GO TO 2040 calls on CMAP to track indicators and set targets on the efficiency, equity, and transparency of the state and local tax system. This is the third in a series of Policy Updates that will examine CMAP's tax policy indicators. This post outlines how CMAP views tax system transparency. Previous posts examined efficiency and equity.

GO TO 2040 recommends that the public have access to the most up-to-date state and local taxation and other fiscal data. The public increasingly relies on governmental data and information to understand their options and make important decisions. To examine the transparency of the tax system in northeastern Illinois, CMAP created a list of information that local governments would ideally provide in a publicly-accessible manner on-line. The list includes information on finances, agendas, and minutes for meetings where financial decisions are made; information on contracts; and data on sales and property taxes. The list is loosely based on the system once used by the Sunshine Review, an organization that rated governments on transparency and was recently acquired and merged into Ballotpedia.

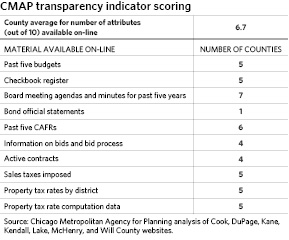

With more than 1,200 units of local government in northeastern Illinois, it is difficult to assess the transparency of every unit. To measure transparency of the tax system, CMAP analyzed the extent to which County governments in the CMAP region make public ten different types of materials on-line. Counties were chosen because their size and level of internal resources makes them ripe for implementing transparency measures. The following chart summarizes CMAP's findings.

In northeastern Illinois, the average County scored 6.7 out of 10, and most Counties made the majority of the items on the list publically accessible on their website. Scoring was limited to what CMAP was able to locate on these websites with a reasonable amount of searching. Counties were most likely to meet criteria for publically posting meeting agendas and minutes, as well as for reporting through budgets and financial reports. The larger Counties in the region included detailed reporting on expenditures, which is sometimes referred to as a checkbook register.

However, a few Counties did not provide information for several categories. The posting of bond official statements was only done in one County, although it appears that some Counties post these on-line as part of board meeting agenda packets. In addition, complete information about bids or contracts were missing from several County websites, although many indicated that the information was available through submitting a Freedom of Information Act request. Data on bidding and contracts allows taxpayers to understand the process by which governments determine which vendors are chosen to carry out taxpayer-funded projects or provide taxpayer-funded goods or services. Posting contracts shows taxpayers the conditions under which tax dollars are being spent.

Property taxes are primarily administered by County government, which includes the assessment process, rate computation, and tax collection. However, not all Counties provide reporting on property tax rates and the data used to compute those rates for each unit of local government within the County. Counties that do not provide these reports forego the opportunity to educate taxpayers on the property tax system, which is a major funding source for local governments.

Fortunately, efforts to provide more access to information have been amplified in recent years, especially as technology improvements have reached the offices of county government. In January 2009, DuPage County began posting their checkbook register. Since then, four other counties in northeastern Illinois followed its lead. While not all counties had five years of archived budgets and Comprehensive Annual Financial Reports (CAFRs) available on-line, all Counties had their current budget posted. CMAP is optimistic that all Counties in the region will soon provide all of the information listed above in a transparent manner on-line. Many other local governments, especially larger municipalities like Chicago, also post financial and tax information on-line, and CMAP expects other smaller local governments to develop the resources necessary to increase transparency.

Moving forward, CMAP will incorporate these measures of the tax system's efficiency, equity, and transparency in its upcoming update of the GO TO 2040 comprehensive regional plan.