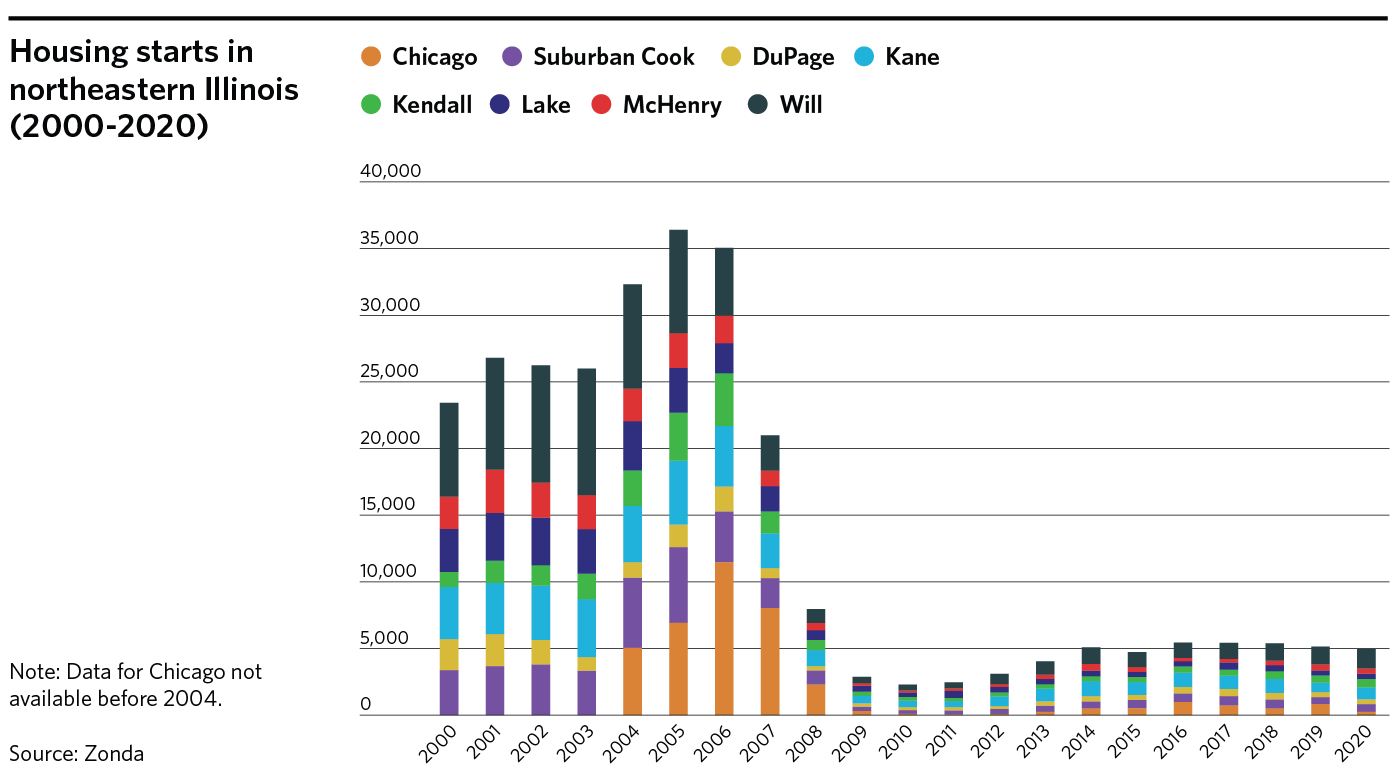

The types of housing units built in the region also changed markedly over the last two decades.

Single-family detached homes

During the early 2000s, permits for single-family detached homes made up about 61 to 75 percent of all permits in the region. But that changed following the recession in 2008. As of 2020, although permits for single-family detached homes continue to be the majority, the share is far less (53 percent). This change is mostly a result of a shift in Chicago and suburban Cook County.

Little to no change has occurred in the collar counties, where roughly three-quarters of new home permits are for single-family detached homes.

DuPage County is an exception. In 2012, 99 percent of new housing permits in DuPage were for single-family detached homes. Today, permits issued in the county are nearly split evenly between single-family detached homes and large multifamily units (five or more units).

Large multifamily units

Permits for large multifamily units have seen some growth throughout the region. In 2020, 41 percent of all permits issued were for large multifamily units, nearly double the share 20 years ago.

Chicago continues to issue the largest share of permits for large multifamily units. However, the share has increased in some collar counties. For example, in Kane County, the share of permits for large multifamily units increased from 4 percent in 2010 to 24 percent in 2020.

Small multifamily units

The share of permits approved for small multifamily units (three to four units) continue to make up a small percentage of permits approved across the region. In 2020, they made up only 3 percent of all permits issued. Similarly, over the last two decades, a small number of permits were issued for duplexes (two units).