The scheduled spring session of the 99th Illinois General Assembly is coming to a close. However, the state's Fiscal Year 2016 budget has not yet been passed due to significant disagreements regarding spending and revenue among legislators and Governor Rauner. For a variety of reasons, namely the Illinois Supreme Court's recent ruling declaring unconstitutional pension 2013 reform known as Senate Bill 1, the FY16 budget seems likely to include new revenue. Two recent reports provide guidance on potential tax policy reforms.

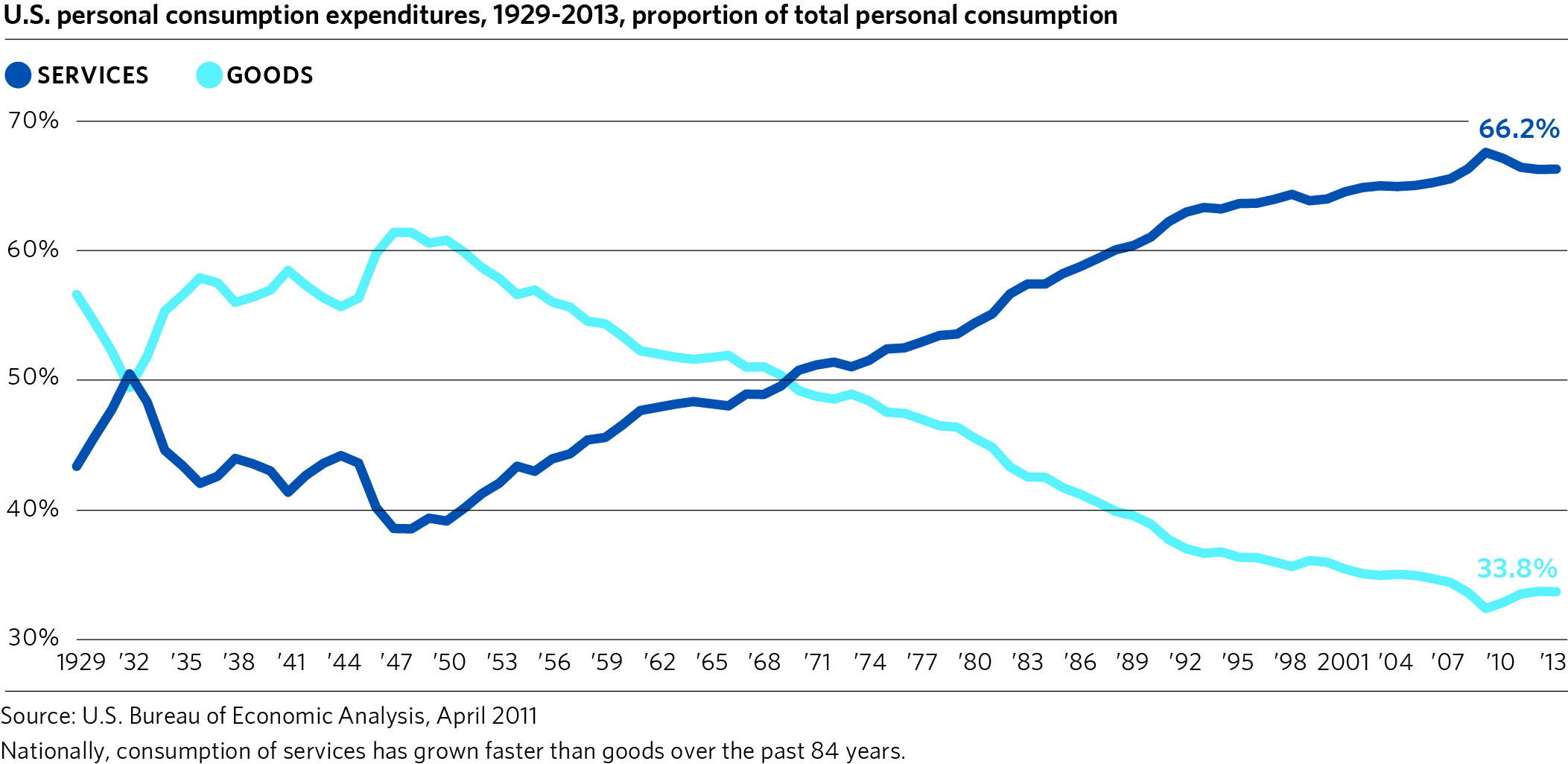

The first report, a joint publication of the Center for Tax and Budget Accountability (CTBA) and the Taxpayers' Federation of Illinois (TFI), examines a potential expansion of the Illinois sales tax to consumer services. The chart below illustrates that consumption patterns have changed substantially in recent decades, resulting in state and local governments taxing an increasingly narrow base of consumer goods. The report argues that reforming sales tax to include consumer services could stabilize a key revenue source for state and local governments. Moreover, the report points out, as does similar research by CMAP, that carefully crafted reforms are an opportunity to modernize the tax system to be more efficient, fair, and responsive to economic trends.

Among many issues examined, one key factor lawmakers will have to consider is how potential policy changes will impact regional competitiveness. The joint CTBA and TFI report and CMAP research analyzed tax rates nationally and among several Midwestern states. Their report finds that Illinois is an outlier both among our neighbors and nationally in terms of the number of services it taxes; the national median number of services taxed is over 50 (among the 45 states that impose sales taxes) while CMAP research found that Illinois taxes only 17 services. Furthermore, the Illinois sales tax rate of 5 percent falls below the national average.

The second report summarizes findings from a forum hosted by the Federal Reserve Bank of Chicago and the Civic Federation to examine the use and efficacy of so-called sin taxes. Sin taxes, particularly gambling revenues, have been used periodically to pay for the region's infrastructure. For example, the Illinois Jobs Now! capital program partially relied on gambling revenues that fell short of projections. Indeed, researchers found that Illinois gambling revenues have been fairly flat or on the decline, despite the state's video gambling expansion. The report concludes, "sin taxes are often subject of attention when states and localities find themselves in tight fiscal conditions. However, as the presentations at this forum demonstrated, sin taxes often offer limited revenue growth and, in some cases, are costly to inforce."

Many findings in both reports echo GO TO 2040 and subsequent research on state and local government revenues. CMAP's Regional Tax Policy Task Force and 2015 Agenda for the Illinois General Assembly emphasize the need for comprehensive reforms of state tax policy to provide adequate revenues for the services they provide and mitigate distortion of land use decisions. Finally, CMAP's principles for a new capital program call for Illinois to adopt user fees to generate new revenues for infrastructure, connecting consumers to the system they rely upon. Both of these reports, like GO TO 2040, aim to further discussions that will support the state's and region's economic vitality and quality of life.