This is the first in a series of three Policy Updates on the structure of transportation funding programs in Illinois, as well as the governance of the state and local highway system. This post provides background information on the local motor fuel tax (MFT) allotments shared by the state with counties, municipalities, and townships, in addition to other transportation revenue-sharing programs. The second post evaluates the effectiveness of the Illinois local MFT sharing program. The final post explores the relationship between municipalities and townships in the local highway system and its funding.

GO TO 2040 calls on transportation agencies to implement performance-based funding, a transparent, data-driven approach for making investment decisions. While CMAP's past research on performance-based funding has focused on the project selection process, the overarching governance and funding of our transportation system also require analysis. This Policy Update will describe the structure of several state and local transportation funding programs in Illinois.

Background

Transportation projects have traditionally been paid for with user fees like gas taxes and vehicle registration charges --- those who use the transportation system pay for its construction and upkeep. The Illinois Motor Fuel Tax (MFT) Law requires the Illinois Department of Transportation (IDOT) to share revenues from the State's 19 cents-per-gallon gas tax with local governments.

After a variety of diversions to various funds, the law specifies that 54.4 percent of the balance be allocated to local governments. Of this portion:

- 49.1 percent is distributed to municipalities, based on population.

- 16.74 percent is distributed to counties with over 1 million residents.

- 18.27 percent is distributed to counties with less than 1 million residents, based on motor vehicle license fees received.

- 15.89 percent is distributed to townships, based on mileage of township roads.

If townships do not impose a property tax for road and bridge purposes of at least 0.08 percent (or in DuPage County, an amount of at least $12,000 per mile of township road is also allowable), their allocation is proportionally reduced.

Summary of Local MFT Allotments

According to IDOT data, the Department shared $553 million in MFT revenues with 2,857 units of local government in 2012. These governments included 102 counties, 1,457 townships or road districts, and 1,298 municipalities. The CMAP region's seven counties account for 109 townships or road districts and 284 municipalities, constituting about 7.5 percent of all townships and 21.8 percent of all municipalities in Illinois.

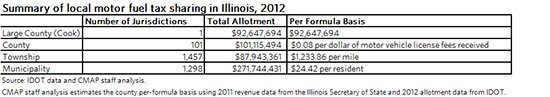

The following table summarizes the total state MFT allotments to counties, townships, and municipalities; it does not consider the other transportation revenues that these jurisdictions receive from other federal, state, or local sources. As the only county in the state with more than 1 million residents, Cook County received the full 16.74 percent of MFT revenues dedicated to large counties. CMAP staff estimates that the allotment for the remaining 101 counties totaled about $0.08 per dollar received in motor vehicle license fees. According to IDOT data for December 1, 2011 to November 30, 2012, the local MFT distribution to municipalities totaled $24.42 per resident and the local MFT distribution to townships totaled $1,233.86 per mile.

Click for larger image.

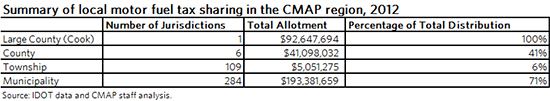

In 2012, the 400 eligible units of government in the seven-county CMAP region received a collective $332 million in local MFT allotments, or about 60 percent of the state's total local MFT sharing. The region accounted for 100 percent of the large-county allotment (i.e., Cook County) and 41 percent of the remaining county allotment. The region also represented 71 percent of the total municipal allotment, but only 6 percent of the township allotment. Counties and cities in northeastern Illinois have larger populations and more vehicle registrations than downstate counterparts, while suburban townships in northeastern Illinois are generally responsible for fewer highway miles than rural downstate townships.

Click for larger image.

Cumulative Distribution of Local MFT Allotments

Under the current system, the vast majority of jurisdictions receive a small allotment of local MFT funds. To illustrate, in 2012 the smallest allotment totaled only $317.46 for Valley City, a small community in Pike County that had 13 residents in 2010. Also in 2012, eight jurisdictions received less than $1,000 (including Elk Grove Township in Cook County), 166 jurisdictions received less than $5,000 (including ten townships and two municipalities in the CMAP region), and 369 jurisdictions received less than $10,000 (including 24 in the CMAP region).

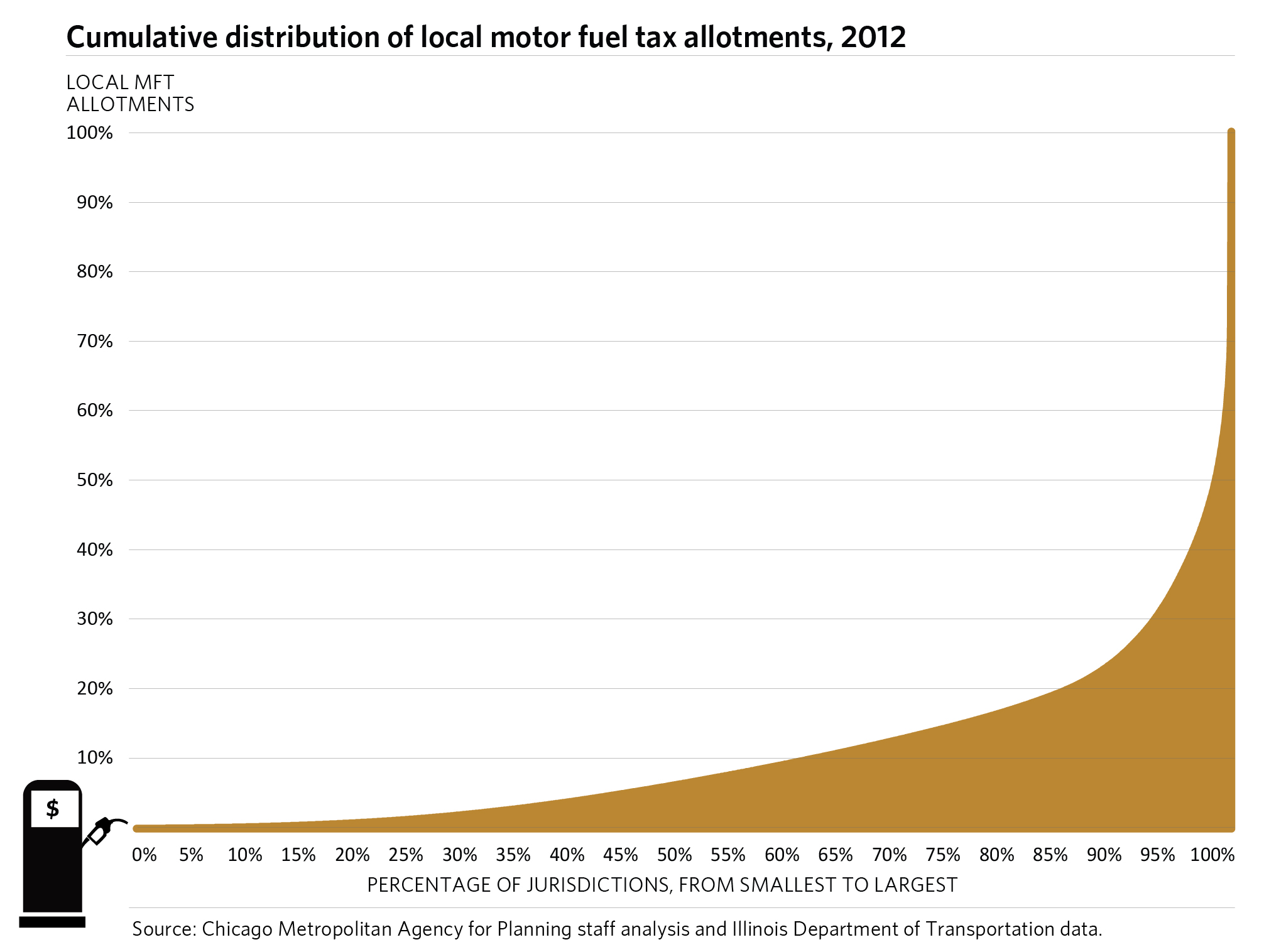

The following chart demonstrates how local MFT distributions are highly concentrated among a small number of jurisdictions. The x-axis measures the percentage of jurisdictions, sorted from those receiving the smallest local MFT allotments to those receiving the largest. The y-axis measures the cumulative percentage of local MFT revenues received. As highlighted in the chart, the smallest 60 percent of jurisdictions received a collective 10 percent of local MFT allotments.

Click for larger image.

In 2012, as shown in the chart, jurisdictions collectively received the following MFT allotments:

- The 1,000 smallest jurisdictions received approximately $16.5 million (or 3 percent).

- The 2,500 smallest jurisdictions (about 88 percent of jurisdictions) received approximately $122.4 million (or 22 percent).

- The 100 largest jurisdictions (3.5 percent of jurisdictions) received approximately $331.2 million (or 60 percent).

Sixty of the 100 largest jurisdictions are located in the CMAP region, including nine of the ten largest jurisdictions. Cook County alone represented 17 percent (approximately $92.6 million) of the total local allotment in 2012, and the City of Chicago's allotment represented 12 percent (approximately $65.8 million).

Other Transportation Revenue-Sharing Programs

In addition to the statutorily defined local MFT sharing program described previously, IDOT administers five additional revenue sharing programs by formula. The Department's Bureau of Local Roads administers the Township Bridge, State Matching Assistance, Consolidated County, Needy Township, and High-Growth Cities programs. Also, either by agreement with local governments or by competitive selection, the Bureau administers a number of other local funding programs that are not profiled here.

- State law funds the Township Bridge program at $15 million annually and uses the same distribution criteria as the local MFT sharing.

- The State Matching Assistance program is funded at $4 million annually and provides assistance to counties with low tax capacity in matching the federal transportation funds they receive. To be eligible for assistance, counties are required to levy a property tax between 0.045 percent and 0.050 percent. Additionally, a county that levies at a rate below 0.045 percent may be eligible for assistance if it transfers an equivalent amount of funds from a non-highway source. The assistance provided to each county is determined by the difference between the required matching funds and tax revenues generated from the property tax, given the program's overall $4 million funding constraint.

- The Consolidated County program is funded at $21.8 million annually. All counties but Cook receive an equal portion of $8 million from the program (about $79,000 per county), with the remaining funds allocated using the same criteria as local MFT sharing.

- The Needy Township program provides $10 million annually to townships and road districts that levy the maximum tax rate allowed but still lack adequate revenue to meet a minimum per-mile funding level. The Department determines eligible townships and assistance based on a district's equalized assessed value of all properties, annual average MFT distribution per mile, and average maintenance costs per mile.

- The High-Growth Cities program provides $4 million annually to municipalities of over 5,000 residents that have experienced at least a 5-percent increase in population between two decennial censuses or between a decennial census and a special census. Eligible municipalities receive funding based on population and their relative per capita population increase.

Additionally, local governments received a total of $100 million in each of three years (FY 2011-2013) through the Illinois Jobs Now! state capital program. These monies were distributed by IDOT according to the same criteria as the local MFT allotment.

Discussion

The State's various programs for sharing revenue with local government represent a substantial amount of funds -- well over a half-billion dollars every year. Although state law is quite specific regarding the funding percentages and distribution of local MFT allotments, the resulting dollar amounts are not necessarily tied to service needs. Furthermore, as set percentages, the overall funding pots for counties, municipalities, and townships cannot respond to changing needs over time. Other counties will eventually reach 1 million residents and be eligible for the 16.74 percent set-aside; current law is silent on how to distribute funds among very large counties. And as municipalities annex formerly unincorporated land, their highway networks (and populations) will grow while townships' highway networks decline.

It is unclear to what extent the State's other five revenue-sharing programs complement the local MFT allotment; two of the programs use more or less the same criteria as the local MFT allotments, but the others use their own criteria. For two of the latter programs, IDOT's public documentation does not specify exactly how disbursements are made. On the whole, these stand-alone programs are fairly small, totaling only $54.8 million a year.

Subsequent posts in this Policy Update series will analyze connections between the State's revenue-sharing programs and system mileage, pavement conditions, and traffic volumes.