Since the housing crisis began, many for-sale single-family homes (SFHs) in the region have become rental units or are now vacant. This has diverse implications for how the region's communities recover from the housing crisis and manage a housing stock that has traditionally been owner-occupied. Recent data from the American Community Survey (ACS), which provides a rolling estimate for the 2007-11 period, estimates that SFH rental units in the region increased by 42 percent and vacant SFHs increased by 126 percent between 2000 and 2007-11.

Regional Analysis

Overall, the region added approximately 40,000 SFH rental units between 2000 and 2007-11, representing approximately 1.6 percent of the region's occupied housing stock. During the same time period, the region added just over 80,000 SFH for-sale units. The region also added approximately 46,000 vacant SFH units during the same time period, eclipsing the increase in rental SFH homes. These now-vacant homes may be unsold new homes, homes that have undergone foreclosure, or for-sale existing homes. Due to economic conditions, lending restrictions, and demographic changes, it is likely that, in the short term, many of these vacant homes will be rented rather than returned to the for-sale market.

This increase in rental and vacant SFHs has had profound impacts on the region's housing values, housing vacancy rates, and housing starts, and it also presents weighty challenges for the region's communities. In many cases, the increase results in less revenue for communities, which then must find ways to track or maintain rental, vacant, or poorly maintained homes. Many communities are also formulating strategies to bring those homes back onto the for-sale market. Rental of SFHs is a growing business sector and an increasing number of large and small investors are creating SFH rental portfolios.

While they have increased significantly in recent years, SFH rental units have traditionally had a presence in the region. For example, SFH rental units comprised approximately 3.0 percent of the region's housing stock and 6.2 percent of the SFH stock in 2000. For the 2007-11 period, SFH rental units comprised approximately 3.9 percent of the region's housing stock and 7.9 percent of the SFH stock. In outlying townships, SFH rental units are often the most prevalent rental option and make up as much as ten percent to 20 percent of the housing stock. As these areas have become more developed and multifamily rental options increased, SFH rental units have taken on a lesser role.

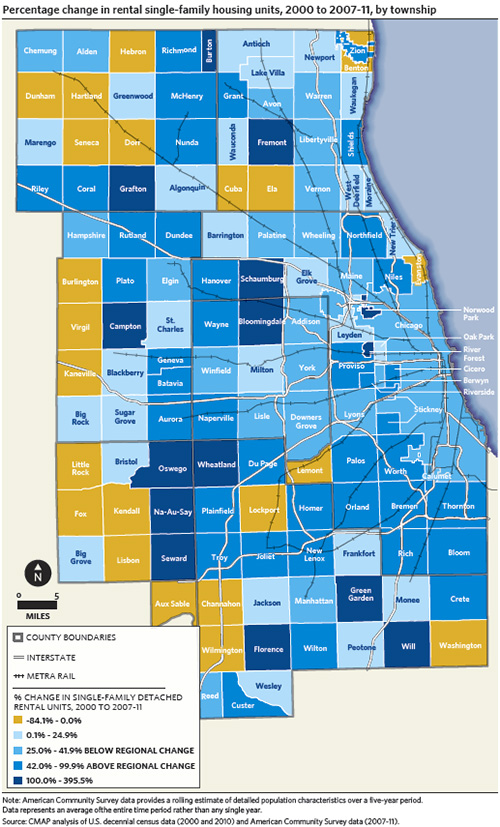

The following map depicts the percentage change in SFH rental units by township from 2000 to 2007-11. Areas in orange lost SFH rental units, and all other areas gained SFH rental units, with the largest increases concentrated in south Cook County and a belt of middle-tier suburbs. Areas in the darkest blue more than doubled their stock of SFH rental units, but still generally have a smaller proportion of their SFH stock in rental units, at 5.1 percent compared to 7.9 percent for the region overall in 2007-11. Instead, SFH rental units have continued to be most concentrated in Chicago, south Cook County, and satellite cities like Aurora and Joliet.

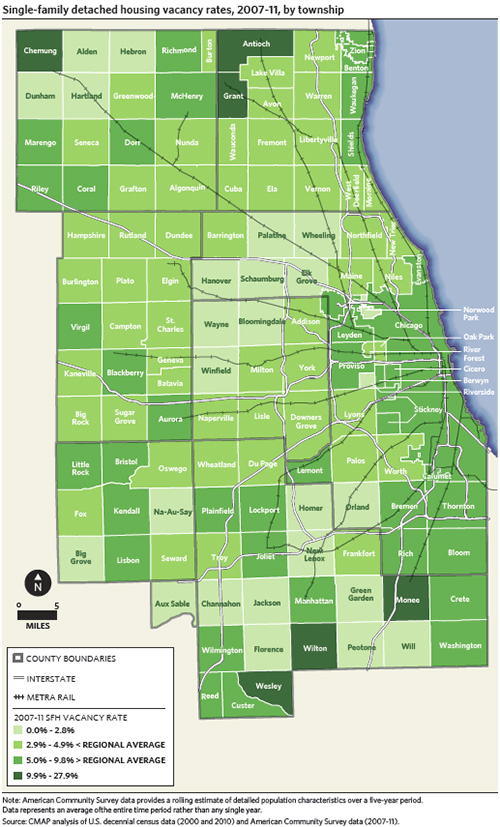

It is likely that subsequent releases of five-year ACS data will show a stronger increase in SFH rental units as the time periods covered reflect more post-recession years. Regionwide analysis of ACS three-year and one-year estimates, which are more recent but only provide consistent data for the region at the county level, indicate a continuing increase of SFH rental, as well as vacant, units. In many areas, the stock of currently vacant units will transition to the rental market because there is insufficient demand in the for-sale market. The following map below depicts SFH vacancy rates by township for the region from 2007-11. SFH vacancy rates are generally highest in the fast-growing townships on the edge of the region, as well in southern Cook County. Townships in darkest green have SFH vacancy rates more than twice the regional rate of 4.9 percent and generally have very few housing units and/or have experienced substantial growth over the last decade. Higher than average vacancy rates are most concentrated in south Cook County and northeastern Will County, an area which also has lower incomes and a lesser increase in income than much of the rest of the region.

Implications

Distressed sales will continue to have an impact on the tenure and occupancy of the region's housing stock, both SFH and multifamily, for some time. For both demographic and economic reasons, many more of the region's residents are renting rather than buying. Also, foreclosures are still on the rise in the region and the state, and the foreclosure timeline (how long it takes to resolve distressed properties) in Illinois is nearly two years. The backlog will continue to generate a steady stream of vacant and/or foreclosed units in the housing market. As noted previously, it is likely that many of these units will be rented rather than owner-occupied. Additionally, an increasing proportion of foreclosures are being resolved as short sales (where a home is sold for less than the value of the existing mortgage), and some of these have also been purchased by rental investors. While the Chicago metropolitan statistical area's for-sale housing market reached a low in March 2012, it is unclear whether prices have truly hit bottom and how long a full recovery will take. In the interim, there will be many more available homes than the for-sale market can absorb, and facilitating the rental of vacant homes can be a positive solution.

Federal and State Actions

Recent federal and state actions may expedite the transition of foreclosed and distressed homes back into the housing market or through loan modification processes. As described in a previous Housing Policy Update, the State recently enacted SB 16 to create an expedited foreclosure process for vacant, abandoned foreclosures, as well as establish funds for foreclosure prevention programs and property maintenance costs incurred by local communities. Recent rule changes by the Federal Housing Finance Agency have facilitated the short sale process, which provides an alternative to foreclosures and has become an increasingly critical part of the housing recovery. The rule changes allow short sales for underwater borrowers with a Fannie Mae or Freddie Mac mortgage who are current on their mortgage but facing specific hardships. Additionally, the Federal Housing Administration has recently begun selling delinquent loans in bulk in the Chicago region through its Distressed Asset Stabilization Program. While this program sells to private investors, groups of homes in some neighborhoods were also set aside for Neighborhood Stabilization Outcome pools, which can only be purchased by local nonprofits and governments that adhere to guidelines intended to promote neighborhood stability. These guidelines prioritize loan modifications, short sales to the owner/occupant, and/or good maintenance of rental properties over foreclosure sales.

Regional Actions

Both the growth in vacant units and the transition of SFHs to rental units have had significant impacts on the region's communities. Many municipalities do not have statutes, policies, or procedures in place to monitor rental or vacant units. These SFH rental units can be a benefit to the community if the homes are maintained in good condition with quality tenants. However, a diversity of rental investors with varying levels of experience and expectations have begun renting SFHs, with correspondent variable impacts. Maintenance and operation of a large stock of SFH rental units is new paradigm for investors and communities, and those involved are still creating best practices. As a result, communities and counties in the region have created a number of strategies to track and maintain vacant properties, monitor rental property condition, and address problematic landlords and investors. For example, Mount Prospect utilizes a Crime-Free Housing Program that requires all rental properties to obtain a license and be inspected, and all property owners/agents must attend a crime-free seminar. Inspection frequency is reduced for compliant properties. South Holland has created a Good Neighbor Rental Housing initiative that also treats SFH rental units like a commercial enterprise and requires a business license for rental of SFH.

To further discussion about best practices regarding SFH rental units, CMAP's Housing Committee, the Regional Homeownership Preservation Initiative (RHOPI), and the Illinois Home Ownership Preservation Initiative recently co-sponsored a forum on the topic. The forum focused on how to ensure that the growing number of SFH rental units in the region continue to be an answer, not a burden, for municipalities and investors. The Metropolitan Planning Council (MPC) released a companion whitepaper on managing SFH rental units. At the forum, discussion focused on better strategies to track and monitor rental homes, as well as creating partnerships with landlords, property managers, and investors to create an environment that encourages communication and facilitates good management practices. Participants also discussed the potential to pool resources to monitor new rental properties, allowing constrained municipalities to share costs and benefits. Data and follow-up materials from the forum will be available on RHOPI's website.

GO TO 2040 recommends that communities work together to address shared problems such as those presented by the housing crisis. CMAP provides housing assistance through its Local Technical Assistance program with the Metropolitan Mayors Caucus (MMC) and MPC via Homes for a Changing Region, a process that assists communities in planning for their current and future housing needs. Through the process, CMAP, MMC, and MPC supported three groups of communities in the region that work collaboratively to attract grants and private investment for investing in their housing stock, creating housing choices, and providing foreclosure-prevention assistance. These collaboratives are described in more detail in a jointly released report from CMAP, MMC, and MPC.

Conclusion

Overall, the growth in SFH rental units presents a mix of challenges and opportunities for the region. Renting homes can provide a positive alternative in a depressed housing market, and it provides more housing choice for the region's renters. However, municipalities must have protections in place to ensure that their housing stock is maintained. These can include registration and inspection of rental properties, education programs for landlords and tenants, strategies to communicate with landlords, and programs like crime-free housing. Continued discussion and partnerships between communities can help to create best practices to maintain a quality stock of SFH rental units in the region.