Indicator

Municipalities with Per Capita State Revenue Disbursement Below 80 Percent of Regional Median

Municipalities with strong revenue levels relative to public service needs may be better able to maintain their fiscal condition and serve their residents and businesses. This may also lead to greater capacity to achieve local and regional goals. This indicator will track per capita state revenue disbursements to municipalities in northeastern Illinois, relative to the regional median. Illinois municipalities receive revenue through state disbursements of several revenue sources, including income, use, sales, motor fuel, and personal property replacement tax revenue. These revenues may be based on current land use, population, or similar factors, but some disbursements are based on long established criteria that may no longer relate to service and infrastructure needs or current conditions in a given community.

The amount of revenue municipalities collect varies throughout the region and depends on local land use mix, the composition of their tax structures, and the level of service the community desires from the municipality. State statutory criteria for revenue disbursements to municipalities also drive divergences, as the criteria do not always relate to the level of public services required or to a municipality’s capacity to raise its own revenue from its own tax base.

Targets

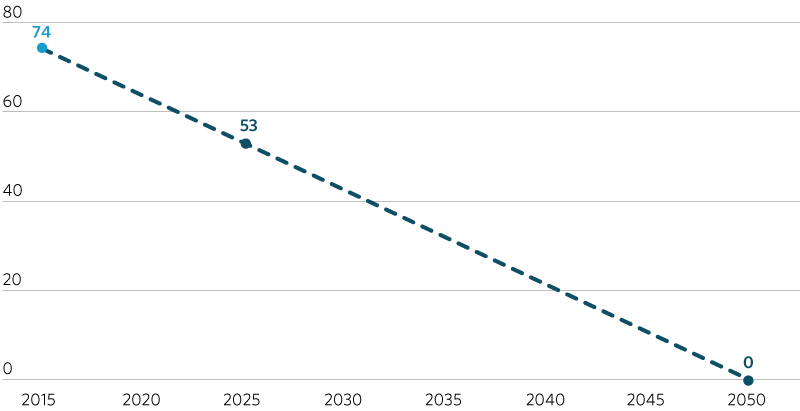

Zero was chosen as the 2050 target because the goal is to ensure that every municipality has sufficient revenues and to lessen the role that state statutory criteria plays in the wide divergences across municipal revenue levels. While it is conceivable that not every municipality requires this level of state support today, the general goal is to increase municipal capacity, including among smaller municipalities that may experience growing needs over the planning period. The 2025 target was derived by following a straight-line decrease between the 2015 figure (74 municipalities) and the 2050 target.

2025: 53 municipalities or fewer with per capita state revenue disbursement below 80 percent of the regional median

2050: Zero municipalities with per capita state revenue disbursement below 80 percent of the regional median

Sections

- Actual

- Target