On May 30, 2013, legislation was introduced in the Illinois House (HB 3637) and the Senate (SB 2589) to reform transportation funding in Illinois. Sharing many characteristics to the proposal advanced by the Transportation for Illinois Coalition (TFIC) earlier in the month, the legislation would eliminate the state's motor fuel tax and replace it with a new tax based on the wholesale price of fuel. In addition to this new 9.5-percent wholesale tax, the bills would increase a number of registration and licensing fees, terminate the gasohol tax incentive earlier than currently planned, and would reform the distribution of transportation revenues. CMAP estimates that the legislation would result in a net increase of $689 million dollars in the first year of implementation compared to current revenue sources.

Revenue Sources

Beginning January 1, 2014, the legislation would eliminate the current 19 cent-per-gallon motor fuel tax and replace it with a 9.5-percent tax on the average wholesale price of motor fuel. The Illinois Department of Revenue would be charged with calculating an average wholesale price on a quarterly basis. The bills would impose a $15 surcharge to motor vehicle registrations for passenger cars beginning in Registration Year 2014 and for some trucks beginning in Registration Year 2015, and would also increase registration fees for electric vehicles from the current $35 every two years to $222 every year. The bills would increase Certificate of Title fees by $10 and driver's license fees by $10. Finally, they would end the gasohol tax incentive, which exempts a portion of gasohol fuel sales from the state sales tax, on December 31, 2013 rather than the current December 31, 2018, and dedicate the proceeds from 1 percentage point of the state sales tax on gasohol sales to a new transportation fund.

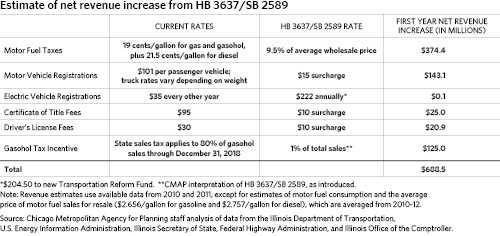

The following table summarizes the revenue sources provided for in the legislation, along with CMAP's estimate of the revenues they would yield in the first year after implementation. Note that this estimate is of net revenues, i.e., the total revenues to be raised from the various sources less the current revenues raised from the same or comparable source. It is important to note that the motor fuel wholesale tax revenues are very price sensitive – as motor fuel prices increase, the net revenue yield would also increase. In the table below we estimate revenues based on most recent data, but recognize that gas prices have generally risen since then.

Click for larger image.

Distribution of Revenues

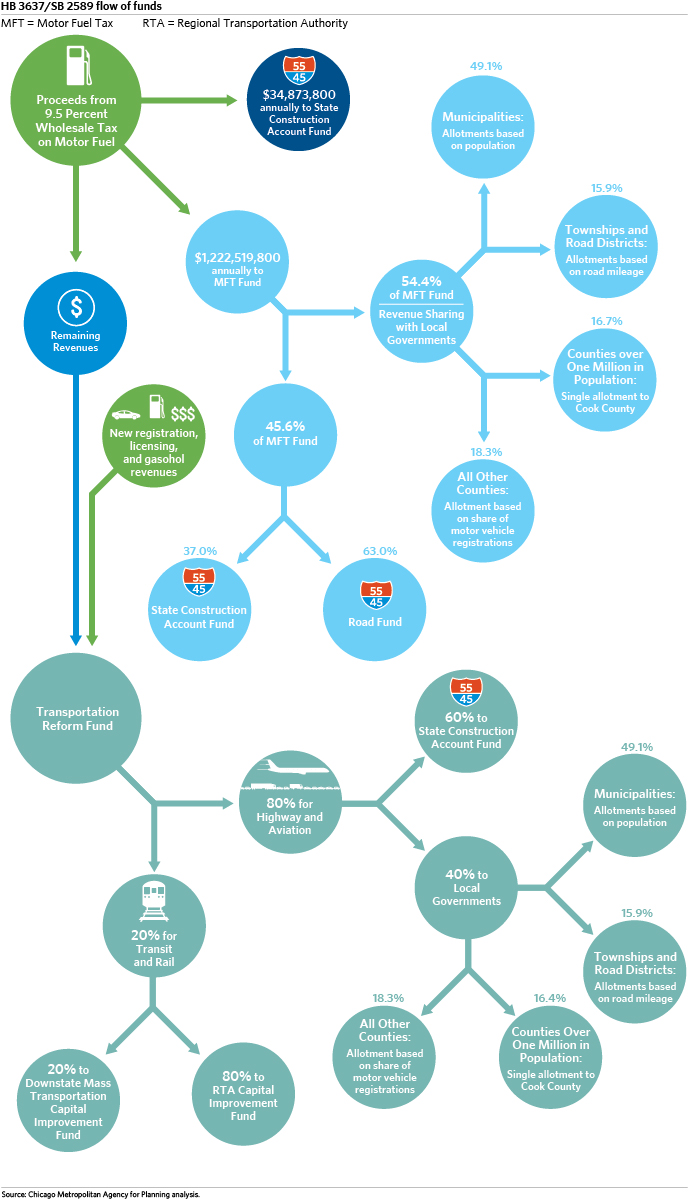

The legislation also modifies the distribution of transportation revenues in the state. The bills essentially follow a two-step process. The distribution of revenues in the first step more or less mirrors current practice, allowing for distributions of the wholesale tax revenues to the existing Road Fund and State Construction Account Fund, as well as allowing for revenue sharing with local governments. The distributions in this first step use existing percentages to allocate revenues across funds as well as the same distribution criteria to share state revenues with local governments. As shown in the flow chart below, these percentages and criteria are applied to a fixed amount of money.

In contrast, the second step provides for a new system. The legislation would create a new Transportation Reform Fund to receive the remaining wholesale tax revenues, new registration and licensing fees, and new gasohol sales tax revenues and distribute them to highway, aviation, transit, and rail purposes. Note that HB 3637 and SB 2589 do not change the distribution of existing registration and licensing fees, which will continue to accrue to the Road Fund, State Construction Account Fund, and Capital Projects Fund as they currently do. The highway and aviation funds would flow to the State Construction Account Fund and to local governments (according to the same local revenue sharing formulas and criteria). The transit and rail funds would flow to a new Regional Transportation Authority Capital Improvement Fund and a new Downstate Transportation Capital Improvement Fund, both to be dedicated to deferred maintenance projects.

Illinois currently allocates highway funds through a non-statutory formula called the "55/45 split," which is not addressed in this legislation. Anywhere in the following image that the icon appears, funds are allocated based on the formula, which directs only 45 percent of highway funds to the Chicago area, despite the region's much higher percentage of the state's population (65 percent) and economy (70 percent). The 55/45 split would continue to apply to all capital expenditures from the Road Fund and State Construction Account Fund, including those in the both the first and second funding "steps" provided for in HB 3637 and SB 2589.

icon appears, funds are allocated based on the formula, which directs only 45 percent of highway funds to the Chicago area, despite the region's much higher percentage of the state's population (65 percent) and economy (70 percent). The 55/45 split would continue to apply to all capital expenditures from the Road Fund and State Construction Account Fund, including those in the both the first and second funding "steps" provided for in HB 3637 and SB 2589.

Discussion

GO TO 2040 recognizes the need for sustainable transportation revenues and has recommended increasing the state motor fuel tax by eight cents per gallon and indexing the MFT to an inflationary measure. In a previous Policy Update, CMAP outlined its general concerns with a motor fuels sales tax -- chiefly its volatility and potential equity impacts -- in comparison to the traditional motor fuel tax.

CMAP has several questions on the language of the two bills as introduced. First, the language defining the distribution of revenues from the new Transportation Reform Fund is unclear. The 20-percent share to rail and transit projects is entirely allocated to transit agencies, which must use the funds on deferred maintenance projects; unless those deferred maintenance projects coincide with broader rail improvements, it is difficult to see how these revenues could be used for rail purposes. It is also not clear why only the new transit capital funding -- and not the new highway or aviation funding -- must be devoted to deferred maintenance projects.

CMAP is encouraged that serious discussions are underway about the need to invest in our transportation infrastructure, and that these discussions include a dedicated source of capital funding for transit. However, these bills do not go far enough in thinking more creatively about the future of our state's transportation program. In addition to the questions raised in the previous paragraph, CMAP has adopted principles calling for any new capital program to promote performance-based funding, an open, transparent approach to project selection that evaluates projects based on clear, explicit criteria and may incorporate the input of various transportation stakeholders. Relatedly, the bills also fail to address the longstanding "55/45 split," the informal policy that directs 45 percent of the state's highway funds to northeastern Illinois and the remaining 55 percent downstate, regardless of performance or need. The 55/45 split is not a law but rather an agreement established decades ago within the General Assembly.

HB 3637 and SB 2589 present an opportunity for our state to rethink the way it allocates transportation funds. While the bills include several of the CMAP's adopted principles for a new state capital program, there is still more that could be done. CMAP will continue to monitor this legislation as discussions continue over the summer and when the General Assembly reconvenes later in the year.