A key component of creating livable communities is providing a range of housing options for residents. However, as noted in CMAP's analysis of Census 2010 housing tenure data, the region added 133,464 owner-occupied housing units and only 31,557 renter-occupied housing units between 2000 and 2010. The City of Chicago lost rental units, and many outer-ring suburbs added housing units but experienced a decrease in the percentage of their housing stock that is rental. The analysis of U.S. Census permit data and MetroStudy housing starts data presented below indicates that much of this new housing was for-sale detached housing. This shift towards for-sale and detached housing has significant implications for land use, transportation, and housing affordability in the region. Provision of compact multifamily and rental housing is one key component to increasing the housing options and connecting new housing with access to jobs. The GO TO 2040 plan emphasizes the need to link planning for these areas in order to improve livability through offering additional housing options, increasing transit and employment access, and decreasing congestion.

Demand for multifamily and rental housing options is growing in the region, spurred on by economic conditions, demographic shifts, and changes in housing preference. For example, economic conditions have prompted many people to delay purchasing a home or move from owner-occupied to rental housing, and home ownership rates in the region and nation declined slightly over the past decade. Our region is also adding residents that often seek multifamily or rental housing, including those aged 20 to 30 and senior citizens. Furthermore, broader demographic trends such as delaying marriage and childbearing can also increase the demand for rental housing. Finally, during CMAP's Invent the Future process, 75 percent of participants indicated that they wanted to encourage moderate to highly compact growth in the region, and 69 percent indicated that that growth should take place in both metropolitan and community centers. This post provides a snapshot of how development has matched these trends and desires by examining where single-family and multifamily housing has developed in the region over the last decade and looking at the new trend toward development of multifamily rental housing.

Recent articles have highlighted significant construction activity in the regional multifamily rental market. According to Axiometrics, a major provider of data on the apartment sector, Chicago was one of the top ten growing apartment markets in the country through the first half of 2011. Chicago Real Estate Daily notes that apartments are likely the strongest real estate sector in the region, and that apartment rents in downtown Chicago have surpassed the previous peak from 2007. Several apartment buildings are under construction in downtown Chicago, while at least seven additional developers were seeking financing for apartment developments. The larger real estate market is also recognizing the value of multifamily buildings, and a number of large rental buildings in Chicago are being successfully placed on the market.

Multifamily rental buildings outside of downtown Chicago are also faring well. AMLI, a major apartment complex developer and manager, recently received approval for a 214-unit mixed-use development in Evanston and hopes to break ground this fall. AMLI originally intended to begin the project in 2008, but placed it on hold due the recession. Suburban apartment market rents have also surpassed 2007 highs and vacancies are decreasing, according to Chicago Real Estate Daily. CMAP's tracking of regional developments and analysis data from the CoStar Group, a provider of commercial real estate data, indicates that at least four apartment developments are under construction or were recently approved in suburban areas, and an additional four "active senior" apartment developments are under construction or have recently been approved. Sales of existing apartment buildings in the Chicago region since January 1, 2011, have totaled nearly $1 billion and, in combination with other under contract buildings and anticipated sales, have the potential to exceed the previous high from 2007.

This recent increase in construction of new multifamily rental housing contrasts with the trend of the last decade toward construction of single-family detached housing units. As noted above, rental housing comprised less than eight percent of the total housing units added to the region since 2000. According to the U.S. Census Bureau, construction of multifamily housing, both for-rent and for-sale, has also been declining in the Midwest as a whole. The table below shows annual housing unit completions in the Midwest since 1974 by structure type and, for multifamily units, by tenure. During the housing boom of the mid-2000s, construction of new, for-rent housing units in the Midwest was at its lowest level since the early 1980s. As a proportion of all new units built, new rental units during the early 2000s were at their lowest level for all years analyzed, comprising less than 10 percent of new housing units completed in the Midwest. However, as construction of all new housing declined, multifamily for-rent housing construction declined at a slower pace and has increased each year since 2007.

The U.S. Census Bureau also provides data on the number of building permits issued in a county or place by attached and detached housing units, without distinction between owner and renter occupancy. While the issuance of building permits does not guarantee that a housing unit will be constructed, seeking a building permit is one of the final steps in the pre-development process. Data from the Federal Reserve Bank of St. Louis indicates that most housing units for which building permits have been obtained are constructed. The Midwest as a whole did experience a rise in authorized, but not under construction housing units immediately prior to the recession. The table below provides the total building permits issued per year since 2000 for all counties in the CMAP region, broken down by structure type.

This data indicates that building permits issued for single-family units peaked in the region between 2003 and 2005, while permits for multifamily units were at their highest level in 2006. Since 2006, the balance between single-family and multifamily housing unit permits has shifted, with multifamily units comprising a significantly larger proportion of permitted units than in the earlier half of the decade.

Finally, multifamily development has generally concentrated within the same areas of the region over the last decade. The chart below provides the annual counts of building permits issued for new residential construction for both single-family (leftmost column in each year) and multifamily (rightmost column in each year) by county and the City of Chicago. As above, this chart points to the changing balance of the type of housing unit constructed in the region, and it also indicates a shift as to where in the region housing units were permitted pre- and post-recession.

In 2000, nearly 46 percent of permitted units in the region were contained in Will, Kane, Kendall, and McHenry Counties, but only 22 percent of the region's permitted multifamily units were in these counties. Of this group, Kane County maintained the highest proportion of the region's permitted multifamily units, with 15 percent in 2000, 11 percent in 2001, and between 7 and 8 percent in 2002 and 2003, with minimal proportions and counts from 2004 forward. By 2006, these counties' proportion of total permitted units had declined to just over 38 percent of the region's total, and less than six percent of the region's multifamily units. By 2010, these counties account for less than 28 percent of the total, but had increased their proportion of the region's multifamily attached unit permits to seven percent. In short, while these counties grew rapidly over the last decade, much of the new housing stock was for-sale, single-family detached housing.

In contrast, the City of Chicago has increased its percentage of region's permitted units, with a particular strength in multifamily units. The Chicago share of the region's total permits grew from nearly 18 percent in 2000, up to highs around 50 percent in 2007 and 2008, down to 36 percent in 2010. As the chart above demonstrates, this predominance relies on multifamily permits, as Chicago generally issued fewer single-family permits than all counties except Kendall. Chicago is the hub of multifamily development for the region, and its percentage of permitted multifamily units in the region ranged from a low of approximately 40 percent in 2001 to a high of approximately 90 percent in 2008.

Suburban Cook also increased both its counts and percentage of regional multifamily development during the beginning of the decade, with multifamily units as a percentage of all permitted units in suburban Cook exceeding 30 percent every year between 2001 and 2006. Both single-family and multifamily permits in suburban Cook have been in decline since 2006. Permitted multifamily units have decreased most significantly, with suburban Cook County's proportion of multifamily permits declining from 12 percent to six percent of the region's total from 2000 to 2010.

Lake and DuPage Counties, which already had a significant amount of developed area at the start of the decade, maintained a steady pace of permitted units, beginning and ending the decade with just over 20 percent of the region's permitted units. These two counties declined as percentage of permitted units during the middle of the decade, but, like Chicago, declined at a slower pace than the region as a whole during the recession and have therefore returned to year 2000 proportions of permitted regional development. Due to the lower overall permit counts in these two counties, their proportion of regional multifamily permits has varied considerably.

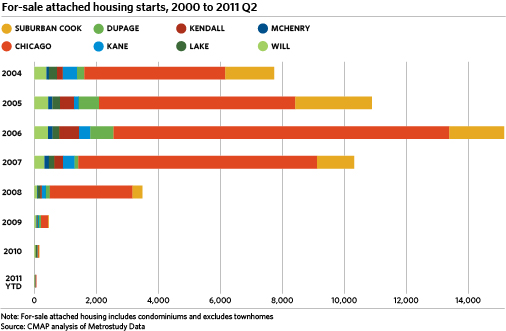

It is important to note that the U.S. Census data on permitted multifamily units is not categorized with respect to for-rent or for-sale units and, as noted above, the City of Chicago actually lost rental units between 2000 and 2010. According to Metrostudy, a major provider of for-sale housing data, for-sale attached housing starts in the region have concentrated in the City of Chicago since 2004 (data is not available prior to 2004). The chart below indicates attached housing starts, meaning projects that have begun construction, from 2004 through the second quarter of 2011. As with multifamily permits, the City of Chicago and suburban Cook County have contained a significant proportion of the for-sale attached housing starts in the region. Further, when the permits above and actual housing starts below are compared, it is clear that a significant portion of the multifamily housing developed in the region over the last decade was for-sale rather than rental, with the exception of 2008 through 2010.

As noted above, providing a balanced supply of housing is a key recommendation of GO TO 2040 and has the potential to increase livability. However, multifamily development in the region has not been balanced. While permitted multifamily attached development since 2006 has matched or exceeded permitted single-family development in the region, the annual number of units under development now are less than 15 percent of the average annual volume produced during the housing boom. Between 2000 and 2006, approximately 93 percent of the new development in the region was single-family homes. Recent multifamily construction activity has concentrated in Chicago and inner-ring suburbs, with the City of Chicago containing approximately 65 percent of the region's new multifamily attached housing over the last decade.

However, many impediments can exist to multifamily development that will continue to direct where new multifamily and affordable construction is located within the region. Addition of multifamily or affordable housing to a community can be contentious, and many municipalities have policies in place that make development for these types of housing difficult. For example, at a recent Urban Land Institute event discussing development potential in the suburbs, developers noted that some suburban communities place cost burdens on multifamily construction through building and zoning code requirements, such that costs can exceed the market rate return potential and prevent new multifamily development from being built. However, encouraging development of multifamily and rental dwellings in transit-accessible locations throughout the region can offer additional housing options to residents at all stages of life and be in line with demographic and economic trends related to housing choice. To address barriers to multifamily and/or affordable housing development in the region, GO TO 2040 offers strategies for communities to facilitate the development of these types of housing, including adopting inclusionary zoning standards, addressing regulatory barriers, and preserving existing housing stock.