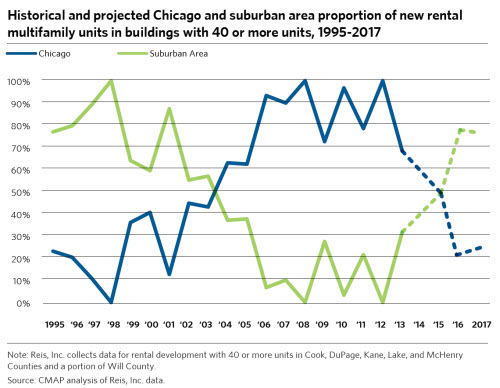

While rental of single-family homes has grown in the region over the last decade, multifamily developments house the majority of the region's renters. Since 2000, the region has experienced significant shifts in the balance of multifamily rental units, with a decrease prior to the recession and an increase during and after. Since 2000, construction of large new multifamily rental buildings has tended to be concentrated in the City of Chicago. During 2012 and the first quarter of 2013, however, new multifamily rental permits and construction shifted outward into suburban areas of the region. According to Reis, Inc, a provider of data on multifamily rental developments, this trend is projected to continue for the next several years. Compared to Chicago in the first quarter of 2013, suburban areas experienced higher year-to-year gains in terms both of permitted units and of completed and under construction large rental developments with 40 units or more.

Multifamily Units Since 2000

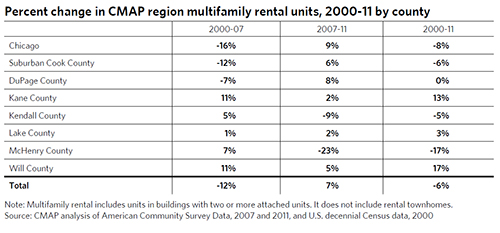

Post-recession gains in multifamily rental development in the region, while positive in terms of encouraging housing balance, must overcome a loss of multifamily rental units since 2000. For example, Reis, Inc., which tracks rental buildings with 40 units or more in Cook, DuPage, Kane, Lake, McHenry, and northern Will Counties, has collected data on the conversion of rental buildings to condominiums since 2003. From 2003-10, 4.2 percent of the units Reis, Inc. tracked were converted to condominiums. The region will not reach its 2003 levels of rental units in large buildings until later this year. According to U.S. Census and American Community Survey data, approximately 12 percent of the region's multifamily rental units were converted to the for-sale market, demolished, or left vacant from 2000-07. By 2011, this loss had halved, likely due to a combination of new construction and rental of formerly for-sale units. Loss of multifamily rental units was concentrated in the region's core, while Kane, Lake, and Will Counties gained multifamily rental units from 2000-11.

While the region gained rental units in buildings with 50 or more units from 2000-11, it lost rental units in all other multifamily building types. These losses were generally concentrated in the City of Chicago and suburban Cook County. The loss of multifamily rental units was most pronounced in buildings with 10 to 49 units, which declined by 20 percent from 2000-11, while owner-occupied units in 10 to 49 unit buildings increased by 23 percent over the same time period. Including vacant, for-rent, and for-sale units, total units in this building type declined by five percent from 2000-11.

The region's decline in small multifamily building rental units may be due to currently vacant units, the continuing impact of foreclosures, demolition of these smaller buildings, or conversion to for-sale housing during the housing boom. A 2010 analysis of multifamily foreclosures in Chicago found that in 2009 alone, newly foreclosed multifamily properties contained nearly 20,000 rental units, with an average of three units per building. In many of these cases, tenants were evicted during the foreclosure process, leading to an increase in vacant rental units in small buildings and a loss of affordable rental options. Both the 2010 analysis and the Woodstock Institute's 2009 report Roadblock to Recovery found that these foreclosures were concentrated in minority and low-income communities. Additionally, once vacant, these properties were found to be more likely to deteriorate to a condition that made their rehabilitation cost-prohibitive. There are also many roadblocks to obtaining loans for the purchase and renovation of these small rental buildings, particularly the two- to-four unit buildings that house 30 percent of the region's renters.

Since 2007, the transition of many for-sale condominium units and buildings to the rental market has greatly reduced the region's previous loss of multifamily rental units. However, the region still has approximately six percent less multifamily rental housing available today compared to 2000. In the near term, much of the unmet demand for multifamily rental units has shifted to rental of single-family homes and/or for-sale condominium units. This shift has the positive impact of providing more housing options for renters who may not desire a unit in a multifamily rental building, and it has also reduced vacancies in the for-sale market resulting from the housing crisis. However, it is unclear whether the recent increase in condominium and single-family rentals will be sustained over the long term.

Rents and Vacancy

Vacancy rates in the region's large rental buildings with 40 units or more have plummeted to 3.7 percent since a recessionary peak of nearly seven percent in 2009, according to Reis, Inc. This vacancy rate is likely lower than the vacancy rate found in all multifamily rental buildings in the region. For example, the American Community Survey has estimated that rental vacancy rates ranged from a low of 5.6 percent in Lake County to 11.9 percent in Kane County in 2011.

Lower vacancies indicate a tighter rental market and often lead to rising rents. Recent increases in rent have outpaced household incomes. According to American Community Survey data, median rents in the region increased by nearly nine percent from 2007-11, but median household income declined by slightly more than two percent, leading to higher housing cost burdens. The number of households in the region that are rent-burdened, or households paying more than 30 percent of their income in rent, has increased by 18 percent from 2007-11. This follows a nationwide trend of increased housing cost burdens for both renters and homeowners. Data from Reis, Inc. indicates that rents in the region's large rental buildings rose by a lesser 3.6 percent from 2007-11. Reis, Inc. projects accelerated increases in rent in the region's large buildings, with average annual increases in rent of nearly 3.6 percent from 2013-17.

Development of New Multifamily Rental Buildings

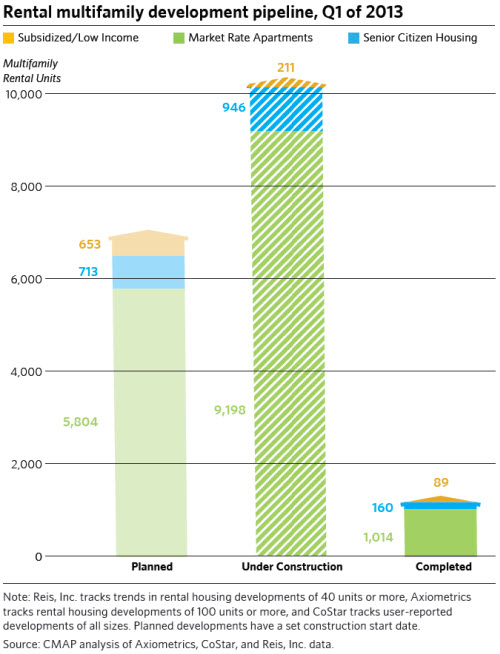

Multifamily rental units under construction in the region have increased, following the trend of increasing multifamily building permits in 2012. While 2012 saw completion of few new rental units, a historically high number of units are under construction in the region. Reis, Inc. therefore projects that more new multifamily rental units in large buildings will be completed during 2013 and 2014 than any year since the company began collecting such data in 1990.

Also, following on the 2012 trend of more multifamily permits being issued in suburban areas, a higher proportion of the region's multifamily rental units are now being constructed in suburban areas. While data from the U.S. Census and Reis, Inc. indicate that the majority of multifamily units were constructed in suburban areas prior to 2000, the 2000-10 period saw a significant shift of multifamily development, both rental and for-sale, into Chicago. According to Reis, Inc. data, from 2000-10, approximately 60 percent of large multifamily rental developments built in the region were within Chicago. In the latter half of the decade, that proportion rose to 87 percent. Of the currently under-construction multifamily rental projects in the region, 35 percent of the units are in suburban areas. Reis, Inc. projects that at least half of the region's new multifamily units by 2014 will be built in suburban areas, with increasing proportions through 2017. This is a positive trend that supports livable communities, as recommended by GO TO 2040. Livability entails a balanced supply of owner-occupied housing and rental housing distributed throughout the region, ensuring that each household has access to the region's assets.

Click for larger image.

Looking Forward

There have traditionally been many impediments to construction of multifamily rental developments in suburban areas. In the many communities that do not have zoning to allow development of rental buildings, developers must undertake long and costly approval processes when seeking to build rental housing. Additionally, many residents fear negative impacts from rental developments. While GO TO 2040 does not seek to increase density for its own sake, the plan does highlight adding density, particularly near transit assets, as one strategy to create livable communities. The addition of rental housing in areas served by transit is one method to add density and provide housing for residents at all stages of life. This diversity of housing options can help to create more vibrant, livable communities. Adding more housing options can help residents to live near where they work, reducing travel and congestion in the region. CMAP assists communities in planning for their future housing needs through the Homes for a Changing Region program.