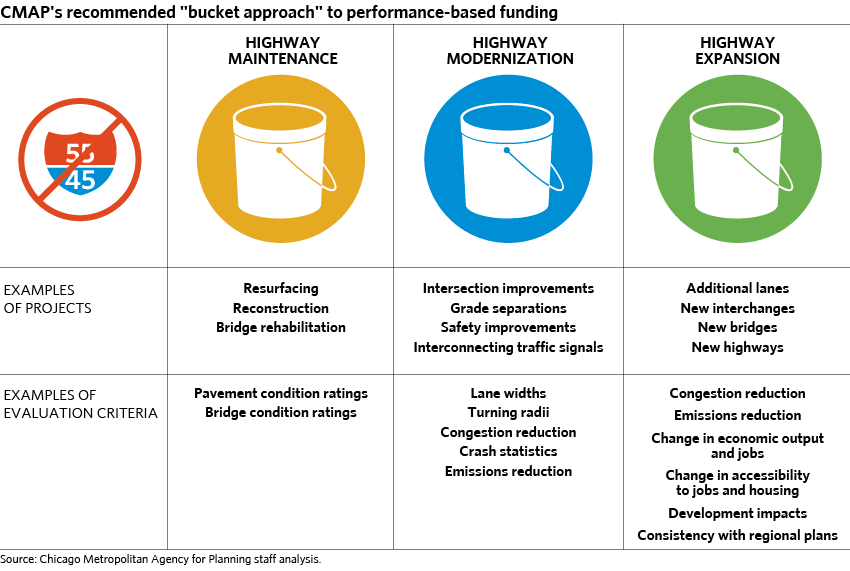

Data-driven, collaborative planning should lead to clear transportation priorities. Billions of transportation dollars are at stake each year in Illinois. Taxpayers deserve to understand how priorities are set for investments in maintaining, modernizing, and expanding our roads, bridges, and transit.

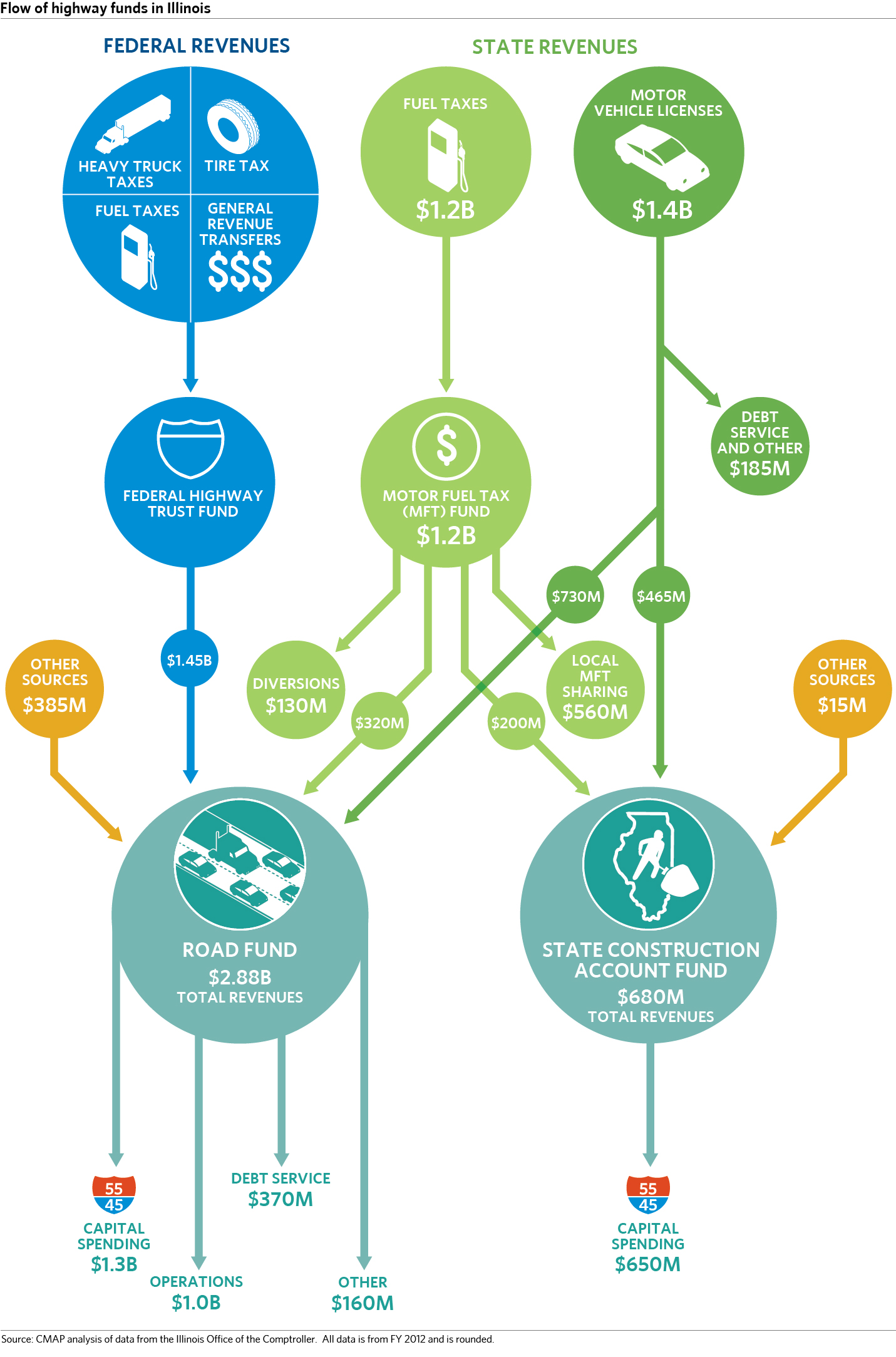

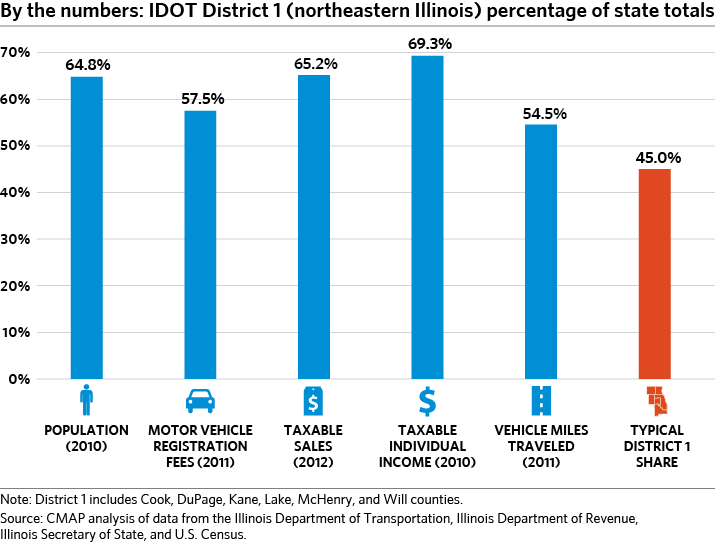

For decades, the purchasing power of the gas tax and other traditional funding sources has declined, while the need for maintaining and improving our transportation system continues to grow – as do its costs. Illinois allocates highway funds through an arbitrary formula called the "55/45 split." Anywhere on this site that the  icon appears, those road funds are allocated based on the formula, which directs only 45 percent to the Chicago area, although the region represents a much higher percentage of the Illinois population (65 percent) and economy (70 percent). Further, the State's investment decisions cannot be easily explained to the public.

icon appears, those road funds are allocated based on the formula, which directs only 45 percent to the Chicago area, although the region represents a much higher percentage of the Illinois population (65 percent) and economy (70 percent). Further, the State's investment decisions cannot be easily explained to the public.

The Chicago Metropolitan Agency for Planning (CMAP) believes taxpayers will support investing in a transportation system that improves their quality of life. To accomplish this, Illinois needs to lead the national effort to implement "performance-based funding" of highway and bridge projects.

Although this website focuses on highways, CMAP believes the approach should apply to all modes of transportation. Working together, the State and region should clearly identify which projects deserve funding. And we should carefully document how these investment decisions serve the broader goals of mobility, prosperity, and quality of life.