CMAP's regional economic indicators microsite features key measures of metropolitan Chicago's economy and, where applicable, compares these measures to peer metropolitan areas. The microsite and accompanying Policy Update series examine the complex factors that shape our region's global economic competitiveness. The first of a two-part series that explores new methods for studying industry clusters, this update explores the region's traded industry clusters, and an upcoming update will explore local industry clusters.

In today's economy, metropolitan areas are the unquestioned engines of economic growth. On a global scale, roughly 80 percent of the world's output this year will be generated in urban areas. That proportion is even higher in the U.S., where metropolitan areas generated over 90 percent of the nation's GDP in 2013. Understanding the strengths, needs, and challenges of our metropolitan areas helps policy makers and planners develop long-range strategies to foster economic growth. One way of understanding the economic strengths of our region is to examine employment growth and concentration in the region's industries.

Research has shown that certain industries within metropolitan areas tend to develop in concert with suppliers, complementary businesses, specialized support services, and customers. The process of related industries growing alongside one another is known as "clustering." Location choice is a critical component of business success. Industries located within strong clusters benefit from better access to talent, suppliers, infrastructure, and specialized services. By enacting policies that support the infrastructure and workforce needs of our industry clusters, our region could facilitate economic growth.

This Policy Update will describe research into clusters, including CMAP's application of the U.S. Cluster Mapping methodology. It will also explore how certain types of clusters foster growth in metropolitan economies and how clusters contribute to the Chicago region's strengths. Although this update is a component of CMAP's ongoing economic analysis, it builds on the foundation of cluster analysis established in GO TO 2040. Moving forward, new methodology explored here will inform CMAP's preliminary analysis for the region's next comprehensive plan, which is scheduled for adoption in 2018.

Industry cluster analysis approaches vary

CMAP's cluster analysis in GO TO 2040 used the Purdue University cluster typologies. While these provide a strong understanding of the benefits of economic clustering, a newer approach that is more suited to large, complex economies like metropolitan Chicago is available. Building on decades of research, a series of leading researchers associated with the U.S. Cluster Mapping Project recently published a methodology for identifying and categorizing industry clusters.

While prior CMAP research explored the region's freight and manufacturing clusters in great depth, the Cluster Mapping identification provides additional tools to understand how these clusters contribute to the region's economy. CMAP's cluster analysis methodology was tailored to specifically study metropolitan Chicago's industries, whereas the Cluster Mapping's methodology was designed to understand national trends. The new methodology provides a foundation for understanding and comparing industry clusters in the Chicago region and other metropolitan areas. Moreover, contributing research for the project has also led to a greater understanding of different types of industry clusters and their differing roles in the economy.

Understanding clusters' differing roles in the economy

The U.S. Cluster Mapping methodology offers a refined look into the roles that different clusters play in metropolitan economies, distinguishing industry cluster types as traded or local. Traded industries and clusters produce goods and services that are consumed nationally and globally. They exist in less than half of all regions nationwide and are highly concentrated in just a few regions. Local industries and clusters serve regional populations with essential goods and services. They are found in all regions across the U.S. at a consistent level of employment concentration. By distinguishing between these two broad industry cluster types, regions can understand their unique human capital assets and better develop and prioritize strategies for cluster growth, since each industry cluster type has its own economic development needs.

Methods for identifying industry clusters have changed over time as researchers develop a greater understanding of clusters. The new research behind the U.S. Cluster Mapping Project identifies groupings of industry clusters by attempting to capture geographic co-location patterns, occupational sharing patterns, and input-output linkages.

To measure geographic co-location of both employment and establishments among industries, researchers used several federal data sources. The methodology uses employment and establishment counts based on Census Bureau County Business Patterns data, with higher levels of co-location patterns between industries indicating greater levels of industry inter-relatedness. Input-output linkage data from the Bureau of Economic Analysis is used to identify buying and selling relationships between industries. Industries that commonly share inputs and outputs are assigned a higher probability of being placed in the same cluster. Finally, data from the Bureau of Labor Statistics Occupational Employment Statistics survey are used to determine the extent to which industries have similar workforce requirements. Industries with similar workforce characteristics are assigned a higher probability of being put into the same cluster.

After measuring linkages using these datasets, economists scored the interrelatedness of potential industry cluster combinations. Expert judgment was then applied, and some clusters were combined or split into two by researchers. The final result of the research was the identification of 51 traded industry clusters that can be compared across regions. While there are now more clusters, identified with more detail, than in prior CMAP work, many of the core elements shared among the clusters are still present.

Clusters grow talent and leverage built-in advantages

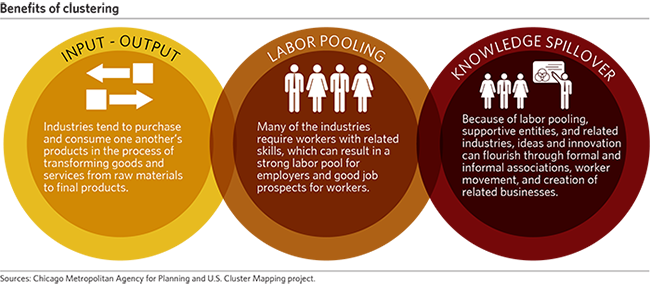

Economists have observed that industry clustering yields several beneficial economic effects. Firms within industry clusters benefit from having access to large labor pools. As the labor pool within a cluster grows, firms can more easily find qualified workers, and workers within the cluster are able to find more employment opportunities. High levels of employment within an industry cluster can also lead to the development of new institutions that support the cluster, such as research collaboratives or professional organizations. As clusters grow, they can also attract specialized investors, which can fuel further growth.

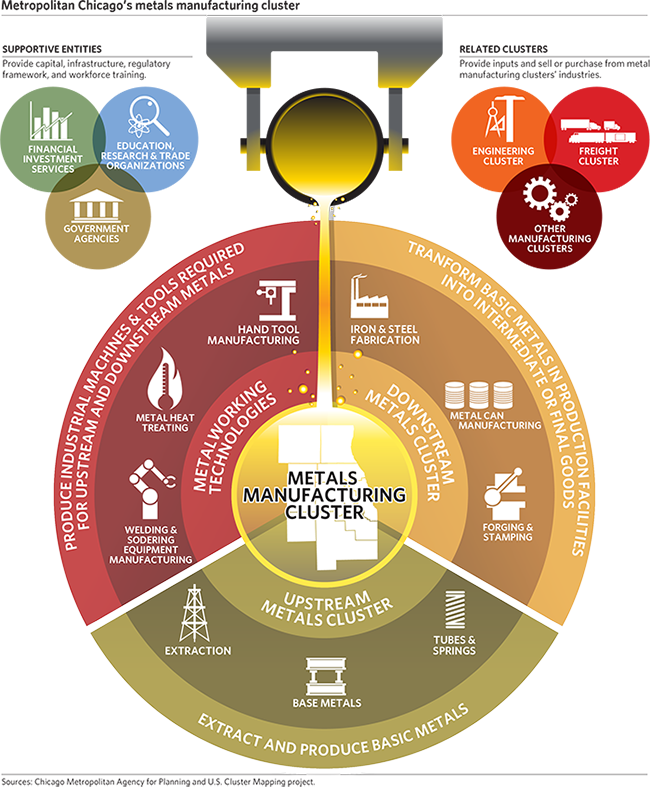

The clustering of industries also provides firms with greater access to inputs and outputs than businesses within a single cluster need, but this access may benefit related clusters. In metropolitan Chicago, clustering relationships are clearly illustrated among the three metals manufacturing clusters – upstream metals, downstream metals, and metalworking technology. Fabricated metals manufacturers, for example, require significant amounts of base metals to produce their products. Thus, primary metals and fabricated metals manufacturers choose to locate in the same region. Co-location increases access to inputs, fosters innovation and process improvement among related industries, and allows for improved logistics and transportation for materials and finished products.

Firms located in concentrated industry clusters also benefit from the formal and informal sharing of ideas among workers. Research shows that areas with high concentrations of related businesses and workers often facilitate these exchanges, which economists refer to as "knowledge spillovers." Employees within a particular industry exchange ideas about how to more effectively produce a good or service. Spillovers can also occur as a result of idea sharing between individuals working in different industries with diverse backgrounds and perspectives. These interactions can lead to the development of new products and services. In either case, as employment density increases, so does the likelihood of knowledge spillover.

Industry clusters are associated with higher employment, growth in wages and establishments, higher levels of patenting, and higher levels of startup activity – all of which are indicators of strong economic performance. However, the benefits of clustering do not apply evenly to all industries or clusters. Local clusters, which predominantly serve local markets, see fewer benefits from clustering compared to traded clusters, which serve a national or worldwide market.

Chicago Region Traded Cluster Strengths

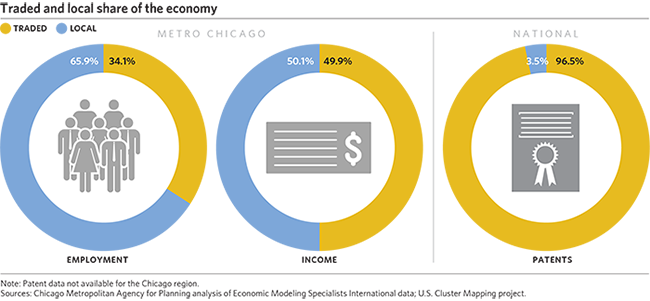

Economic research shows that traded clusters, as compared to local clusters, play a significant role as drivers of wage growth and innovation. Because of their high growth potential, economic developers often focus on attracting traded industries to their region. Nationwide, traded clusters account for 33 percent of jobs but more than one-half of the payroll, as well as 90 percent of patenting activity. In the Chicago region, traded clusters make up 36 percent of the region's jobs.

Applying the Cluster Mapping approach to metropolitan Chicago shows that the region is home to a diverse economy with a number of areas of specialization, measured by location quotient. These include advanced manufacturing clusters -- such as biopharmaceuticals, lighting and electrical equipment -- and downstream chemical products, along with service clusters such as marketing, design, and publishing, and transportation and logistics. These findings largely echo CMAP's prior cluster research. The following table shows the ten most specialized industry clusters in the region and their specialization and change in employment since 2001. While these specialized clusters have all lost employment, the region's continued specialization indicates that we have retained these jobs at a higher rate than the rest of the country. A full list of the seven-county Chicago region's traded industry clusters and employment totals can be viewed here.

Each of the region's clusters of specialization offers an opportunity for potential economic growth and investment. This Policy Update provides a high level overview of several clusters of regional strength: metals manufacturing, lighting and electrical equipment manufacturing, transportation and logistics, and distribution and electronic commerce.

Supporting strong clusters in Illinois

Several traded clusters have strong concentrations in metropolitan Chicago. These industries benefit from specialized talent pools, formal and informal opportunities to exchange ideas and further innovation, and specialized suppliers, consumers, and service providers. For example, the U.S. Cluster Mapping project indicates that the Chicago region is one of the nation's largest metals manufacturing hubs. The region has above-average concentration in all three metals manufacturing clusters. These concentrated clusters are a positive addition to the region's other globally and locally traded clusters, and they benefit from being supported by a variety of entities with relevant expertise and assets.

The metals manufacturing process generally begins in the region's upstream metal manufacturing cluster, where raw metals are transformed into basic products, such as pipes, tubes, wires, or springs. Upstream metals are then sold to the region's downstream metals cluster, which then transforms these components into intermediate and refined goods, such as kitchen cookware, home fixtures, or metal door and window parts. These processes are supported by the region's metalworking technology cluster, which produces the industrial machines and tools used by the region's upstream and downstream metals clusters. The supportive relationship between these and other related industries are outlined in the graphic below. Analysis of EMSI data show that, combined, these three metals clusters contain 56,000 jobs and 2,500 establishments. The clusters created an estimated $12 billion in output in 2013.

Clustering not only lets industries build upon strengths, it also can focus public and private sector economic development efforts. In May of 2014, the seven CMAP counties successfully competed for designations as an Investing in Manufacturing Communities Partnership (IMCP) region. The federal designation gives the region access to special economic development funds to help enact plans to support the development of the region's metals clusters. Additional efforts are underway to support the growth of metals exports from the Chicago region through the Metro Chicago Exports program.

A second area of economic strength for the region is lighting and electrical equipment manufacturing. This cluster manufactures lights, lighting fixtures and parts, as well as electrical wires, switchboards, and transformers, and accounts for approximately 17,000 jobs in the region. The lighting cluster in the Chicago region is the seventh largest in the U.S. with a location quotient of 1.96. This concentration of employment is nearly twice as high as the U.S. average.

The lighting cluster has undergone significant changes over the last decade with the introduction of new technologies such as energy efficient lightbulbs and the widespread adoption of energy efficiency systems in commercial and industrial buildings. Although cluster growth has waned since the end of the recession, the cluster presents an opportunity for future growth given the region's history as a center of innovation in building design and architecture.

In addition to strengths in goods-producing industries, the Cluster Mapping methodology also highlights the region's strengths as a provider of services across the country. The region has a large transportation and logistics cluster, as well as a sizable distribution and electronic commerce (DEC) cluster. While the Chicago region is predominantly known for its strength in manufacturing, the value that service clusters bring to the region's economy cannot be understated. In 2013, according to Bureau of Economic Analysis data, approximately three-quarters of the region's output came from service industries.

Some of the industries contained in CMAP's prior freight cluster fall into the Cluster Mapping Project's distribution and electronic commerce (DEC) cluster. The DEC cluster is comprised of wholesalers and electronic merchants, as well as industries that support e-commerce operations, such as packaging, labeling, and equipment rental and leasing. The region's DEC cluster is the fifth largest in the nation and accounts for nearly 200,000 jobs. Within the cluster, the region has particular strengths in warehousing and in industrial equipment and metals wholesaling. Metropolitan Chicago's strategic location makes the region a primary point for goods storage and distribution. Similarly, metals wholesalers are concentrated in the region and assist with the sale and distribution of local upstream and downstream metals cluster output. CMAP's freight-manufacturing nexus report also examined how the concentration and co-location of freight and manufacturing fosters many interrelated activities across clusters. Freight carriers bring in raw materials and intermediate inputs, enable intraregional supply chains, and provide access for final goods through local consumption and exporting.

Looking forward

Since the adoption of GO TO 2040, researchers have made significant strides in understanding how to study and support industry clusters. Nationally, efforts culminated in the launch of the U.S. Cluster Mapping project. In the Chicago region, CMAP and its partners analyzed the multifaceted freight and manufacturing clusters. As CMAP moves forward in its planning work, the agency will conduct additional industry cluster analysis using the U.S. Cluster Mapping Project definitions to understand the region's economic strengths, employment trends, and evolving needs.

The new methodology provides a number of insights about the region's economic strengths and weaknesses that merit exploration in greater depth. The analysis presented here is an initial glimpse of traded industry clusters in the region. Traded clusters provide a number of economic benefits to the region in the form of good paying jobs and innovative activity. The next comprehensive regional plan will offer the region an opportunity to evaluate our progress so far, improve our methods, and continue to assess economic challenges and opportunities.