NOTE: This is the first in an on-going series of Housing Policy Updates.

The regional housing market has experienced some significant changes since the beginning of 2012. Total housing permits and starts have ticked back up, and the for-sale market appears to be slowly recovering. However, much of this growth has been driven by single-family starts concentrated primarily in the region's outer edges, signaling a potential  return to pre-recession trends. Meanwhile, construction of multifamily housing is lagging with the exception of some areas in the city of Chicago. On the rental side, vacancy rates have decreased and monthly rents have increased, although change in both of these has slowed in the first half of this year. Finally, the Chicago region appears to be falling behind other regions in producing new multifamily rental housing.

return to pre-recession trends. Meanwhile, construction of multifamily housing is lagging with the exception of some areas in the city of Chicago. On the rental side, vacancy rates have decreased and monthly rents have increased, although change in both of these has slowed in the first half of this year. Finally, the Chicago region appears to be falling behind other regions in producing new multifamily rental housing.

GO TO 2040 seeks to strengthen existing communities, partly by encouraging redevelopment and infill. While the plan's emphasis on livable communities includes both new and old developments, new single-family housing development concentrated in the region's outer areas creates the need for new infrastructure, can increase commute times and costs, and often reduces transit access. Additionally, because livability entails a balanced supply of owner-occupied housing and rental housing distributed throughout the region, GO TO 2040 encourages municipalities to plan for their housing needs and to tailor affordable housing policy options into an appropriate plan for their community.

Rental Housing

Increased rents and decreased vacancies illustrate the recent trends in the region's rental housing market. These changes are likely due to a number of factors, including the economic downturn, stricter lending standards for residential mortgages, and/or increases in the demographic groups that traditionally rent. According to Reis, a provider of multifamily rental data for projects larger than 40 units, average monthly rent in the Chicago region has increased approximately 2 percent compared to June 2012, while the vacancy rate has decreased a full percentage point, from 5.1 percent to 4.1 percent. This is the region's lowest vacancy rate since 2001, and the region has had consistently lower vacancy rates than the rest of the nation.

Increases in monthly rental payments in the Chicago region have exceeded national increases for several quarters, and Reis predicts that Chicago average monthly rents will exceed both Midwest and national averages by 2013. Overall, the region's growth in average monthly rent ranks 20th in the U.S., but that growth has slowed over the past year. However, some areas of the region are still experiencing fast growth. For example, rents in southeast Cook County have increased 2.1 percent over the last quarter. The top five submarkets with rent increases over the last quarter were all suburban areas.

Widespread increases in rent can negatively impact low- and moderate -income households. An analysis by the National Low Income Housing Coalition indicated that Illinois has only 28 affordable and available units per 100 households whose family income is less than 30 percent of the metropolitan area's median. Affordable rental housing can be a contentious issue in many communities, and CMAP's 2010 Municipal Plans, Programs, and Operations Survey indicated that only 27 percent of the region's communities actively plan for affordable housing of any type.

For-Sale Housing Values

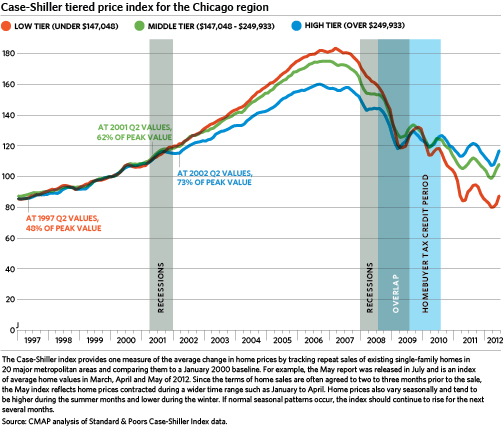

While the region's for-sale housing market is still declining overall, that rate of decline has slowed significantly and values in some counties are actually beginning to tick back up. According to data from the Illinois Association of Realtors (IAR), Cook, DuPage and Kane counties experienced increases in median home prices compared to the second quarter of 2011, and Kane experienced an annual increase in average prices. In all counties except Kendall, total units sold have increased significantly compared to the second quarter of 2011. The Standard & Poor's Case-Shiller index indicates that, while values still declined compared to June 2011, average housing values in the Chicago Metropolitan Statistical Area (MSA, the Chicago-Joliet-Naperville MSA is a 14-county area that covers portions of Indiana and Wisconsin) have increased significantly every month since March. While this is an expected seasonal change, it has brought the index very close to an annual gain in values. Of the 20 MSAs tracked nationally by the single-family index, six experienced year-to-year value decreases in June. Of the five MSAs tracked in the condo index, Chicago and Los Angeles experienced annual declines. For an in-depth explanation of the major home value indices, see this article from the St. Louis Federal Reserve.

However, despite the annual decline in value, the Chicago region experienced some of the nation's largest month-to-month gains during the second quarter of 2012. Closer analysis indicates that recent home value changes have not been even across all market segments. The chart below shows the change in the Case-Shiller index for single-family homes in three price points. The lowest tier is the only price tier still below its 2000 base level (100), while the highest tier did not appreciate in value as much during the boom and has not fallen in value as much since the recession began.

Wide disparities in existing home values can impact the region's communities. A steep loss in home value can lead to negative equity if the drop in value exceeds the amount of principal that a homeowner has paid on their mortgage. This is commonly referred to as an "underwater" mortgage. These losses in value drain personal wealth, are associated with higher rates of foreclosure, and can negatively impact community stability. The steep declines in the lowest price tier also affect communities that may inherently have lower property values and, therefore, fewer fiscal resources to address the impact of properties that are vacant, foreclosed, or not well-maintained. Several housing collaboratives have recently formed in the region to address housing issues in this environment, working particularly on strategies to address and prevent foreclosures.

For-Sale Housing Starts on the Rise

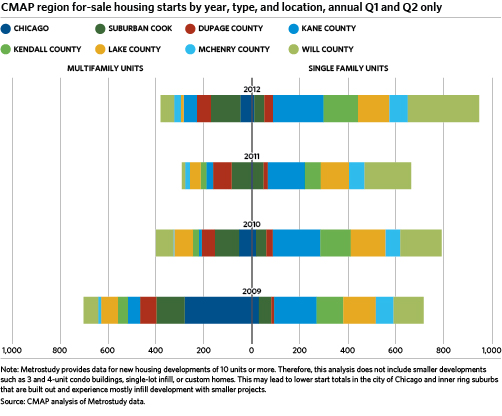

For-sale, single-family housing starts have increased significantly compared to recent trends. While total starts are still well below pre-recession levels, single-family starts in the first half of this year have surpassed the same time period in 2011. For-sale multifamily starts in the first half have experienced their first annual increase since the start of the recession. Additionally, a shift has occurred in the balance between single-family and attached housing starts. In the years immediately prior to and during the recession, the region experienced either an even distribution between for-sale single-family and attached housing starts or a predominance of attached housing starts.

Recently, for-sale housing starts have shifted toward the single-family market. This may be due in part to market conditions. The Case-Shiller condo index indicates that the Chicago regional condo index is slightly below the single-family index. County data from IAR indicates a similar trend, with average condo price changes on year-to-year basis faring worse than single-family in all counties except Cook, DuPage, and Kane. On a quarterly basis, single-family is ahead in all counties except McHenry. Median price changes tell a similar story. Additionally, the city of Chicago historically comprised between 30 to 60 percent of the region's for-sale attached starts, and is only at 14 percent for the first half of 2012. The city is considered a strong market for multifamily rental, and new multifamily construction appears to be directed toward that market rather than the for-sale market. While rates of for-sale attached housing development have fallen compared to single-family in suburban areas, too, high development levels in Chicago drove the predominance of attached for-sale starts prior to the recession.

In the first half of 2012, new for-sale single-family starts have been concentrated in Kane and Will counties, which have half of the region's starts. Lake and Kendall contained another quarter of the region's starts. Finally, suburban Cook County has also experienced a significant increase in single-family starts over the last 18 months and is now on par with Lake and Kendall. This may be a positive sign of infill development, which often holds down public costs due to its use of existing infrastructure and services. However, a resurgence of housing starts in the outer areas of the region may also indicate a return to pre-recession trends of new single-family development in subdivisions on the urban fringe, which can create the need for costly new infrastructure and services.

Building Permits

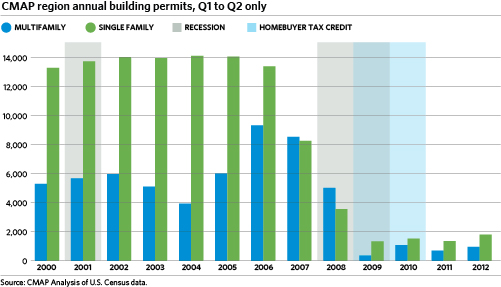

Most new housing units for which building permits have been obtained are constructed, and the volume of permits offers a good barometer of the region's real estate market. Total permits issued for new housing units in the first half of 2012 exceeded the numbers seen in the first half of 2008, 2009, and 2010. Single-family permit increases in the first half of 2012 were concentrated in DuPage, Kane, and Will Counties, although the City of Chicago increased 57 percent from the first half of 2011 and has attracted a growing share of the region's single-family permits each year. In contrast, multifamily permits have declined in Lake, McHenry, and Will and have doubled in the City of Chicago compared to the first half of 2011.

As shown above, the region is issuing fewer residential building permits compared to pre-recession highs. However, the region is also falling behind other regions in recovering from recessionary lows. Prior to the recession, Chicago ranked as high as 20th in the nation amongst large MSAs (the 51 MSAs with more than one million people) in terms of permitted multifamily units per 1,000 people, and has fallen to below 40th for 2011 and the first half of 2012. Similarly, the Chicago MSA ranked as high as 34th for single-family permits prior to the recession but is now 49th. However, the decline in rankings has been steeper for multifamily permits than for single-family.

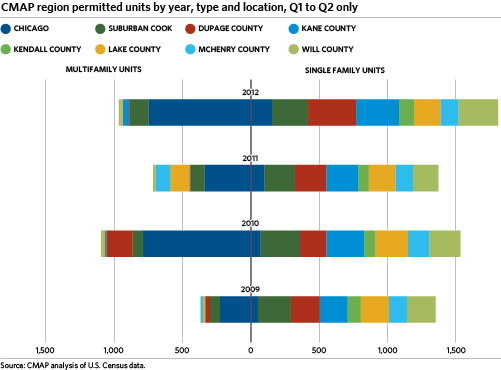

In short, the Chicago MSA as a whole is falling behind the nation in production of multifamily units. The region was highest ranked when nearly 40 percent of the multifamily units produced were for-sale units such as condos or townhomes, but it is lagging now that nearly all new multifamily units are for-rent rather than for-sale. However, this lag is not distributed evenly throughout the region. Areas within and near downtown Chicago are considered to be an excellent market for rental multifamily housing, and nearly 7,000 units are expected to be constructed in the area through 2014. However, this construction boom has not affected the suburbs at the same rate. While high-end apartment developments are underway in several suburbs, the multifamily unit counts are far below those of the City. No large suburban rental developments have yet been completed in 2012, but 1,620 units are under construction. Data from Marcus & Millichap indicate that approximately 15,000 rental units are currently planned in the City of Chicago, with only 7,000 planned in the suburbs.

Intraregional building permit data illustrate this trend of fewer multifamily units produced in the suburbs. Prior to 2000, suburban areas issued 60 to 75 percent of the region's multifamily unit permits. That figure declined steadily between 2000 and the recession, reaching a low of 14 percent in 2008. In the first half of 2012, suburban areas issued just 23 percent of the region's multifamily permits. The region's suburban areas are now issuing single-family permits at over four times the rate of multifamily units, compared to a pre-recession average of slightly more than double the multifamily rate. While suburban Cook County has maintained a more stable proportion of multifamily permits, other counties have declined significantly.

A number of factors pose potential obstacles to construction of rental developments in suburban areas, including regulatory barriers; the need to prove demand for multifamily development in areas that have traditionally consisted of for-sale, single-family homes; and the difficulty of financing rental development in unproven areas. Zoning regulations -- which govern all development -- can discourage multifamily construction by increasing development timelines, mandating lower unit counts (thereby decreasing developer returns), posing significant lot-size or setback requirements, or otherwise minimizing the potential for multifamily development. In contrast, the increasing rents and falling vacancies in suburban areas are a key market sign that demand for rental housing is increasing in these areas. Due to the age of both baby boomers and millennials, overall demand for rental housing is expected to increase nationwide for the next 10 to 20 years. GO TO 2040 anticipates that the number of residents between 65 and 84 years of age will double by 2040, and that 20 to 29 year olds will also experience a significant increase.

GO TO 2040 supports the region's transition to a balanced supply of rental and owner-occupied housing, and the plan encourages place-based solutions that help each community determine its best fit to reach this goal. Newly constructed units are not the only source of rental housing – some stalled condominium projects have been converted to rental developments and rental of single-family detached units is on the rise. However, new multifamily units will also be needed to provide full housing options for the region and meet projected growth in renter populations. In partnership with the Metropolitan Planning Council, CMAP sponsors Homes for a Changing Region. This program helps communities to chart future demand and supply trends for housing in their communities and develop long-term housing policy plans, with the goal to create a balanced mix of housing, serve current and future populations, and enhance livability.