The use of property tax classification in Cook County makes it difficult to encourage and strengthen non-residential development in existing communities. In particular, commercial and industrial properties in Cook County may experience higher tax burdens as compared to similar properties in adjacent counties. This may reduce the potential for nonresidential development and redevelopment.

Commercial and industrial properties in Cook County account for 17.0 percent of the overall market value, but 35.1 percent of the overall tax base. While the magnitude of impact varies from place to place, commercial and industrial property owners shoulder a greater tax burden than residential taxpayers in Cook. This disproportionate burden does not exist in the collar counties, where business and residential properties are assessed at the same rate. The following charts illustrate the effects of classification on nonresidential taxpayers in Cook County.

Reforming classification could reduce commercial and industrial property tax rates in many communities, making them more attractive for development. High tax burdens for commercial and industrial properties, as compared to similar properties in adjacent counties, can deter businesses from locating in certain communities. If this causes the tax base to grow slower than the cost of public services, residents and businesses alike could face even higher tax rates to cover public service costs.

As recommended by

GO TO 2040 and reinforced by the

Regional Tax Policy Task Force, CMAP continues to study how property tax assessment classification in the region may impede business development and economic activity. This Policy Update builds on

prior CMAP analysis and describes the effects of classification on property tax rates in Cook County.

How property tax classification works

The vast majority of local governments, including counties, townships, municipalities, school districts, and special districts, impose a property tax. To

calculate property taxes, county assessors first estimate the market value of all properties, then apply an assessment ratio to that market value. The Illinois Department of Revenue calculates an equalizer for each county so that the median assessment ratio is the same across counties. This equalizer is applied to assessed values in the appropriate counties, resulting in an Equalized Assessed Value (EAV). Finally, the EAV is multiplied by the combined rates of each taxing district for the final property tax rate.

The

state constitution allows counties with populations above 200,000 to apply different assessment ratios to different property types. Cook County, which assesses commercial and industrial property at a higher percentage of market value than residential property, is the only county in the state that uses this assessment approach. This results in a greater property tax burden on commercial and industrial property taxpayers.

The effect of classification on tax rates

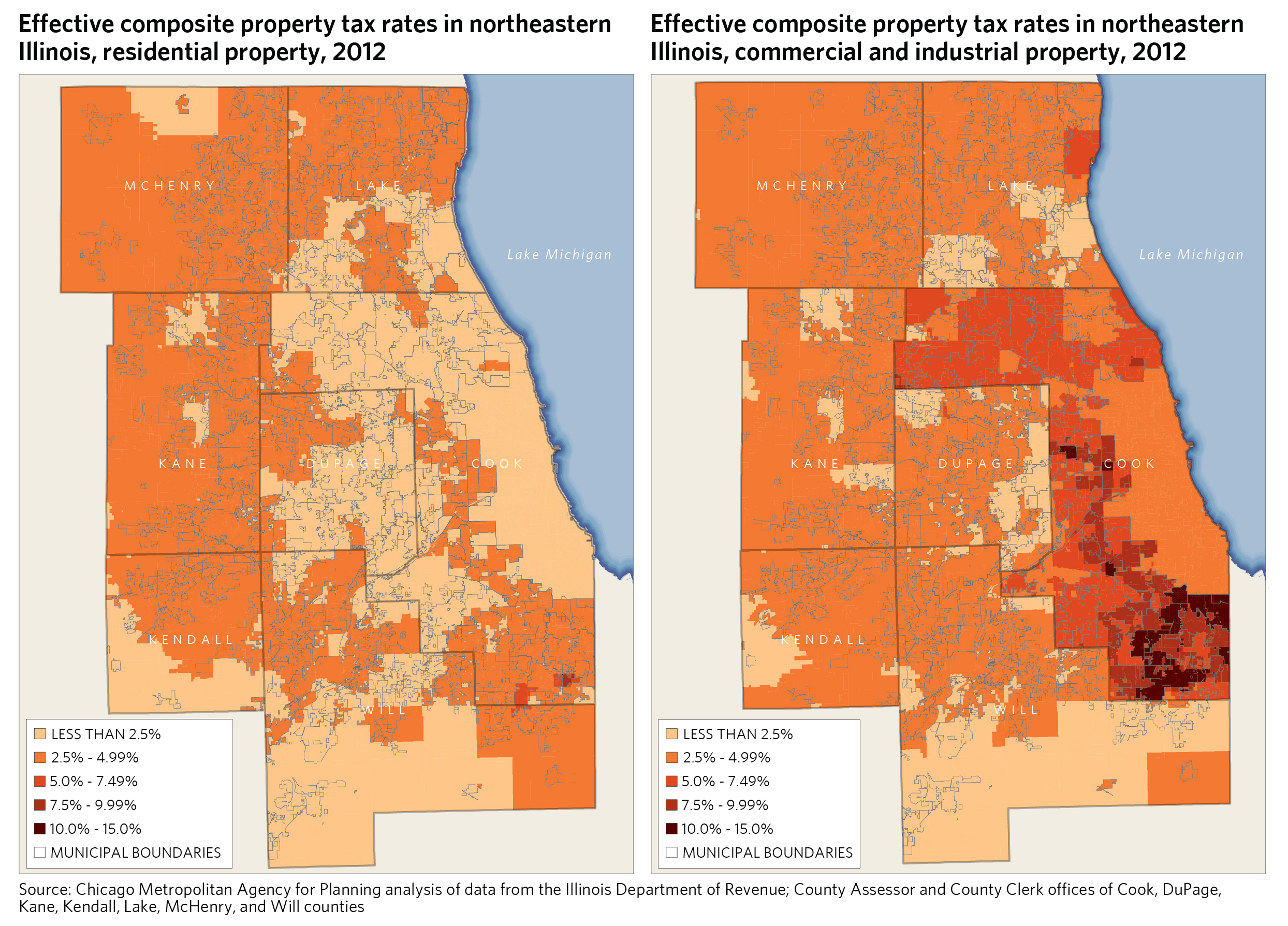

In Cook County, different classes of properties carry different effective tax rates due to classification. While property tax rates are calculated as the tax levy divided by the EAV, effective tax rates refer to the property tax levy as a percent of market value. Examining property taxes through a property's actual market value, rather than the EAV, allows for comparison across property classes and geographies. The following maps (also available in an interactive format) illustrate effective composite property tax rates for commercial, industrial, and residential property in northeastern Illinois for 2012. Most of the region's residential property tax rates are below five percent, as are rates for most commercial and industrial taxpayers in the collar counties, which do not employ classification. However, commercial and industrial rates are above 5 percent for large swathes of suburban Cook County.

Under classification, effective tax rates in a given district rise when the concentration of commercial and industrial property declines. Variability in tax rates depends on various factors, including whether a particular class of property dominates the property values in that taxing district. As indicated by the following chart, the land use characteristics in a community influence how classification impacts effective tax rates.

If commercial and industrial property comprises a large proportion of a taxing district's market value, their effective tax rates are mostly functions of the tax levy and base, rather than classification's differential levels of assessment. This is because industrial and commercial taxpayers already bear most of the tax burden, thus reducing the effect of the differential assessment level under classification.

In contrast, communities with low concentrations of commercial and industrial properties can primarily attribute their effective tax rates to classification. A predominance of residential property assessed at a lower ratio results in a lower property tax base, which leads to overall increases in property tax rates. Commercial and industrial properties are disproportionately affected by these high rates as a result of the burden shift from a large residential base to a small commercial and industrial base. Essentially, the impact of classification on the tax burden of a commercial or industrial taxpayer is stronger in areas with fewer commercial and industrial properties.

Other drivers also affect classification's impact on the tax rate. For example, in some areas, extremely

low property tax bases drive up rates for all property types. As a result, any reforms to the classification system would have less of an impact on the tax rate in these areas.

The utilization of incentive classes in Cook County is another driver of that affects classification's impact on the tax burden. Many communities attempt to mitigate the effects of classification by awarding incentive classifications to commercial and industrial properties. These classes reduce the level of assessment to the same percentage of market value as residential property for ten years, which is renewable for certain incentive classes. In 2012, 6.2 percent of estimated commercial and industrial market value across Cook County was designated with an incentive class. A total of 81 municipalities have at least one property with an incentive class among the 134 municipalities completely or partially in Cook County.

The following map depicts the proportion of the tax rate on commercial and industrial property taxpayers attributable to classification, which falls between 50-59 percent in most areas of Cook County. In other words, for most communities in Cook County, just over half of the tax burden for commercial and industrial taxpayers is a function of the tax burden shift inherent in the classification system.

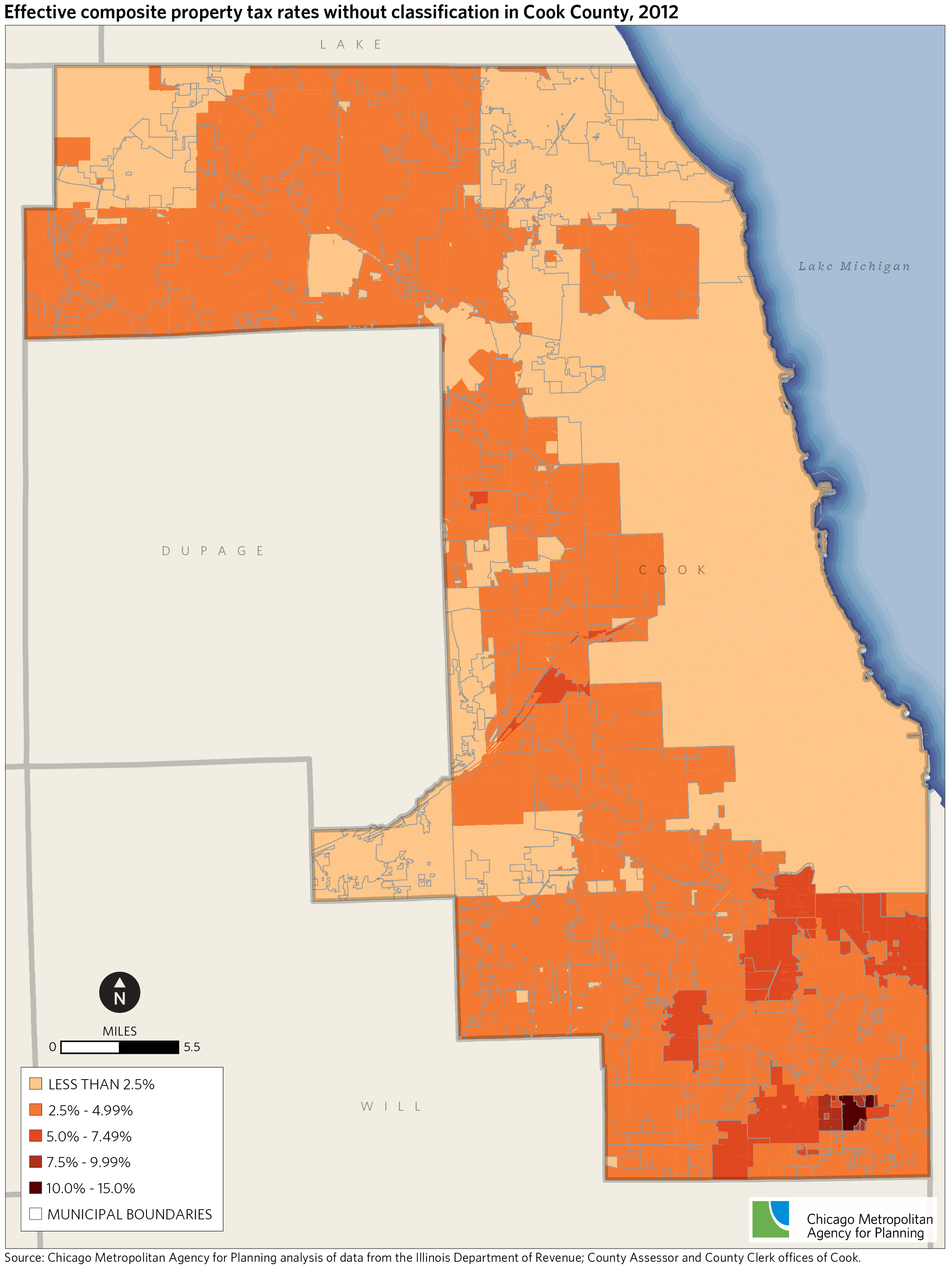

Eliminating property tax classification

CMAP's analysis indicates that property classification in Cook County may impede business development and economic activity. The following map illustrates what effective property tax rates would be if classification were not employed in Cook County in 2012. The map generally shows rates of less than 5 percent, which is more consistent with the rates that currently exist in the collar counties. Classification could ideally be phased out over time, allowing residential taxpayers to adjust. This map does not necessarily reflect what tax rates would look like after the phase-out, as market values and development patterns may change in response to a different system. It is only meant to provide an illustration of effective property tax rates under current market values without the effects of classification.

Implications for GO TO 2040

GO TO 2040 recommends that tax policies should encourage local decisions that make effective use of land, generate good jobs, and trigger sustainable economic activity. The classification system in Cook County is a driver of high property tax rates for commercial and industrial property in many communities. Lower property tax rates for businesses, especially in border communities, could help the county and region compete more effectively for economic development opportunities. In fact, the prevalence of incentive classes, which communities use to lower the assessment level of certain commercial and industrial properties, suggests that the existing classification system is a barrier to encouraging economic development for many communities. Keeping the current system could constrain the growth of the county's property tax base, putting a greater tax burden on both residents and businesses.

There are significant opportunities for infill development in Cook County, as recommended by GO TO 2040, but its higher property tax rates for comparable commercial and industrial properties present challenges. Eliminating classification could lower property tax rates in many communities with available infill and existing infrastructure and may make these communities more attractive to developers. While gradually eliminating the classification system would increase the tax burden faced by residential property owners over time, this may be mitigated by growth in the commercial and industrial property tax base due to improved economic development opportunities.