ON TO 2050, the region’s comprehensive plan, seeks to improve our region's ability to adapt in a changing global economy and to thrive by reducing inequality. To compete successfully, metropolitan Chicago must tap into the full potential of our workers, businesses, and infrastructure. Yet the region is falling behind economically because our past economic drivers – our traded industry clusters – are declining without being replaced by new sources of growth.

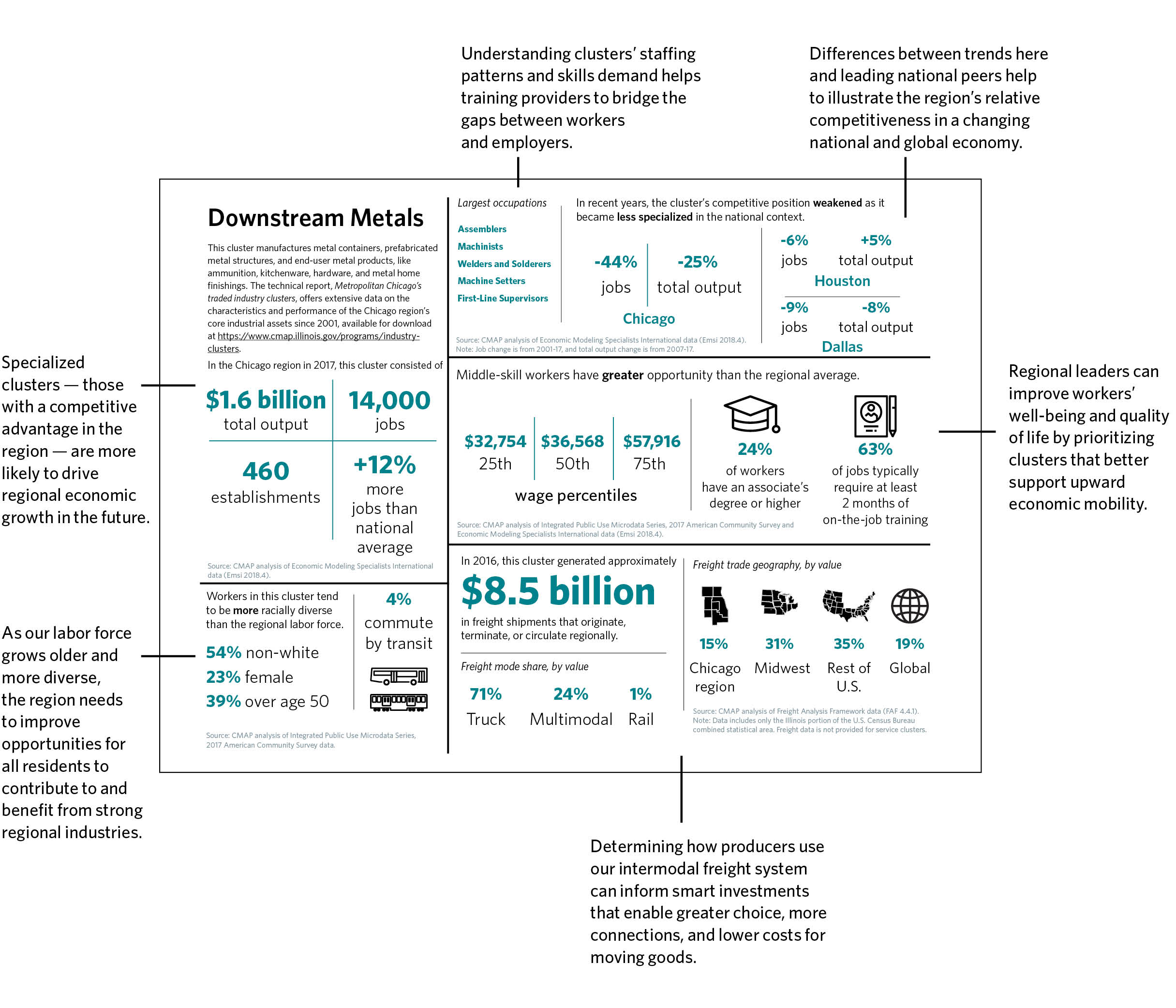

Traded industry clusters are groups of interlinked businesses that sell goods and services in markets outside the region. They have excellent potential to drive inclusive growth for our region. Examples of traded clusters include metals and machinery manufacturing, biomedical products, freight and logistics, and business services.

Traded industry clusters can also provide good jobs for workers. They account for more than half of the region’s wages, but only-one third of its jobs. On average, industry cluster jobs pay $15,200 more per year than industries serving only local customers.

Recent declines among our traded industry clusters have constrained growth in the rest of the economy. Most traded clusters are not keeping up with peer regions and national averages, losing a total 144,000 regional jobs (9 percent) during 2001-17.

These declines are mainly in traded industry clusters that employ more people of color and workers without a college degree, undermining efforts to ensure that everyone can contribute to and benefit from regional progress. For instance, every cluster that employs a higher share of non-white workers than the regional average – and all but one specialized goods-producing cluster – lost jobs during 2001-17. By comparison, many of the region’s largest, most specialized, and fastest growing clusters remain disproportionately white.

ON TO 2050 calls for prioritized investment in our traded clusters as metropolitan Chicago’s best strategy for restarting inclusive economic growth.

This technical report (PDF) and companion traded cluster snapshots (PDF) provide in-depth analysis and data across the region’s traded clusters. This report identifies challenges and opportunities among the region’s traded industry clusters, as well as strategies that draw on a cluster-based approach to restart regional growth. This framework builds on prior CMAP research – such as drill-down reports on advanced manufacturing and freight – to spur and inform better economic practices.