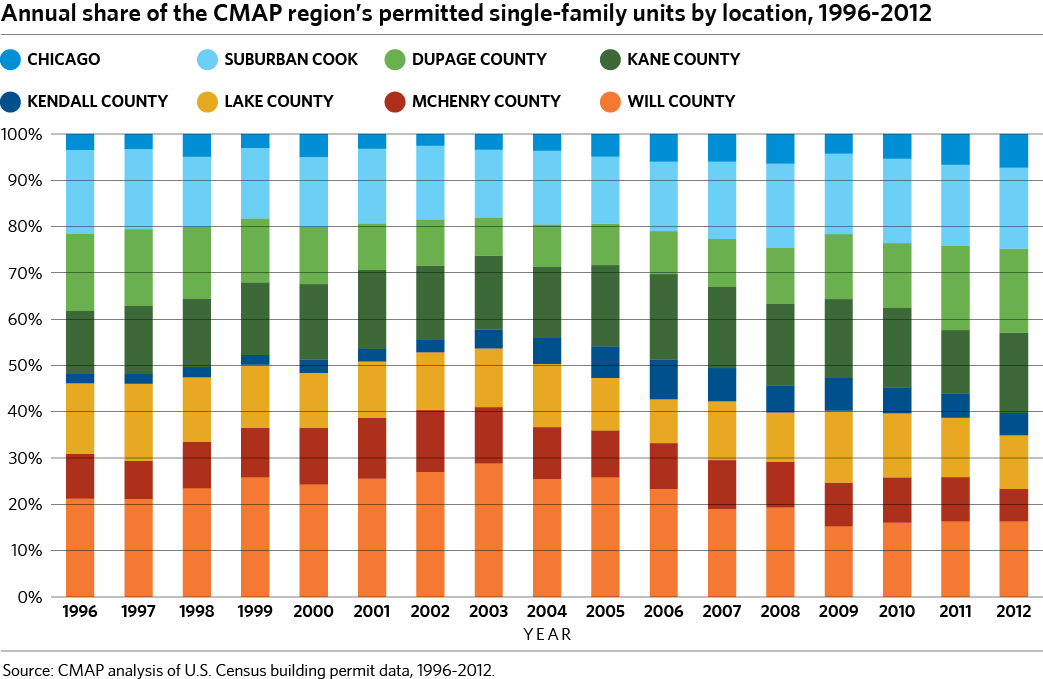

Single-Family Permits

As with multifamily permits, 2012 permitted single-family units remained low compared to historic levels. But development patterns have shifted. DuPage County permitted the most single-family units in 2012, continuing a 2011 trend. Chicago and DuPage Counties increased their share of the region's single-family permits, a trend that began in 2004. Also generally on the rise since 2004, suburban Cook County maintained its proportion of single-family permits. Because these parts of the region are substantially developed, new residential development in such areas is more likely to be infill and/or utilize existing transportation and infrastructure resources, a key goal of GO TO 2040. A recent U.S. Environmental Protection Agency report indicated that the Chicago MSA increased its proportion of infill residential development from 2005 to 2009 compared to 2000 to 2004. Recent permitting levels appear to continue this trend.

However, single-family development also continued on the region's edges. Kane and Will Counties increased their unit counts and proportion of permitted single-family units in 2012. Kane experienced the largest increase in single-family permits, rising from 439 in 2011 to 754 in 2012. Will County, while just below the other top counties, is still well below its historic share of the region's single-family units. Kane, Kendall, and Lake Counties reached their lowest single-family permit levels in 2011 and began to rebound in 2012, while Chicago and DuPage, McHenry, and Will Counties reached a low in 2009.

The region's single-family permits increased 35 percent from 2011 to 2012, exceeding the national increase of 23 percent. However, this year's growth did not catch the region up to the rest of the country. The Chicago MSA ranked 50th in single-family permits per capita among the 51 MSAs with populations greater than one million. In raw numbers, the MSA ranked 14th, though it had often been in the top 10. While demand is increasing for single-family homes, it is still well below historic levels, and existing home values have just begun to grow on an annual basis.

Conclusion

The CMAP region increased its single-family and multifamily permits in 2012, continuing its post-recession growth. Additionally, the increased distribution of multifamily permits outside the City of Chicago and increased single-family permits in infill areas follows development patterns encouraged by GO TO 2040. However, the region's growth in permitted units has not kept pace with other major metros, particularly in the multifamily sector. This may be due to higher unemployment levels in the region, a slower stabilization of housing values, or other factors. As the region continues to grow out of the recession, CMAP assists communities in planning for their future housing needs through the Homes for a Changing Region program. These plans aim to create a balanced mix of housing, serve current and future populations, and enhance livability.