In Cook County, property tax classification can drive up commercial and industrial property tax rates, hurting disinvested communities in particular. This may deter business investment in Cook County in favor of opportunities elsewhere. By using a higher assessment ratio for businesses than residences, this system shifts a higher share of the property tax burden to businesses. This policy does not exist in the collar counties. It can deter reinvestment in affected communities, as well as hinder potential growth in their property tax base. In many communities, high commercial and industrial tax rates present a barrier to attracting development, even when infrastructure and infill opportunities are plentiful. By reforming its classification system, Cook County could grow the tax base over time and eventually reduce the tax burden on residents. This effect would mitigate the need for potential increases in residential rates.

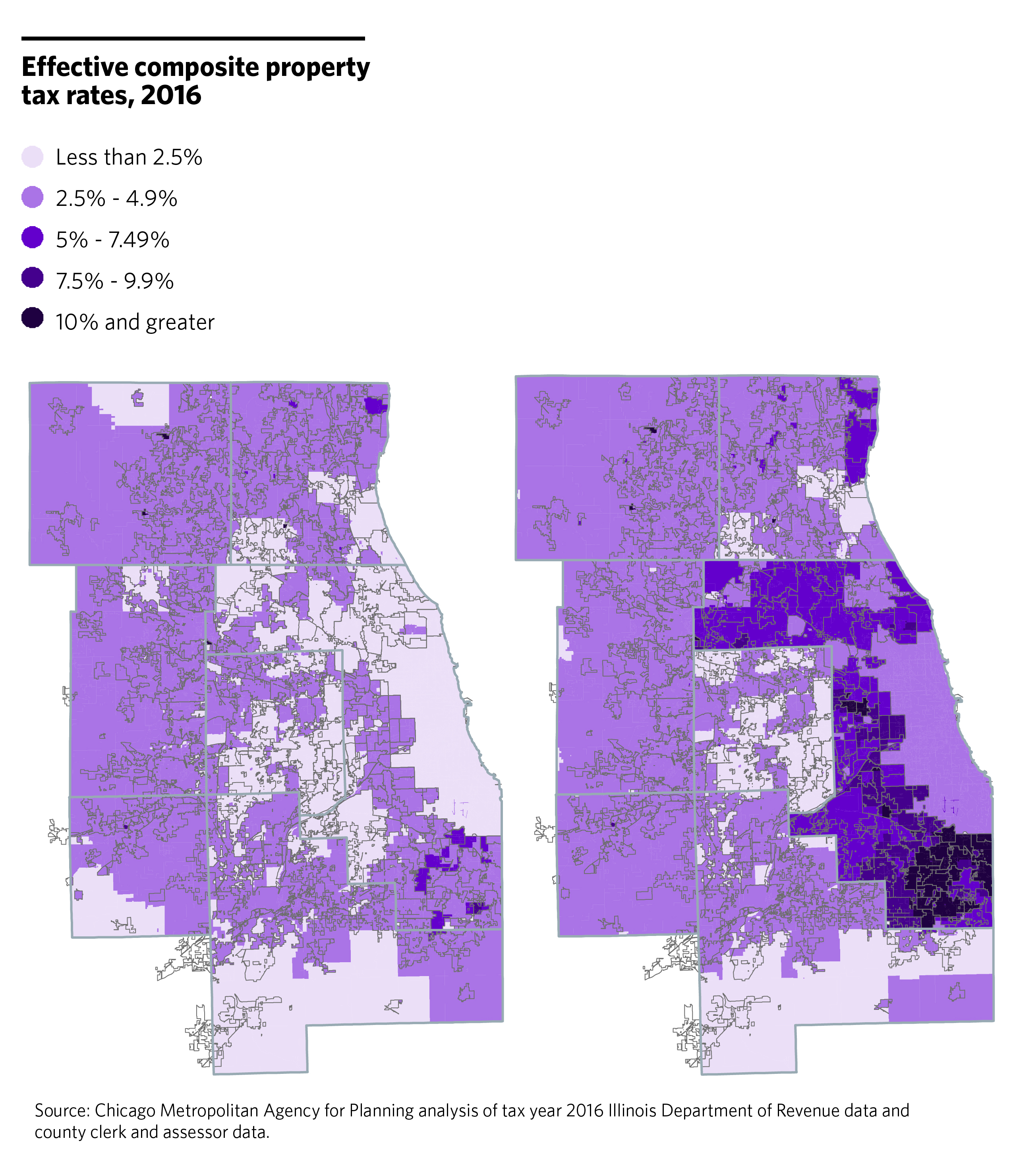

The following maps illustrate effective, composite property tax rates for the seven-county region. Effective property tax rates are property tax extensions as a percentage of market value, rather than EAV, allowing for comparison across counties and property classes. Composite rates are a sum of the rates levied by each local taxing district. Taxing districts may include counties, townships, municipalities, school districts, and special districts. Generally, school districts comprise the largest portion of the overall rate.