NOTE: This is the second in an on-going series of Housing Policy Updates.

Regional housing market trends during the third quarter of 2012 continued to mirror those found in the first half of the year, with growing permits and housing starts counterbalanced by a continued, but slowing, annual decline in existing home values.  The region also continues to return to pre-recession patterns, with single-family development largely occurring in the outer areas and multifamily development occurring in the central city and inner-ring counties. Some small shifts to this pattern occurred in the third quarter of 2012, with more multifamily building permits in outer areas and a growing proportion of single-family building permits in the City of Chicago and inner-ring counties. However, these shifts have not yet been reflected in under-construction developments. Finally, the Chicago region continues to lag others in terms of new housing permits, particularly with regard to multifamily housing.

The region also continues to return to pre-recession patterns, with single-family development largely occurring in the outer areas and multifamily development occurring in the central city and inner-ring counties. Some small shifts to this pattern occurred in the third quarter of 2012, with more multifamily building permits in outer areas and a growing proportion of single-family building permits in the City of Chicago and inner-ring counties. However, these shifts have not yet been reflected in under-construction developments. Finally, the Chicago region continues to lag others in terms of new housing permits, particularly with regard to multifamily housing.

GO TO 2040 emphasizes the need to plan for livable communities by offering a range of housing options and encouraging infill and redevelopment. These strategies can help seniors age in place and allow residents to choose housing that fits their stage in life. Investing in new housing within developed areas of the region allows communities and the region as a whole to take advantage of existing infrastructure and, therefore, reduce the need to build costly new transportation, water, and other facilities. Infill development can also potentially provide better access to existing job centers, improving the jobs-housing balance in the region.

Home Values

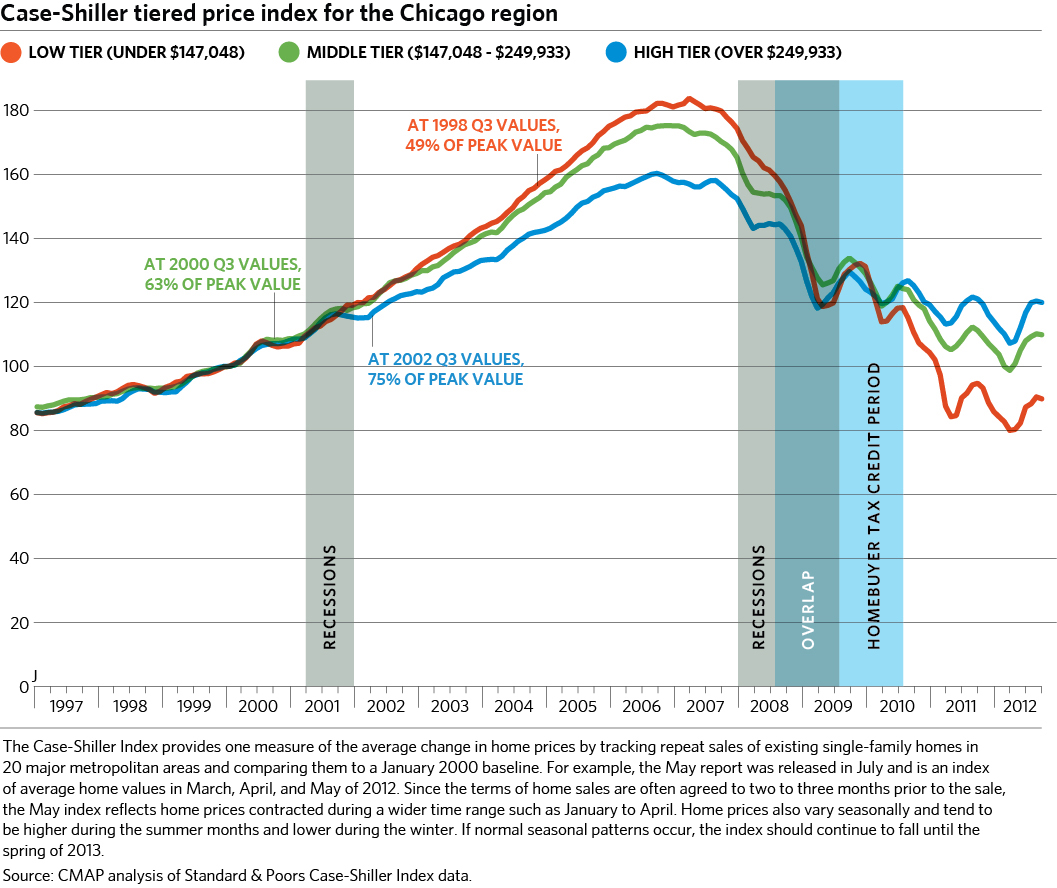

While data indicates that home prices in the region have begun to flatten out, the Chicago Metropolitan Statistical Area (MSA) is still lagging behind the rest of the country according to the Standard & Poors Case-Shiller Index. The Chicago MSA experienced its smallest year-to year decline in home values since the start of the recession, but is one of only two regions in the 20-metro index that was still experiencing year-to-year declines at the end of the third quarter of 2012. Although the Chicago MSA's index began to decline on a month-to-month basis in September, the closing annual gap is a positive sign. Additionally, index increases in July and August led to overall gains for the third quarter of 2012. The September home value index represented an increase of approximately 14 percent from the region's low in February of 2012. Illinois Association of Realtors market data indicates a similar year-to-year downward trend in home values across the region's counties, with year-to-year single-family home median price gains during the third quarter limited to Kendall and McHenry.

Unfortunately, the gap between the low- and high-value tiers of the Case-Shiller Index widened to an average of 30 points over the course of the quarter, leading to the largest index gap between the Chicago MSA's low- and high-value tiers since the index was created. At the close of the third quarter, this gap was the second-largest in the country, behind only Atlanta. Standard & Poors recently cited Atlanta and Chicago as examples of regions struggling to recover from the sub-prime loan crisis, resulting in a lag in value for low-tier homes.

Click for larger image.

Data from Corelogic indicates that the Chicago Core-Based Statistical Area (a 16-county area encompassing parts of Illinois, Indiana, and Wisconsin and defined by the U.S. Office of Management and Budget to associate adjacent, related metropolitan and micropolitan statistical areas) still has one of the highest foreclosure rates in the country, at 6.1 percent of the mortgaged housing stock, but that the region has also begun to resolve foreclosures at a faster rate than other high-ranking regions. For example, data from RealtyTrac indicates that the proportion of pre-foreclosure properties undergoing short sales rather than foreclosure has increased in Illinois. Additionally, the General Assembly recently passed SB 16 which, if signed by the governor, will provide for an expedited foreclosure process for vacant, abandoned foreclosed homes, as well as foreclosure prevention assistance for homeowners. Illinois has a judicial foreclosure process, which provides critical additional protections for homeowners but also extends the foreclosure process timeline.

As noted in CMAP's last housing update, lower property values combined with the need for more resources to address vacant, foreclosed, or poorly maintained properties pose a significant problem for many communities. In addition to State-sponsored initiatives such as the Building Blocks Program and upcoming localized allocation of the National Mortgage Settlement Award, local communities have also worked together to address common housing problems. The Metropolitan Planning Council, the Metropolitan Mayors Caucus, and CMAP recently released "Supporting and Sustaining Interjurisdictional Collaboration for Housing and Community Development," a report outlining the policy reforms and best practices needed to support the success of the region's housing collaboratives.

Rental Apartment Market

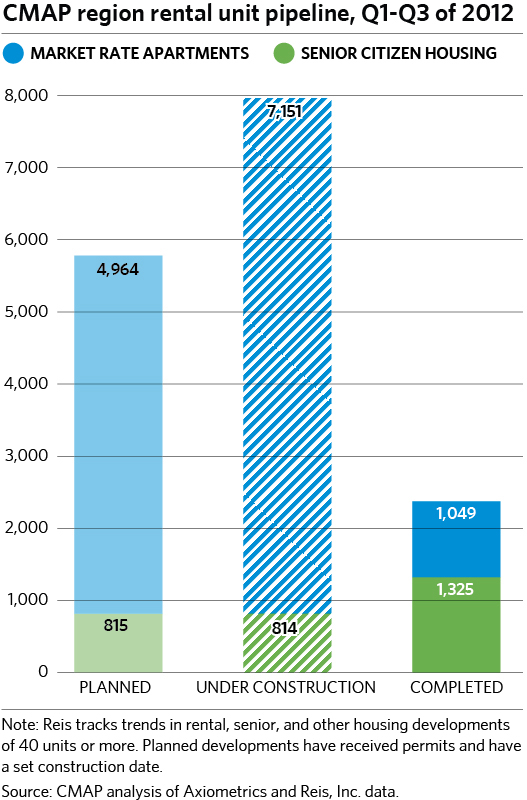

While 2012 has seen fewer new rental units than annual production from 2008 through 2010, many more multifamily units are under construction and are likely to produce new highs in 2013 and 2014. According to CMAP analysis of data from Axiometrics and Reis, Inc., the region has added approximately 1,050 rental apartments through the third quarter of 2012, all of them within the City of Chicago. Nearly 7,200 units are under construction, 5,500 of which are in Chicago. The ratio is reversed for the 1,300 completed and 800 under-construction senior housing units. Eighty percent of the completed senior units and 70 percent of the under-construction units are in suburban areas, providing new housing options for the region's seniors. However, declining vacancy rates and increasing monthly rents indicate growing demand for all types of rental housing.

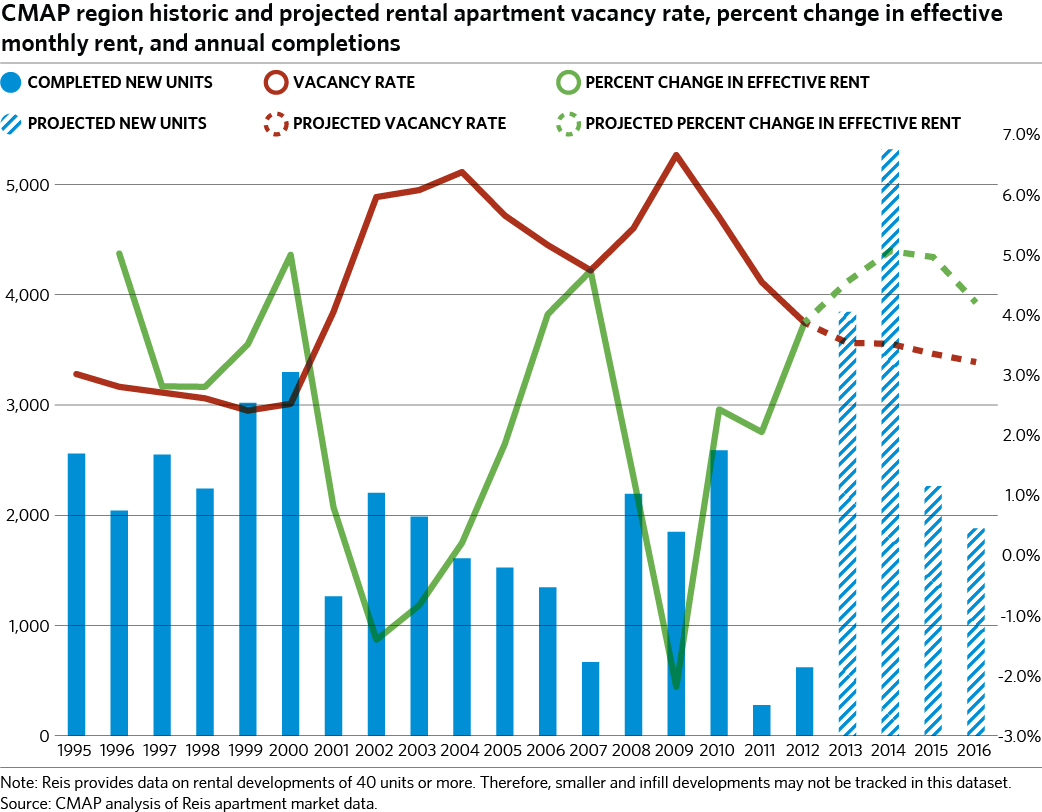

Rental vacancy rates also continued their decline in 2012, from 3.5 percent at the start of the year to 3.2 percent at the end of the third quarter. These vacancy rates are highly variable throughout the region, and some of the largest decreases were in suburban areas. For example, the Reis Glen Ellyn/Wheaton and Glenview/Evanston submarkets experienced the highest vacancy decreases over the last year, falling from 6.0 percent to 4.5 percent vacancy and from 4.1 percent to 2.6 percent, respectively.

Finally, rents are also on the rise in the region, having increased nearly four percent between the start of the year and the third quarter of 2012. These increases exceed the other annual increases in rent since the recession began, and Reis projects that they will continue through 2014. Again, while Chicago submarkets experienced rent increases, some of the largest rent increases were found in suburban submarkets such as Aurora/Naperville and Woodridge/Lisle, with increases of 5.7 and 5.5 percent through the end of the quarter, respectively.

Click for larger image.

These continued vacancy rate declines and monthly rent increases are likely the result of a number of factors. First, larger economic conditions have probably turned many would-be homebuyers toward the rental market. Second, demographic shifts like the growth of the population in the 25 to 29 age bracket and other traditional rental demographics will continue to push demand for rental housing for a number of years. Finally, rising rents and falling vacancies indicate a mismatch between supply and demand.

While the City of Chicago has facilitated construction of many new, market-rate rental units over the last several years, new rental development has been much slower in the region's suburbs. This slow growth can be due to a variety of factors, including developer concerns about market demand in traditionally single-family communities, restrictive zoning regulations that make rental development difficult, resident opposition to rental development, and/or lack of financing for large rental development in unproven suburban markets.

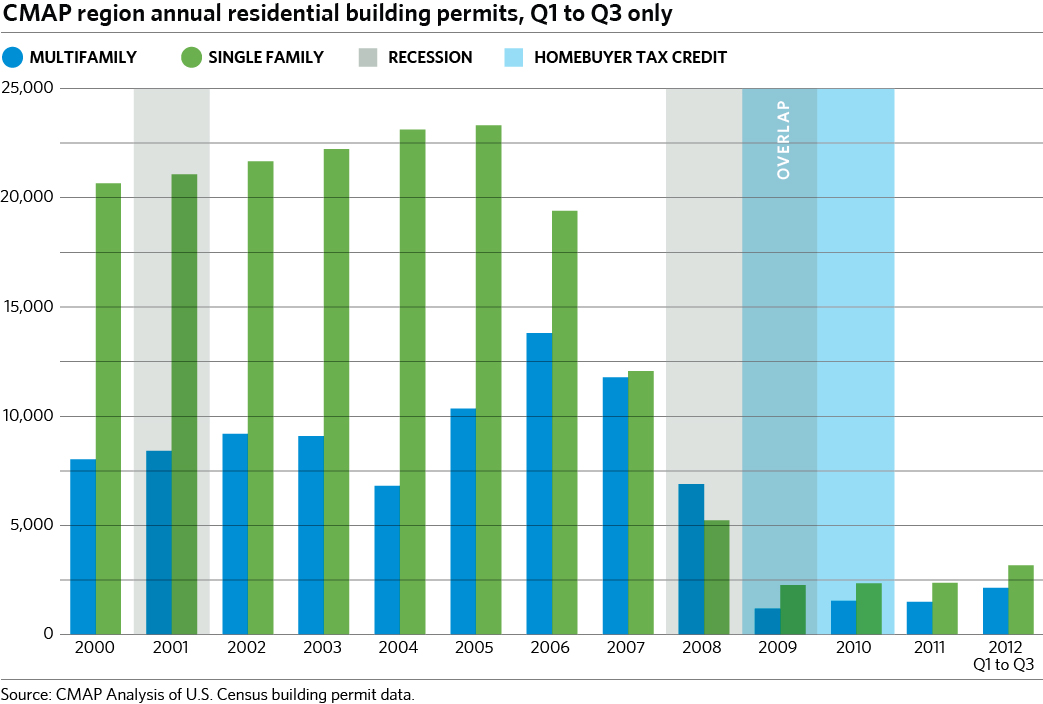

Building Permits

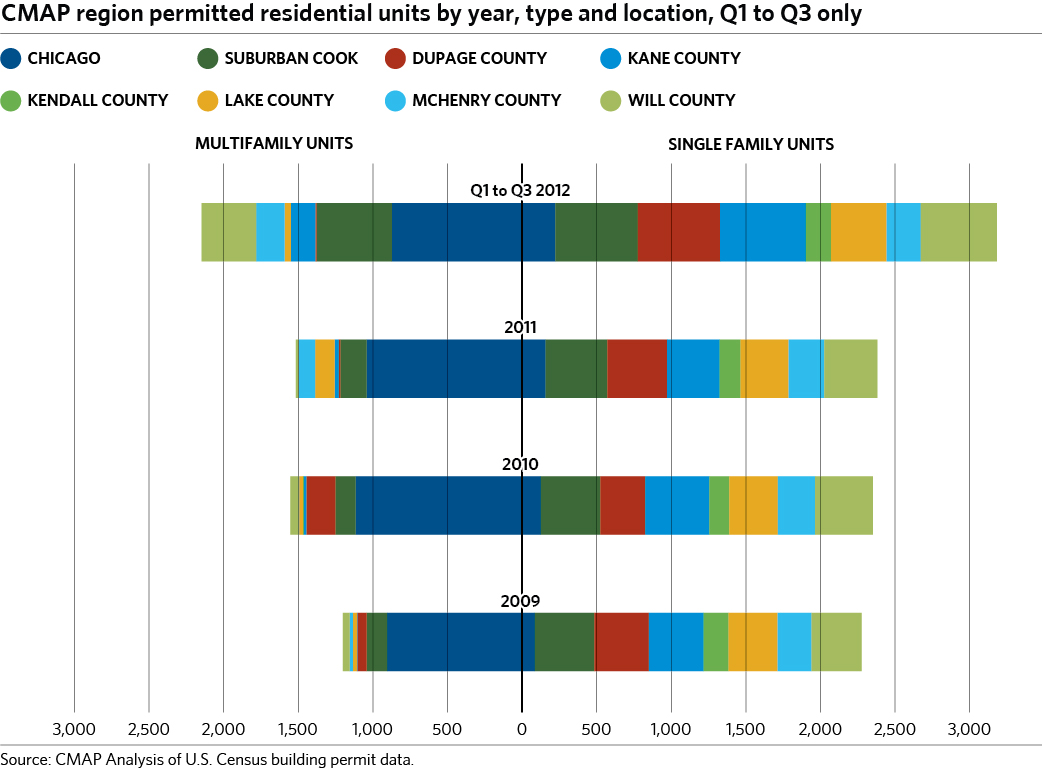

As in the first half of 2012, total building permits in the region continue to exceed other post-recession years. The total single-family permits through the third quarter of 2012 are actually greater than the full annual totals for 2009 and 2010, and only slightly below the 2011 total. In-region multifamily permits grew at a faster rate than single-family permits in 2010 and 2011, but single-family permits took the lead in the first three quarters of 2012. Chicago, Suburban Cook, and DuPage County have gained an increasing share of the region's single-family permits, continuing a post-recession trend. This development is more likely to be infill in nature and utilize existing infrastructure and community assets, a goal supported by GO TO 2040. Single-family development also continued in the outer areas of the region, with increases in single-family permits in Will and Kane Counties, although Will County has a smaller proportion of the region's single-family permits than it has historically.

Click for larger image.

Multifamily permits were issued in a broader swath of the region during the third quarter. Over the last several years, the region's multifamily permits have been issued primarily in the City of Chicago or in inner-ring suburbs and satellite cities. However, permits issued for market rate, senior, or supportive-living rental developments in Crystal Lake, East Dundee, Huntley, Plainfield, and Orland Park helped boost suburban multifamily permits to their highest proportion of the region's multifamily permits since 1999. These increases balanced a decrease in multifamily permits in the City of Chicago, which issued its smallest number of multifamily permits in the third quarter, as well as for the first through third quarters, since the end of the recession. Chicago has numerous apartment developments under construction, and permitting of new units may have slowed to reflect concerns about a glut of new rental units. In keeping with recent trends, the majority of multifamily permits were likely issued for rental developments rather than for-sale projects.

Click for larger image.

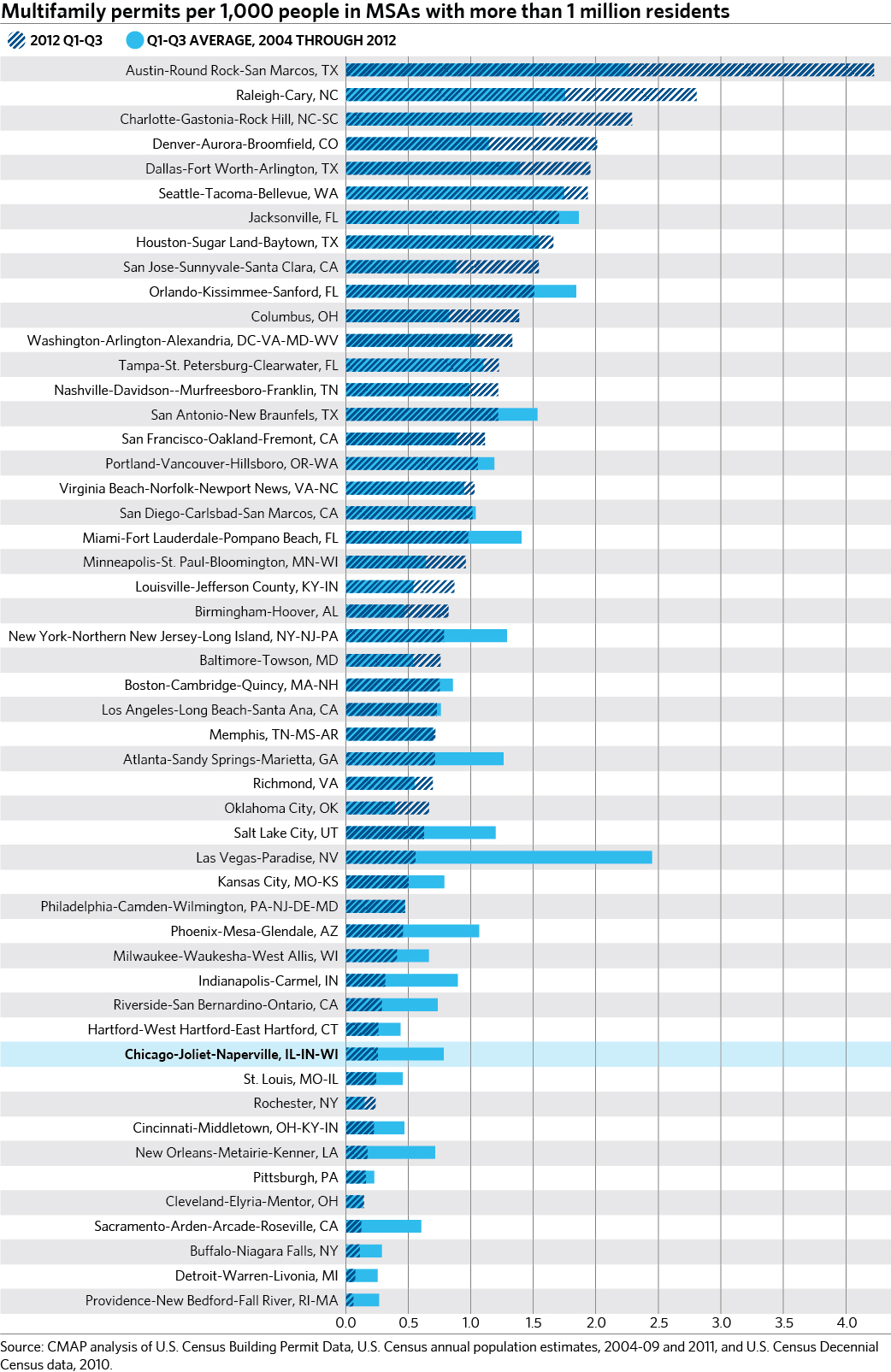

Finally, the Chicago MSA continues to lag other regions in terms of permitting new single-family and multifamily housing units. While many of the country's fast-growing metropolitan areas are exceeding their pre-recession averages in permitting of new, residential multifamily units, the Chicago region is well below its average and is ranked 41st out of the 51 metropolitan areas with more than a million residents. Similarly, the region is also below its average in single-family permits, but none of the major MSAs have begun issuing single-family permits at their pre-recession rates.

Click for larger image.

For-Sale Housing Starts

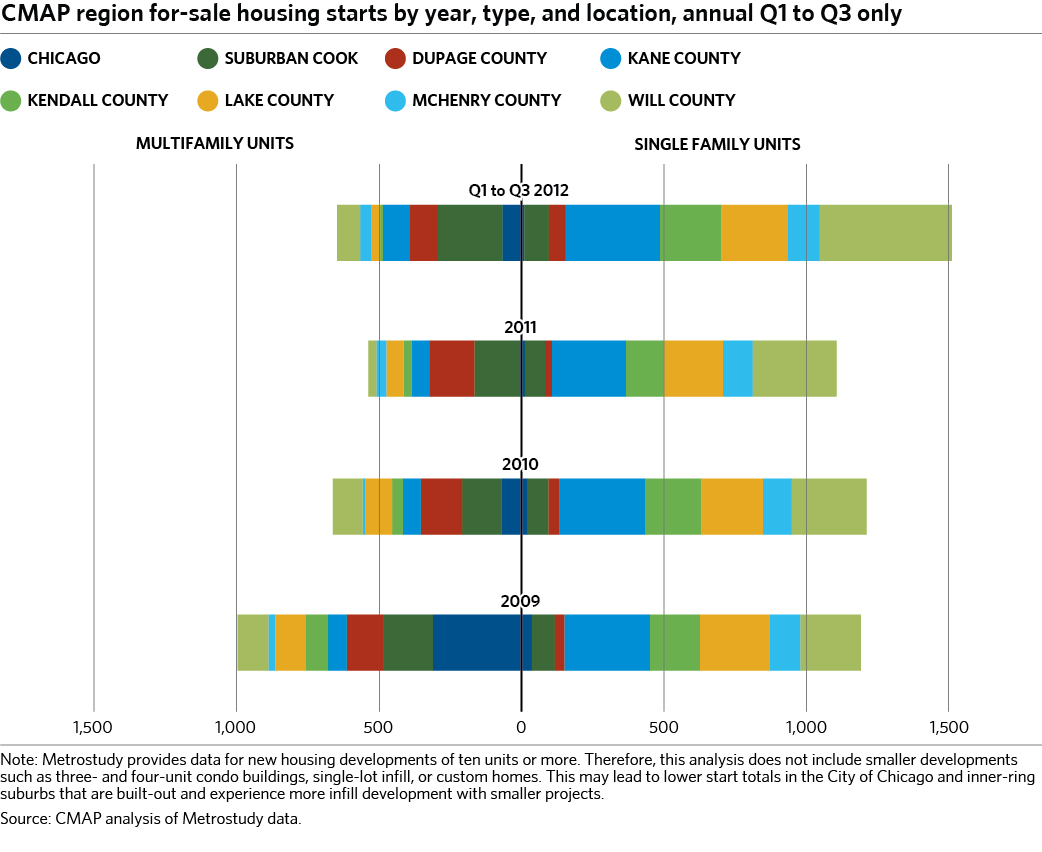

According to data provided by Metrostudy, total for-sale housing starts through the third quarter of 2012 have exceeded starts through the same time period in any post-recession year. However, this resurgence has been led by single-family development. For-sale multifamily development continues to lag as it is mostly within the rental market. In particular, single-family starts have increased significantly in Kane, Kendall, and Will Counties. In contrast, for-sale multifamily development has been occurring predominantly within the City of Chicago and suburban Cook County. This mirrors pre-recession trends, with single-family growth focused in the outer-ring counties and multifamily development in Chicago and inner-ring suburbs.

Click for larger image.

Conclusion

Overall, new residential development in the region is on the rise, while existing home values are still showing the recession's effects. Metropolitan Chicago is trailing other regions in terms of both housing value recovery and new residential permits. However, new single-family development has gained strength throughout the region this year, and multifamily development appears to be gaining strength in suburban areas.