Nurturing the region's industry clusters is one of the main recommendations from the Human Capital chapter of GO TO 2040. The plan directs CMAP, with the support of its partners, to perform "drill-down" analyses into specific established industry clusters, including freight, advanced manufacturing, and biotech/biomed, to better understand them. CMAP is focusing on freight as the first in its series of cluster studies. This Policy Update discusses the preliminary findings of that research, which will be published in June 2012.

Background on Cluster Studies

Clusters are interdependent firms that are in close geographic proximity, share common resources and technologies, and depend on a similar labor pool and institutions. The Chicago region's freight cluster contains not only core modal industries (i.e., rail, truck, air, and water freight transportation), but also the customers served by freight industries (e.g., wholesalers), the companies that supply and support core industries (e.g., transportation equipment manufacturers or logistics firms), and the companies that indirectly support these industries (e.g., road construction firms).

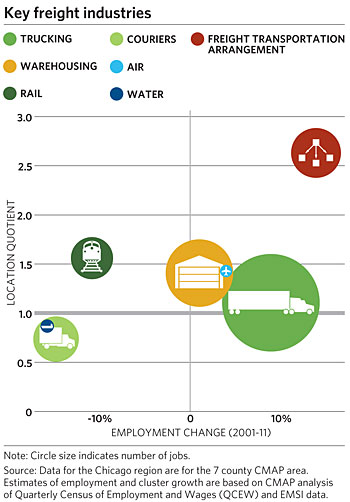

The bubble graph below shows the growth and concentration of these core freight industries in northeastern Illinois, as well as the larger industries involved in moving goods through the region. The horizontal axis measures employment change from 2001-11, and the vertical axis shows the 2011 location quotient, which measures how concentrated an industry is compared to the national average. The size of each industry's circle is based on 2011 employment figures. As of 2011, the local trucking industry had over 60,000 employees, while the air freight industry had less than 1,000 employees. Overall, over 200,000 people are employed in the region's freight cluster. This represents four percent of regional employment.

Study Objective

CMAP's drill-down analysis explores the connection between the freight cluster and the regional economy, examines how national and international developments are affecting freight in the region, and identifies key infrastructure, workforce, and innovation challenges and opportunities that affect future cluster growth. The report also surveys major efforts to support and strengthen the cluster and evaluates how these efforts align with identified challenges and opportunities. The final report will conclude with strategies for the region to better align resources and investments with the needs of the cluster so that the cluster can continue to remain competitive and grow.

Key Findings

Cluster Dynamics

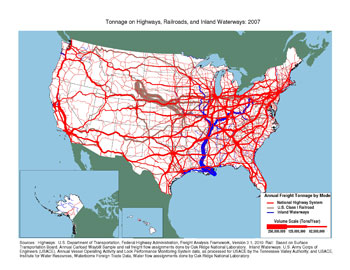

The freight cluster is a driver of economic growth in the Chicago region -- in the past decade, employment in the cluster has increased by seven percent while overall employment in the region has increased by less than one percent, according to CMAP analysis of Economic Modeling Specialists, Inc. (EMSI) data. EMSI's numbers are based on Bureau of Labor Statics (BLS) counts and have been integrated with roughly 90 other sources to improve accuracy and allow for more precise analyses. Furthermore, metropolitan Chicago is the nation's freight hub. Between a quarter and a third of all U.S. freight tonnage originates, terminates, or passes through the Chicago region (see map of freight movements).

Source: Federal Highway Administration. http://ops.fhwa.dot.gov/freight/freight_analysis/nat_freight_stats/tonhwyrrww2007.htm. Click image for larger version.

National and International Developments

Globalization and increased consumption continue to drive enormous demand for freight, which is expected to double within the U.S. in the next 20 years. Efforts to address this increased demand in freight are underway in the U.S and abroad.

Some of these external efforts, such as expansion of the Prince Rupert port in British Columbia, will likely increase the volume of freight coming through the region. In contrast, the Chicago area is also facing competition to capture increasing freight demand from other regions, such as Memphis. Developments like the widening of the Panama Canal may also direct freight flows away from Chicago. To stay competitive, the northeastern Illinois region must stay abreast of international and national developments in freight movements while developing proactive strategies that enable the region to benefit from these developments.

Challenges and Opportunities

Despite metropolitan Chicago's role as a leading freight hub, a number of serious issues may inhibit growth in the freight cluster relating to infrastructure, innovation, and workforce challenges. Infrastructure is the most significant challenge facing the cluster because of the region's congested transportation system, which was discussed in a recent article from the New York Times. Currently, our region ranks amongst the most congested in the nation. Regional congestion is exacerbated by fragmented freight land use and by a dwindling stock of industrial/freight land. Because almost every industry relies on the freight cluster for efficient movement of goods, the rising costs of moving goods through the region will affect the competiveness of the greater regional economy.

In addition to infrastructure issues, innovation is rapidly changing the needs and operations of businesses within the cluster. Technology is increasingly being used to control supply chains that are global in scope. Improvements in carrier and terminal operations are being adopted to realize new efficiencies. External and internal pressure to "green" the cluster is leading to a slew of innovations, such as increasing fuel efficiency and reducing emissions. To stay competitive, the regional cluster must stay ahead of the curve in adopting freight innovation and addressing the barriers that inhibit the creation of innovations.

The changing dynamics of the freight cluster are altering workforce needs. The increased technology-intensive nature of the freight cluster means that workers need new skillsets to be competitive. This is an important opportunity for the workforce, yet the region is having difficulty attracting technology-savvy workers to manage complex supply chain movements.

Other major workforce challenges and opportunities include retention issues and the high number of projected job vacancies.

Cluster Support

Significant resources across the region are targeted toward strengthening the freight cluster. Policies on freight are often determined independently based on jurisdiction. The consequences of these policies, however, have regional repercussions. Because implementation efforts often occur at the local level, freight support structures tend to be siloed as efforts are concentrated on specific issues or geographies. Better understanding the existing priorities and strategies will reveal opportunities for regional coordination and strategic investment to support the Chicago region's status as a leader in freight and logistics.

CMAP's freight drill-down report will build on these preliminary findings and will conclude with strategies on what the freight cluster needs to remain competitive and grow, as well continue to return economic benefits to the region. Upon release of the freight drill-down in June 2012, CMAP will work with partners and stakeholders across the region to organize strategic efforts to support innovation and growth in the freight cluster.