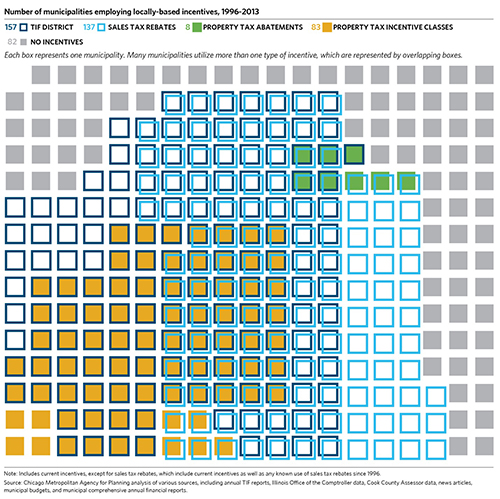

Local economic development incentives play a major role within the overall economic development landscape of northeastern Illinois. In recent years, 202 of the region's 284 municipalities have used at least one of four local economic development incentive tools: tax increment financing (TIF), sales tax rebates, property tax abatements, and Cook County property tax incentive classes.

A new CMAP report, Examination of Local Economic Development Incentives in Northeastern Illinois, explores the use of these incentives in the region and focuses on their prevalence, structure, community goals for their use, types of firms receiving assistance, and the extent to which they support the overall economic, livability, and sustainability goals of GO TO 2040. In addition, the report includes an appendix of 40 case studies summarizing developments in the region that have received incentives. These case studies were used as the basis for much of the analysis in the report.

The report is an outgrowth of CMAP's Regional Tax Policy Task Force, an advisory group that consisted of representatives from local and state government, business, civic organizations, and academia. In early 2012, the task force issued its report, which among other issues addressed the use of local tax incentives, specifically sales tax rebates, to spur the development of large, sales tax-generating establishments. In its final advisory report, the Task Force recommended that CMAP analyze the impact of sales tax rebates on development decisions. In its discussion of this report, the CMAP Board directed staff to conduct a detailed study on these rebates as well as other local incentives, and analyze the impact on local and regional economic development. The CMAP staff report is available at www.cmap.illinois.gov/economy/tax-policy/economic-development-incentives.