This is the second in a series of three policy updates assessing the potential for increased energy efficiency in the region's manufacturing sector. The first reviewed energy use and conservation at the region's manufacturing plants and the third assessed potential policy changes to increase energy conservation in the region's manufacturing sector.

This update reviews near-term policies and initiatives that will affect energy supplies and conservation in the region's manufacturing sector. GO TO 2040 recommends a number of local, state, and federal regulatory changes to improve energy efficiency in the region's buildings and transportation network. Some of these improvements, such as expanded energy efficiency retrofit programs, are underway. As discussed below, upcoming smart grid updates, grid modernization, state-level energy efficiency requirements, federal product compliance requirements, and stricter climate change regulations will continue to push energy reduction measures forward. But low prices furthered by an increased supply of natural gas will continue to hamper market-driven energy conservation. In the near term, regulatory changes will likely be a primary driver of increased energy efficiency in the manufacturing sector.

Upcoming regulatory changes, infrastructure improvements, and energy supply changes will affect energy efficiency

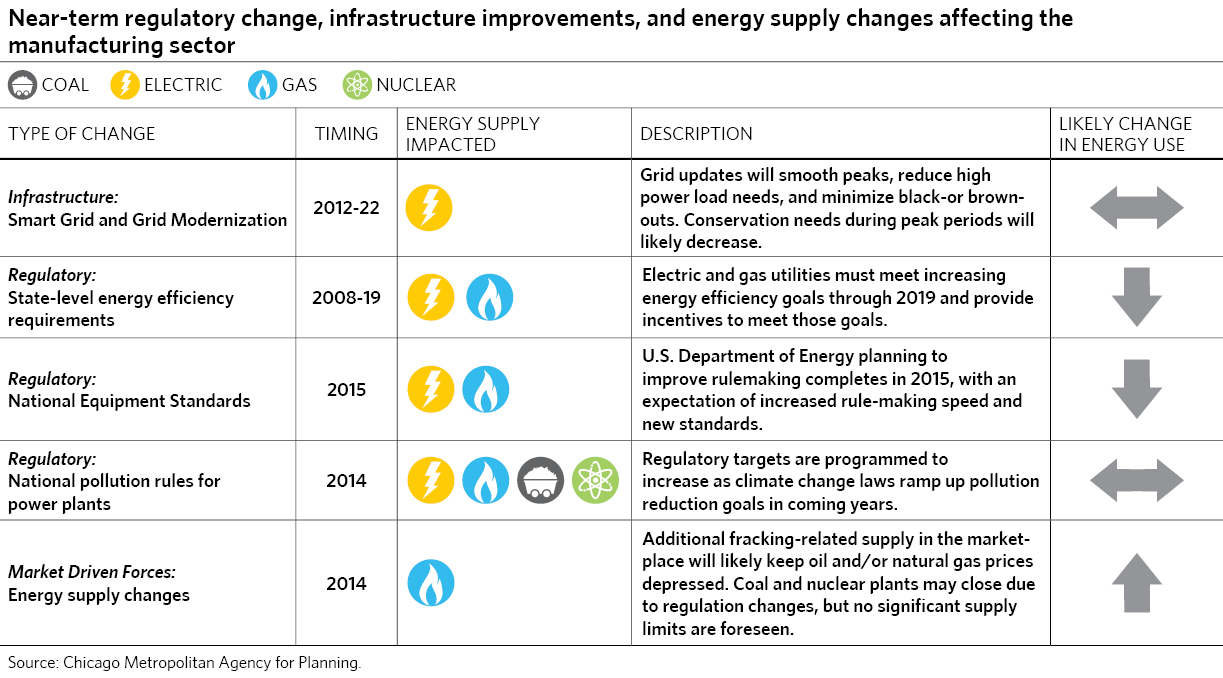

As highlighted in the first Policy Update in this series, energy conservation measures adopted by the region's manufacturers have been driven by factors other than cost savings. But the region has opportunities to increase energy conservation at manufacturing plants. The table below outlines the potential impacts of near-term infrastructure, regulatory, and supply changes on manufacturers' energy consumption.

Click on image for full-size.

Infrastructure improvements will lead to a more efficient, reliable, and transparent electric grid

The Energy Infrastructure Modernization Act (EIMA) requires ComEd to update the region's electricity grid, improving the flow and distribution of power. The region's current grid experiences brown-outs and black-outs during storm events or high peak loads. These interruptions can stop production or ruin in-process materials, incurring high costs for manufacturers.

Per the EIMA, ComEd has undertaken a 10-year program to increase power reliability and transparency in the region. Grid improvements to be completed by 2019 will include upgrades to power stations and lines to reduce storm outages and other black-out vulnerabilities. Smart Grid involves improved movement and tracking of electricity throughout the electric system. Finally, smart meters, which allow real-time tracking of energy consumption, are already in use at many of the region's manufacturers.

In combination, these improvements will lead to increased power reliability and transparency for the region's manufacturers. But, changes in energy use at local manufacturers are likely to vary by business size. Based on CMAP interviews, many large manufacturers already have a smart meter and possess the sophistication to consume power in a manner that reduces costs and interruptions to manufacturing processes. Mid-to-small businesses will see the most immediate benefit from smart meters, with the largest energy conservation impact resulting from improved transparency and understanding of how they consume energy.

State and national regulations will increase the efficiency of manufacturing products and equipment

State energy efficiency standards as well as updates to the national equipment standards over the next decade will reduce the energy footprint of manufacturing plants at the machine level. As manufacturers upgrade equipment over time, the increased availability and lower cost of efficient products will lead to increased installation of efficient equipment. This will make energy savings a function of the product used instead of requiring changes in operational behavior.

State of Illinois-regulated electric and gas utility energy efficiency programs began in 2008 and 2010, respectively. As described in the prior Policy Update, many manufacturers express frustration with accessing incentives through these programs. But, as easily-implemented residential incentives are exhausted, utilities are directing more resources to incentives for manufacturing plants. For example, ComEd has expanded and adjusted its incentives to respond to customer demand, in contrast to their initial one-size-fits-all model in 2008.

In addition, the U.S. Department of Energy (DOE) has been revising its national equipment standards. In 2010, the U. S. Department of Energy (DOE) issued a five-year plan to improve the rulemaking process for energy efficiency standardization of equipment and products. The plan includes efficiencies in publishing proposed rule changes and improved up-front collaboration with interested parties to avoid legal challenges. This allows DOE to create standardization requirements for equipment efficiencies at a greater speed and with greater detail. In its February 2014 Semi-Annual Report to Congress, DOE reported having met its scheduled rulemaking obligations for the first time since it began reporting in August 2006.

The improved products developed in response to proposed new standards will increase energy efficiency and reduce manufacturers' energy costs in a number of ways. Most critically, plant operators will increase efficiency without manually adjusting operations, making both energy use and plant operations more efficient. For example, DOE is finalizing an updated energy efficiency standard for previously unregulated electric motors. The new, energy-efficient motors will also reduce the need for behavior-based conservation activities such as a plant operator turning systems on and off. Standards will also lead to broader availability of efficient products as economies of scale are reached for new, efficient products.

National air pollution rules may have little effect on the price of electrical power in Illinois

In July 2011 and December 2011, the U.S. EPA issued the Cross-State Air Pollution Rule and Mercury and Air Toxics Standards, respectively. These actions set regulatory goals to reduce mercury, acid gas, and sulfur dioxide emissions from power plants. Both actions have multiple court proceedings underway. But, on April 15th, 2014 a federal appeals court upheld the EPA's standards, which are scheduled to take effect in April 2015. As a result, power plants, primarily coal-fired power plants, will need to increase investment in pollution control equipment. This may increase compliance costs and consumer electricity costs.

While increased costs may drive energy conservation, prior regulation in Illinois may limit new costs to power plants and customers. In 2006, the State established rules to reduce mercury emissions from power plants, ahead of the U.S. EPA regulations. Many power plants in Illinois have therefore installed sufficient improvements to meet the federal standards. While the market for electrical power is national in scope, Illinois is already a net exporter of energy. As a result, increased energy costs due to compliance changes may be minimal statewide.

Energy supply changes may keep energy prices low

In June 2013, Governor Quinn signed into law a regulated expansion of fracking in downstate Illinois. In November 2013, the Illinois Department of Natural Resources (DNR) then issued rules to clarify how fracking would proceed. DNR is currently reviewing public comment prior to finalizing those rules. Fracking will mostly occur above the New Albany Shale basin – located in southeast Illinois, western Indiana, and northern Kentucky.

While the majority of the natural resources extracted via fracking will be shipped outside of Illinois, the anticipated size of the shale reserve and value of the extracted resources could affect already-low natural gas prices. The U.S. Energy Information Administration predicts a slow increase in natural gas costs, but prices are still projected to remain lower than other energy supplies. Others predict increased costs as power plants switch from coal and/or nuclear to natural gas. Unique events such as the extended cold in winter 2014 will also drive temporary price changes. Regardless, the introduction of fracking into Illinois may disincentivize market-driven energy conservation activity by adding to the natural gas supply and keeping prices low.

Policy and regulation will continue to be a major driver of energy efficiency in the region's manufacturing sector

Infrastructure and regulatory changes occurring within the next five years will continue to be a primary driver of energy efficiency if market prices track their projected minimal increases. In particular, incentives provided by utilities seeking to meet state-mandated efficiency targets via expanded offerings for manufacturers may be a primary driver of energy conservation activities. The increased adoption of national standards for more energy efficient products will also increase access to efficient equipment, slowly increasing conservation over time.

While the intent of this policy update is to focus on near-term drivers of energy consumption, CMAP's Manufacturing Cluster Drill-Down outlined the broader need for a healthy, economically competitive manufacturing sector. Saving energy translates into more price-competitive manufacturers and more dollars available to invest in other plant improvements or expansions. The next update in this series will examine improvements to current initiatives to help drive the adoption of energy conservation in the region and state.