Municipalities across northeastern Illinois are responsible for more than 20,000 miles of roadway, accounting for nearly 70 percent of regionwide mileage. The region's transportation infrastructure is key to economic prosperity. Residents and businesses must be able to rely on the transportation system to travel efficiently throughout the region, but much of the system's infrastructure has suffered from inadequate ongoing investment. Ensuring investment in the maintenance and modernization of the system means prioritizing the region's limited resources and identifying revenues to fund improvements.

In addition, continued investment at the local level will mean that local governments will need to develop innovative ways to fund improvements. Communities have several sources of revenue that they regularly use to operate and maintain roadways, including state motor fuel tax (MFT) revenues that are disbursed to municipalities based on their population. In addition, many municipalities have other sources, such as property or sales tax revenues. Yet many municipalities impose transportation user fees such as local MFTs or vehicle license fees, sometimes utilizing the funds generated for municipal transportation costs. Municipalities may move toward these sources when other federal, state, or local sources are insufficient to meet local road needs. This Policy Update will explore the use of these sources in northeastern Illinois.

Overview of local-option user fee trends

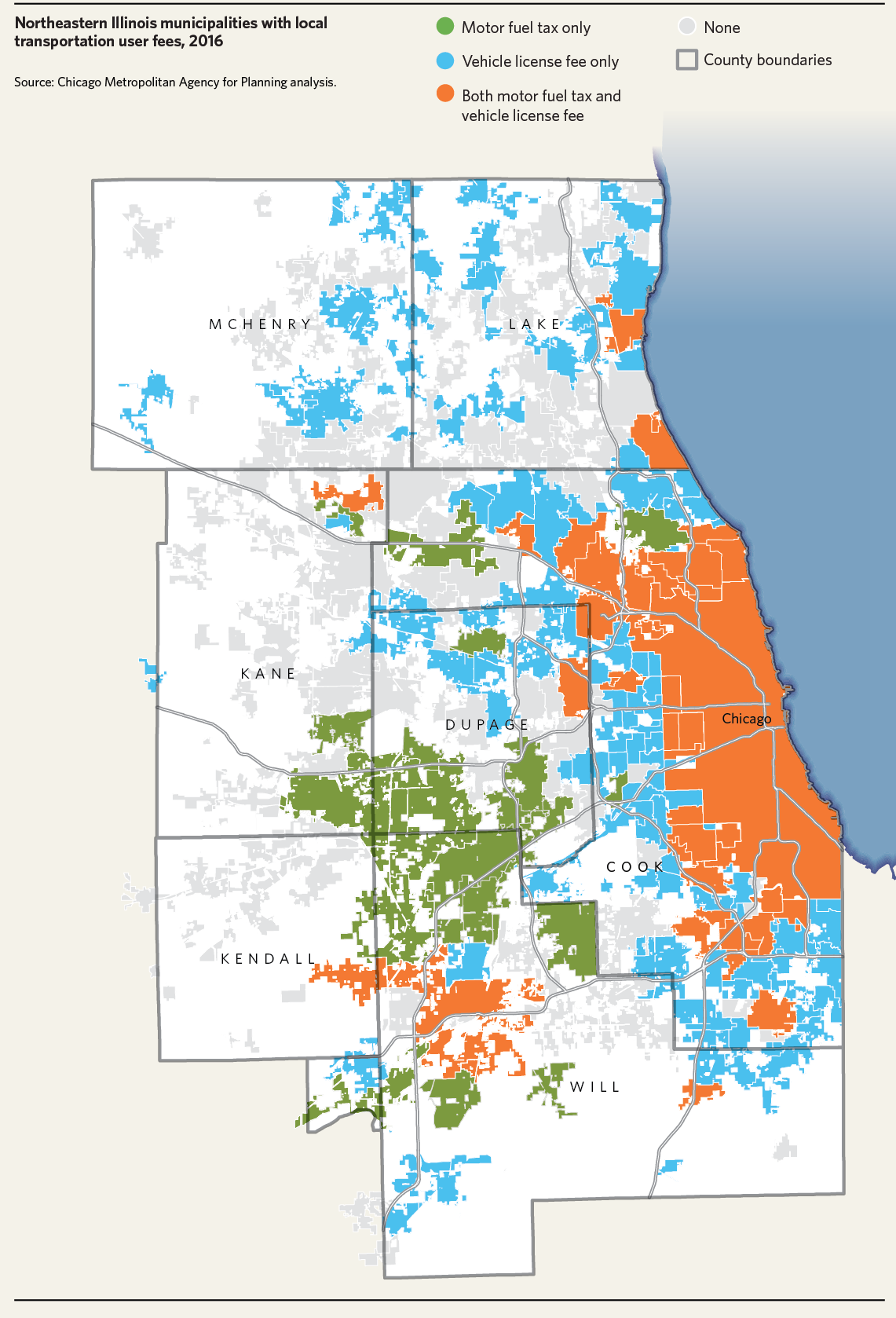

According to a 2016 report from the National League of Cities, federal and state transportation funding for local governments nationwide has declined and become less predictable. However, Illinois is among many states that authorize municipalities to impose local transportation user fees to supplement federal and state funds. Across northeastern Illinois, 60 municipalities impose a local MFT, and 158 impose vehicle license fees. Local MFTs, which can only be imposed by the 138 home rule municipalities in the region, have become increasingly popular; eight municipalities have enacted such a tax over the past two years, and several others recently increased their rates. At the same time, anecdotal evidence suggests that fewer municipalities have been imposing vehicle license fees in recent years, in part due to the cost of administration. The following map provides an overview of which municipalities in the region impose local user fees.

The City of Aurora illustrates recent trends. The City enacted a 4-cent local MFT in December 2015 to fund local road needs. Previously, the City used a combination of state MFT disbursements and gaming tax revenue for this purpose. Gaming tax revenue has dropped in recent years, however, with revenues totaling $7.1 million in 2015, in comparison to greater than $10 million in 2010 and 2011. The local MFT is expected to generate $3.2 million to make up this loss. In recent years, transportation-related costs have risen due to increases in the number of municipally maintained lane miles. Aurora also considered reinstituting vehicle stickers but chose not to pursue that source due to the cost of administering the program.

Local motor fuel taxes

In northeastern Illinois, 60 of the region's 138 home-rule communities have enacted a local MFT. These municipal MFT rates range from 1 cent to 7 cents per gallon. These rates are added to federal and state per gallon MFTs, as well as county MFTs in Cook, DuPage, Kane, and McHenry counties. The following chart provides an overview of the municipal MFT rates imposed across the region.

Geographically, municipalities that impose this tax tend to be concentrated in inner ring suburbs, as well as in western Will County and southern DuPage County. CMAP analysis indicates that, among home rule suburbs, those with local MFTs tend to have larger populations than those without local MFTs, but no significant relationship exists between local MFT and total local road mileage. The following map illustrates local MFT rates across northeastern Illinois.

Across the 46 municipalities where data was available, local MFT revenues vary based on the rate and the number of gallons sold within the municipality. In 2014, suburban totals ranged from $23,351 generated by Park City's 1-cent rate to $2.8 million generated by Naperville's 4-cent rate. Chicago represents the preponderance of local MFT revenues raised, with $48.2 million. In total, $70.2 million in local MFT revenue was generated in 2014 in these 46 municipalities. Note that, of the 60 municipalities with a local MFT, eight enacted their MFT after 2014, and revenue data was not available for six.

Local vehicle license fees

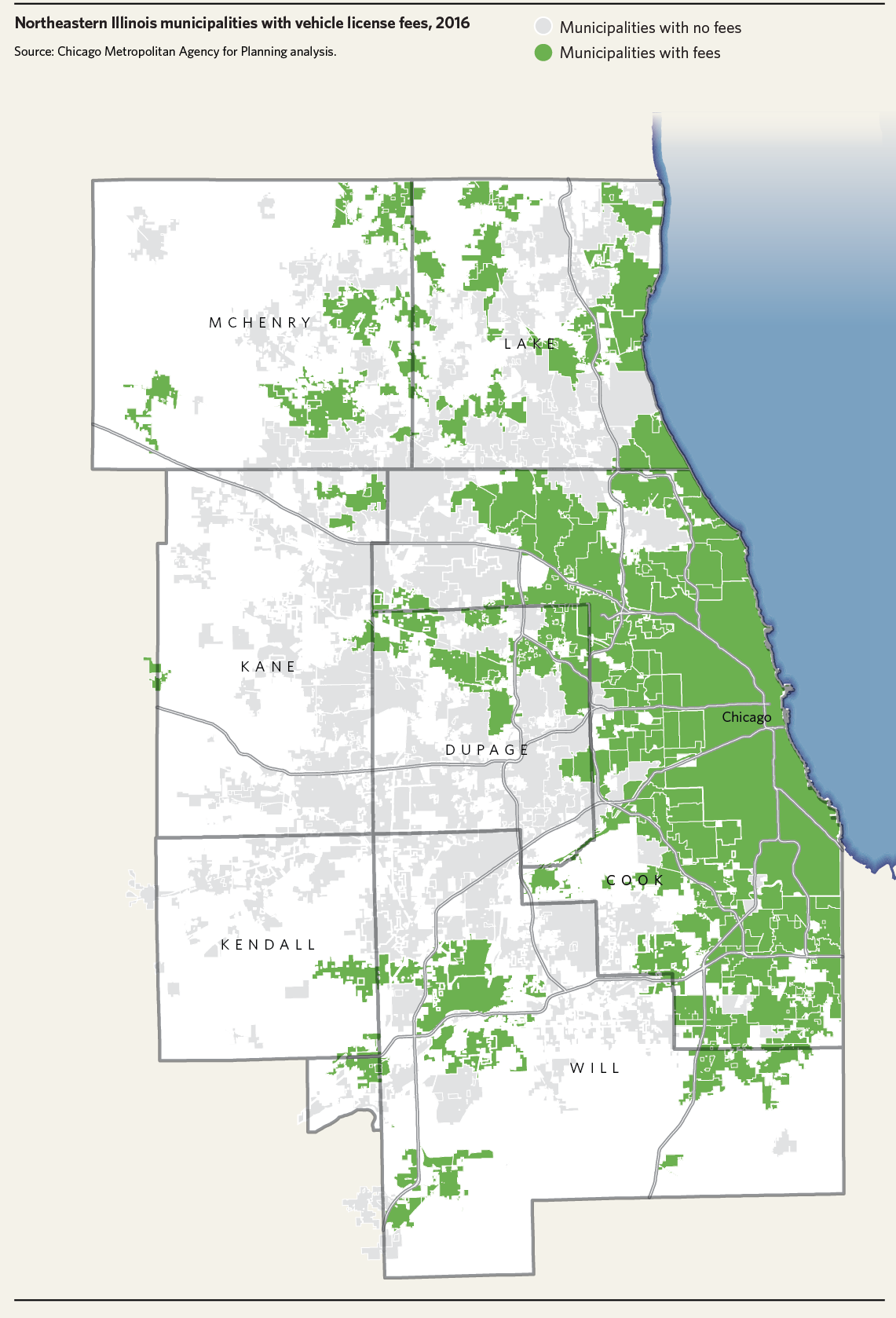

Any municipality in Illinois may impose a license fee on vehicles registered in their jurisdiction. Fees often have differing rates for passenger vehicles, as well as for trucks of various weights. Vehicle license fees are more common than other user fees, having been enacted by 158 of the region's 284 municipalities. Across the municipalities with vehicle license fees, passenger vehicle rates range from $3 to $146 annually. For trucks, rates may start as low as those for passenger cars in some jurisdictions. However, many municipalities charge high fees for heavier trucks, up to $455.13 in Chicago, and $300 in several suburbs. The following chart provides an overview of fees for passenger vehicles in northeastern Illinois.

Across the region, CMAP analysis found no relationship between the imposition of a vehicle licensing fee and home rule status, population, or local road mileage. But there are clear geographic patterns, with a cluster of municipalities imposing vehicle license fees in Cook County. The following map illustrates the location of municipalities that impose vehicle license fees.

Looking forward

Local transportation user fees with broad applicability -- such as MFTs and vehicle license fees -- can provide municipalities with long-term sources of funding for transportation maintenance and operations costs. Local MFTs generate revenue broadly from drivers purchasing motor fuel within a jurisdiction, including trips that originate in different jurisdictions. This can be particularly important for municipalities that are struggling to pay for roadway maintenance and enhancements. Municipalities must use caution when relying on motor fuel tax revenues, however, as improvements in vehicle fuel economy and stable levels of vehicle travel have caused fuel consumption to drop overall.

As part of ON TO 2050 strategy development, CMAP and its partners are exploring how to ensure that communities have sufficient revenue to deal with the significant infrastructure maintenance needs, particularly those that may arise from industrial development. Asset management strategies may also help communities to systematically and cost-effectively maintain and upgrade their road networks. In addition, new funding strategies to replace the state MFT in the long-term are also being evaluated for inclusion in ON TO 2050.