CMAP's regional economic indicators microsite features key measures of metropolitan Chicago's economy and, where applicable, compares these measures to peer metropolitan areas. The microsite and accompanying Policy Update series are a resource for economic development professionals, planners, and others who seek to understand the complex factors that shape our region's competitiveness in the global economy. This Policy Update supplements the site's patents indicator by diving deeper into the complexities of the indicator, exploring the decisions that firms make when patenting products, and patent production in the state's computers and chemicals industries.

Economic innovation – the transformation of new ideas into new goods and services – plays a major role in sustaining regional economic prosperity and enhancing global competitiveness. Although innovation is an important indicator of the health of the region's economy, it is difficult to define, let alone measure. Innovations can manifest themselves as astounding breakthroughs or as more mundane, subtle shifts in processes, and either can generate tremendous efficiencies and increased economic vitality. CMAP's regional economic indicators follow four measures to understand the region's capacity to innovate:

- Venture capital

- Technology transfer

- Employment in science, technology, engineering, and mathematics (STEM)

- Patents

To analyze the patenting strengths of Illinois, this Policy Update looks beyond a more typical analysis of aggregate number or per-capita utility patents, known as "patents for inventions," to examine the considerations that inventors and businesses face when seeking patents. Although most patent analyses focus on broad trends, patenting is not equally important or advantageous across all industries or types of inventions. Inventors face a complex set of decisions when deciding whether to patent their work. This update explores patenting activity in two of the state's areas of patenting strength: Computer and Peripheral Equipment (C&PE) and Basic Chemicals (BC). These two industries face distinctly different considerations when applying for patents. Even within these particular industries, patenting can vary among firms for a number of reasons, many of which are unrelated to an invention's innovative potential. This limits the usefulness of using patents as a standalone measure of innovation.

Deciding Whether to Patent

Businesses and inventors consider numerous factors when deciding whether to patent a product or process. At its core, the decision to patent is driven by whether it makes sense for the inventor to disclose an invention (through a patent filing) in exchange for exclusive rights to use the invention. Inventions that are easily copied are prime candidates for patent protection, while inventions that are difficult to copy or are unique processes that can be concealed and maintained as trade secrets may benefit less from being patented. Whether a patent will provide continued value over its lifespan guides an inventor's decision to patent or not. Finally, inventors and businesses must determine whether they will be able to defend their patent in the case of litigation.

Not all inventions are good candidates for patenting. Products that can be easily reverse- engineered, such as some pharmaceuticals or chemicals, are prime candidates for patent protection. A patent may prove less valuable or necessary for other industries in which reverse engineering can be more complex, such as food or machinery manufacturing, where examining a final product does not necessarily provide insight into how the product's components were fabricated or assembled.

Further complicating the decision to patent is the question of whether an inventor will be able to feasibly defend or enforce a new patent. In short, an invention patented by one firm could be copied and utilized by another firm until the patent-holding firm decides to or can afford to pursue litigation. Thus, the burden of patent policing and enforcement falls on the patent holder and not on the Patent and Trademark Office. Litigation costs can be substantial for both the winners and losers and have been a growing concern in recent years. Cases can be costly even when settled out of court. According to research by PricewaterhouseCoopers, the average patent litigation suit in 2013 resulted in a damage judgment of $5.9 million per case -- an unaffordable amount for many individuals or small businesses. In addition to covering the cost of damages, patent owners must also dedicate significant time and resources to the litigation process itself.

Just as the decision to patent varies across industry and invention type, patenting strategies can vary among firms within a particular industry. Some firms patent prolifically while competitors may forego aggressive patenting strategies. IBM and Oracle, two major information technology competitors, illustrate this phenomenon. Research shows that, during the 1990s, IBM out-patented Oracle at a rate of 100 to 1. This is not necessarily because IBM was 100 times more innovative than Oracle in the 1990s, but rather because each firm had its own discrete patenting philosophy, with IBM seeking to patent as many innovations as possible while Oracle sought to patent only its most essential inventions.

Oracle's limited patenting strategy has been emulated by other large high-tech companies who have decided that granting some free use of inventions to others produces a greater long-term benefit than restricting the use of the inventions through patenting. In 2014, electronic car manufacturer Tesla made waves when it decided to freely license its patents to competitors. Analysts have suggested that the move was made in an attempt to spur new growth in the electric car market and eventually bring more business to Tesla. Other companies, such as Twitter, have made similar efforts by making portions of their software open source in an effort to spur a greater level of platform development and adoption.

Patenting in Illinois

Measuring aggregate or per-capita patenting rates does provide some measure of innovative activity and potential economic activity. The relative level of patenting to employment varies substantially across industries, however, making comparison between metropolitan areas with unique economic compositions difficult. Thus, industry-level analysis of patenting provides a clearer picture of the role that patenting plays in regional economies.

Where possible, CMAP's regional economic indicators use metropolitan-level data. But this analysis uses industry-based patent data, which is only available at the state level. The Chicago region accounts for roughly 75 percent of patenting activity in Illinois. The following table shows the top ten most patent-intensive U.S. industries (based on patents per 1,000 employees) and their respective patenting intensities nationwide and in Illinois. For each industry, the far right column shows our state's location quotient (defined as the concentration of a particular industry in a given area).

U.S. and Illinois average annual patent intensity in select industries, 2009-12

|

CATEGORY |

U.S. |

ILLINOIS |

ILLINOIS |

|

Computer and Peripheral Equipment |

123.2 |

236.5 |

0.29 |

|

Communications Equipment |

105.8 |

69.5 |

1.21 |

|

Other Computer and Electronic Products |

48.8 |

22.1 |

1.26 |

|

Semiconductors and Other Electronic Components |

28.2 |

13.0 |

0.66 |

|

Navigational, Measuring, Electromedical, and Control Instruments |

27.6 |

22.6 |

0.82 |

|

Basic Chemicals |

21.6 |

32.0 |

0.94 |

|

Electrical Equipment, Appliances, and Components |

15.7 |

11.3 |

1.54 |

|

Medical Equipment and Supplies |

14.2 |

8.3 |

0.94 |

|

Pharmaceutical and Medicines |

13.8 |

5.1 |

1.57 |

|

Other Chemical Product and Preparation |

10.0 |

5.2 |

1.62 |

*Patent intensity measures patent rate per 1,000 industry employees

Source: Chicago Metropolitan Agency for Planning analysis of U.S. Patent and Trademark, Moody's Analytics data.

Note: Category classifications are based on 2012 4-digit NAICS, and the industries listed above are the top ten categories of utility patents in the Chicago region.

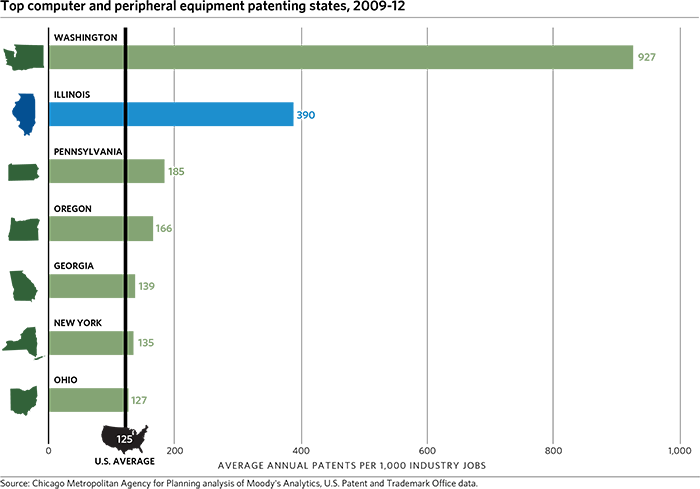

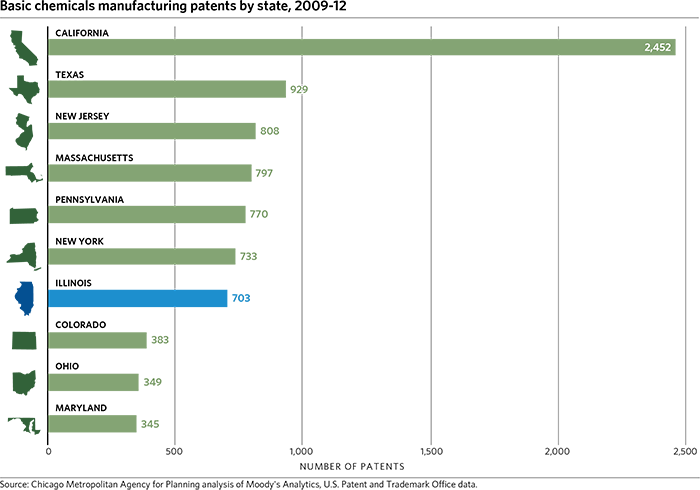

To better understand an area's strengths and illustrate the varied industry approaches to patenting, this analysis explores two industries -- Computer and Peripheral Equipment and Basic Chemicals Manufacturing -- in the chart above, both of which have particularly high patenting intensity in Illinois. The data show that inventors in the state have received a significant numbers of C&PE manufacturing and BC manufacturing patents. In the case of C&PE manufacturing, the state of Illinois produced the second largest number of patents per C&PE job in the nation (see the chart below). The state is also a large producer of BC manufacturing patents, ranking fourth in the nation in terms of average annual patents between 2009-12.

On a national scale, patenting rates are at all-time highs, with much of the growth driven by increases in the C&PE manufacturing industry, where patenting more than doubled nationwide between 2000-12 and grew by 62 percent in Illinois. Meanwhile, patenting in BC Manufacturing grew by roughly 12 percent nationwide between 2000-12 but grew by over 50 percent in Illinois during the same period.

Patenting and Strategy

The massive national growth of patenting activity in the C&PE industry compared to the BC industry reflects significant advances in computer technologies since 2000, as well as differences in patenting strategies between each industry. Firms in the C&PE industry tend to patent inventions with the ultimate goal of licensing their patent portfolio to other companies to generate revenue. Final products produced by the industry, such as mobile phones or computers, are often composed of a number of individually patented components, and manufacturers in the industry must license each other's patent portfolios to produce products. Computer and electronics firms thus face an incentive to build the largest possible patent portfolio to attract licensees. The information technology industry pursues a related strategy where patents are sought for abstract concepts, such as Amazon's patent on one-click ordering. Abstract patents may apply to a multitude of other information technology concepts. In recent years these practices have led to patenting as many inventions as possible, even if the invention represents relatively minute advances in a product or process.

While computer and electronics manufacturers seek to build large patent portfolios and sell their knowledge to other firms, the BC manufacturing industry is much more discrete in its patenting choices and does not usually engage in product licensing. Patents are a critical defensive tool in the BC industry, because, unlike computers and electronics, manufactured chemicals are generally protected by a single patent and are generally easier to reverse engineer.

Patenting to maintain or grow role in a sector

Between 2009-12 there were approximately 79,000 CP&E manufacturing patents granted nationwide. Illinois accounted for about 1,800 of these. While the state's proportion of total patents is small, adjusting the data to account for industry employment shows that Illinois produced roughly 390 patents for every 1,000 C&PE jobs. This patent rate was the second highest in the nation, second only to Washington state, and over three times the rate in California.

Despite being home to major CP&E manufacturers such as IBM, Hewlett-Packard, Motorola, Bosch, Alcatel Lucent, and AT&T, both the state of Illinois and the Chicago region have very low employment concentrations in the industry. The state is home to only 1,250 C&PE jobs and has a location quotient of only 0.18. Nearly all of the state's C&PE jobs are located in the seven-county CMAP region (1,100), but the region's industry location quotient remains low as well at 0.14. The fact that the state produces a significant number of patents with such a small number of employees might suggest that many C&PE jobs in the state relate more to research and development (R&D) rather than actual manufacturing.

Patenting to protect R&D

Patenting rates are generally tied to industry employment levels, with increased industry employment concentrations leading to increased patent activity. However, this relationship does not hold true for patenting in the BC manufacturing industry, where employment totals are a relatively poor predictor of patenting activity. Between 2009-12, the state produced 703 BC patents, ranking seventh in the nation. The Chicago region is home to a number of chemicals manufacturing firms, including UOP, Dow Chemicals, Abbott Laboratories, and DSM. Despite the large number of chemicals patents produced in Illinois, the state's concentration of BC manufacturing jobs is slightly below average, with a location quotient of 0.95. The Chicago region's BC location quotient is further below average at 0.67 with 2,750 jobs in the region.

Profits in the BC industry are affected by patent protections because competitors can easily copy products without incurring the expense of R&D and then sell products at lower prices. Therefore patents issued for the creation of a new chemical compound are an important defensive tool used to prevent other firms from producing a specific chemical compound. In a similar vein, the Pharmaceuticals and Biotechnology industries also tend to patent product inventions because of the high levels of investment required for R&D and the comparatively low cost of manufacturing.

Looking Forward

Recent economic research indicates that innovation and technology play a role in growing the economy. Patents are one avenue by which innovation can be measured. Recent research by the Brookings Institution, for example, shows how metropolitan areas that produce a larger number of patents have tended to experience more robust economic growth than metropolitan areas that produce fewer patents. The use and purpose of patents among industries varies significantly, however, which suggests that not all patents have the same innovative potential and not all inventions are worth patenting. While monitoring the number and rate of patent production provides some insight into the region's capacity to innovate, additional research reveals industry-specific insights that broad analysis does not.

Despite the many complexities of the patenting process, patent production is still one of the more widely accepted measures of innovation. CMAP's economic indicators examine patent production, along with several other measures of innovation in an attempt to provide a more holistic picture of innovation metropolitan Chicago and its peer regions. CMAP's manufacturing cluster drill-down report found that manufacturing accounts for a disproportionate amount of R&D spending nationally -- 68 percent according to a 2007 study by the National Science Foundation. For Illinois, the share of R&D for manufacturing jumps to 87 percent. GO TO 2040 underscored the importance of continuing to refine the region's understanding of innovative activities so that private and public stakeholders could be better informed to support our regional industry specializations. Continuing to examine and discern the differences in patenting among industries can help the region further identify its areas of economic strength and opportunity while providing insight into in the region's ability to develop new technologies, advanced products and processes, and even to establish new markets.