There is growing consensus that continued reliance on the motor fuel tax (MFT) is not an appropriate long-term solution for transportation funding. Despite being one of the primary revenue sources for transportation in Illinois, the state MFT has not been increased since 1990. Generating revenues through a flat, per-gallon tax, the MFT has failed to keep pace with inflation. The cost to operate, maintain, and expand the state's transportation system increases over time; to keep up, the revenues to support the system must also grow. Fuel consumption has declined as vehicles become more efficient, and overall vehicle travel has stagnated in recent years, further reducing MFT revenues.

To provide adequate revenue for modernizing and expanding the transportation system, GO TO 2040 recommends implementing new and enhanced sources of reasonably expected transportation revenues, including a long-term replacement for the MFT. In support of that GO TO 2040 recommendation, CMAP has initiated an analysis of state MFT alternatives as described in an issue brief. As summarized in this Policy Update, the brief explores MFT replacements implemented by other states and assesses several possible MFT replacement options using common tax policy considerations. Alternatives evaluated include mileage-based user fees, motor fuel sales taxes, and motor vehicle registration fees. While the CMAP analysis evaluates each approach, it does not make specific recommendations for the State of Illinois.

Criteria for evaluating revenue mechanisms

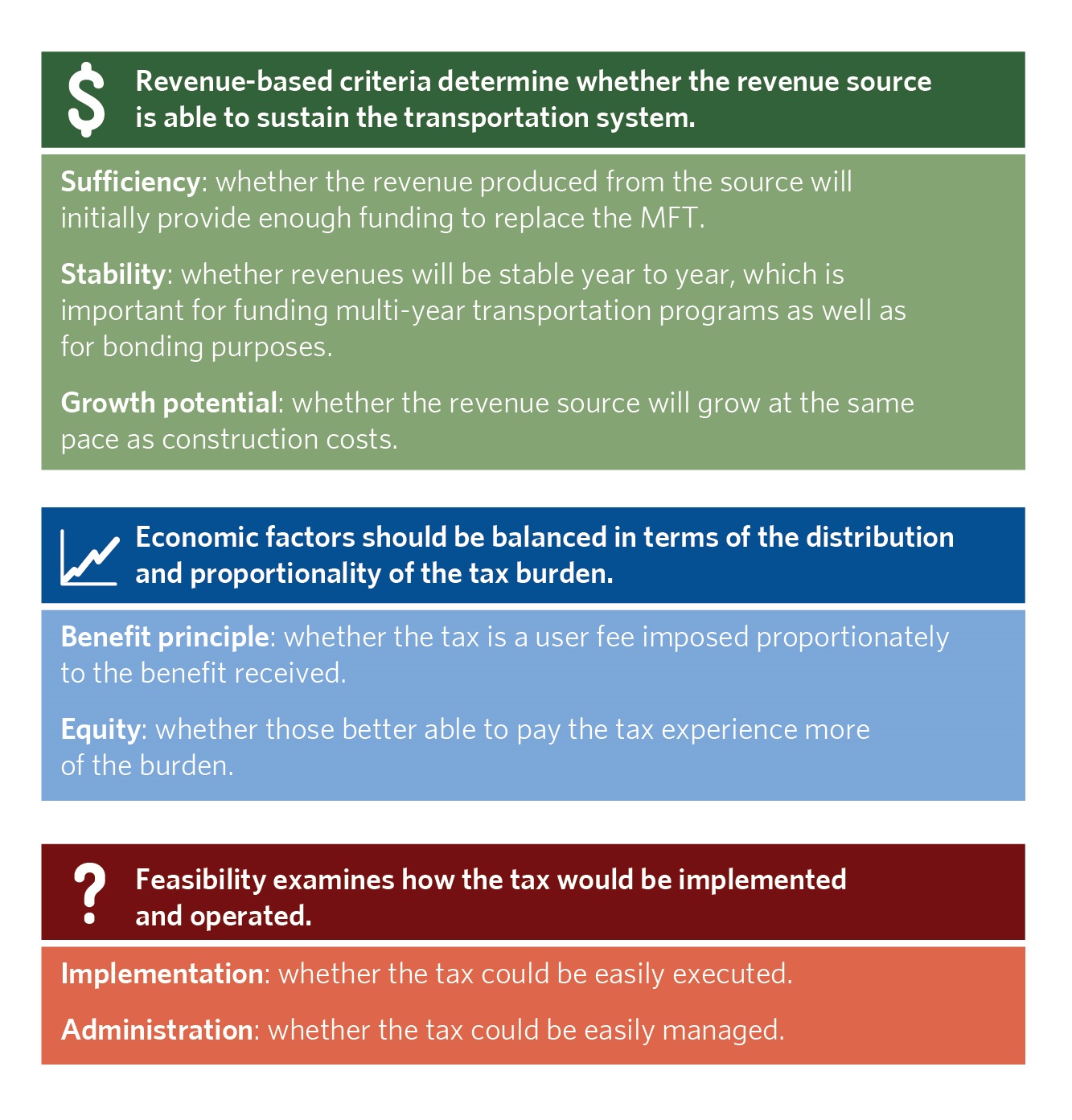

Finding a suitable replacement for the MFT requires careful examination across a number of criteria -- both objective and subjective -- including revenue-based metrics, economic factors, and implementation and administration issues, as shown in the following graphic.

Evaluation summary

CMAP analyzed the performance of mileage-based user fees (primarily a VMT fee based on miles driven, rather than on the amount of fuel consumed), a motor fuel sales tax, vehicle registration fees, and the current MFT. The following chart summarizes CMAP's findings.

While mileage-based user fees appear relatively positive under most considerations, implementation and administration remain significant hurdles. Such fees could raise sufficient revenue to replace the existing MFT (including an 8-cent-per-gallon increase), provide a stable source of revenue with moderate growth potential, and offer a strong user fee that fulfills the benefit principle.

Combining a VMT fee with facility-level tolling serves as a targeted pricing mechanism because it can raise significant revenues that more fully account for the costs of using the transportation system. For example, facility-level tolling could be used concurrently with a comprehensive VMT fee to charge variable rates on certain types of roads at particular times of the day.

Because motor fuel sales taxes can be implemented under existing systems, many states, including Illinois, have examined them. However, some states have recently learned that reductions in motor fuel prices can reduce revenues significantly. Fluctuations in fuel prices have made motor fuel sales volatile, and therefore stability is one of the greatest deficiencies of this alternative. The growth potential of this revenue source is hampered by greater utilization of fuel efficient vehicles, and its connection to use of the transportation system is even more distant than the MFT's is.

Motor vehicle registration fees would be straightforward to administer and implement but are significantly problematic as a wholesale replacement because they would not likely be implemented at a level that would be sufficient to replace the MFT. In addition, motor vehicle registration fees do not offer a strong connection between the use of the transportation system and the amount of the registration fee, resulting in poor performance under the benefit principle.

None of the alternatives performs particularly well under the equity consideration. With the right configuration, however, mileage-based user fees have the greatest potential to be an equitable source of transportation revenue.

Ultimately, to provide adequate revenue to enhance and expand the transportation system, new revenue sources must be implemented. In addition to advocating for replacing the MFT, CMAP is committed to implementing other policy changes to bring additional revenues to the region, such as congestion pricing and performance-based funding. As part of the planning process for the region's next long-range comprehensive plan, CMAP will continue to analyze and assess potential replacements for the MFT. Please see the full issue brief for additional detail on alternatives to the state motor fuel tax.