This analysis is one of a series examining transportation funding in northeastern Illinois and explaining the revenue recommendations included in ON TO 2050. This analysis highlights opportunities to use tolling and value capture to fund transportation improvements. Other analyses in the series examine existing revenue sources for the regional transportation system, and explain recommendations including using tolling and value capture to fund transportation improvements, expanding the sales tax base, expanding parking pricing, and implementing a federal cost of freight service fee.

By keeping people and goods moving, our transportation system supports the economic vitality and quality of life of northeastern Illinois. But the region has fallen behind in making critical transportation infrastructure investments to maintain and modernize the system. Traditional transportation revenue sources are growing slower than the cost of operating and maintaining the system. As a result, the draft ON TO 2050 plan estimates that the cost of operating and maintaining the transportation system in today’s less than optimal condition will exceed the funds expected to be available under the revenue sources we use today. If the state and region fail to address the imbalance between funding needed and revenues available, the condition of our roads, bridges, and transit system will decline.

The funds available today are not even sufficient for maintaining our current infrastructure. To simply operate and maintain the system, as well as to modernize and improve its condition, the state and the region must pursue additional revenues. To carry out the plan’s transportation recommendations, ON TO 2050’s financial plan proposes five new revenue sources for federal, state, and local lawmakers to pursue, including in the short term increasing the state motor fuel tax (MFT) to at least make up for the cost of inflation since it was last raised nearly three decades ago. Ultimately, the MFT should be replaced with a road usage charge (RUC), sometimes called a vehicle miles traveled (VMT) fee. While this replacement is a long-term transition, the State of Illinois should begin a pilot program in the short term to demonstrate the viability of this new revenue source and consider issues related to fairness and privacy. This analysis explores this ON TO 2050 recommendation, discussing how a RUC could work, policy considerations, and implementation efforts in other states.

Increase the motor fuel tax in the short term

The motor fuel tax is one of the primary state revenue sources for transportation, but several forces have eroded its long-term viability as an adequate or fair source of revenue. The tax revenue depends on how much fuel individuals use -- meaning it is also related to how far people drive -- though its revenues decline as vehicle fuel efficiency increases or drivers shift to electric vehicles. Furthermore, as a tax charged in cents per gallon, the MFT also loses purchasing power over time due to inflation. Finally, actual miles traveled in recent years, and therefore fuel consumption, have grown slower than historical rates. As illustrated below, CMAP projects that, absent any rate change, MFT revenue will continue to decline over time, and both the state and local units of government that receive this revenue will come up increasingly short.

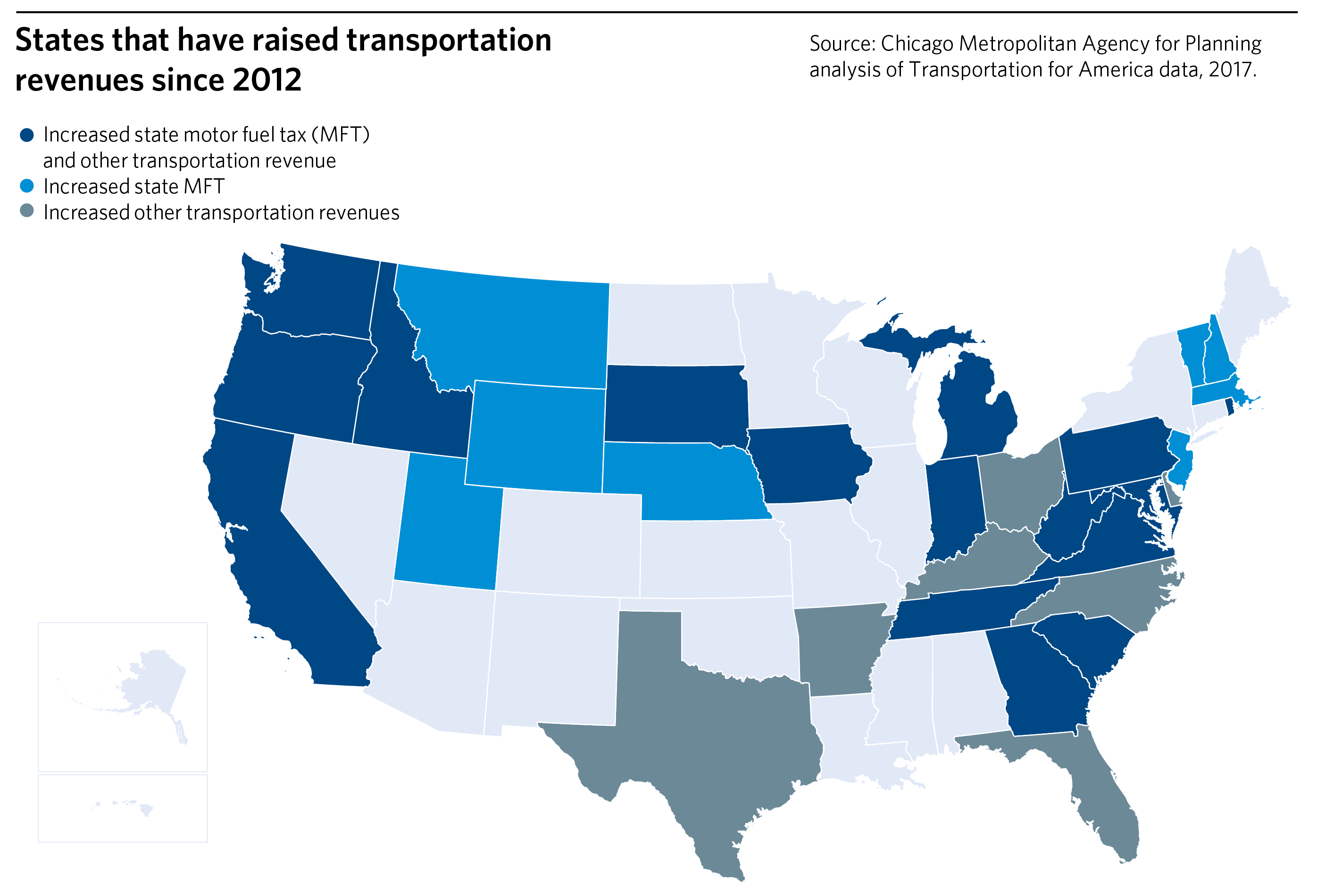

Many other states facing this quandary have recently increased their motor fuel tax rates. The map below shows the 24 states that have increased their MFT rates since 2012, as well as an additional seven that raised other transportation revenues.

GO TO 2040 recognizes that the state’s tax rates on motor fuel -- 19 cents per gallon of gasoline and 21.5 cents per gallon of diesel -- have been in effect since 1990 and are no longer sufficient for the region’s transportation needs. These rates are second lowest among Midwestern states. Thus, the plan recommends the MFT be increased, indexed to inflation to grow gradually over time, and eventually replaced with a more sustainable source. Because the state has taken no action, the ON TO 2050 draft continues and further clarifies this recommendation. In the short term, it calls for increasing the state MFT by at least 15 cents and indexing the rate to inflation. This would offset the long decline in purchasing power of the current rate, bringing it to just below an equivalent 1990 rate. Over the long term, though, the state will need a modern solution to adapt to changing vehicle technology and travel patterns.

Replace the motor fuel tax with a modern road usage charge

In the long term, the ON TO 2050 draft plan recommends full replacement of the MFT with a RUC, which is collected as a per-mile fee when driving on public roadways. While increasing use of fuel efficient and electric vehicles results in environmental benefits, it also means that less MFT revenue -- and in the case of electric vehicles, no MFT revenue -- will be collected for the same amount of driving, which means some drivers are paying insufficient motor fuel tax relative to their use of roadways. The RUC is a more direct and more equitable way of drivers paying for the maintenance needs, safety improvements, and other costs of the roadways they use.

Establishing a simple per-mile RUC could ensure that drivers who travel the same number of miles are charged equivalently. Charging drivers of electric and very fuel-efficient vehicles for mileage traveled is not expected to cut into demand for these vehicles, which would still have the attractive benefit of paying less (or not at all) for the motor fuel itself. In addition, RUCs provide more flexibility than other types of user fees as the transportation system and vehicles evolve, allowing more complex charges that depend on users’ impacts on the transportation system, based on vehicle type or size; roadway type or congestion level; urban, suburban, or rural location; or other factors. To remain an adequate source of revenue over the long term, the RUC rate must be indexed to an inflationary measure.

ON TO 2050 projects that a RUC of 2 cents per mile, indexed to inflation, would provide a sufficient, stable revenue source for Illinois. In contrast, simply increasing the state MFT and indexing the rate to inflation alone would result in 25 percent less new revenue through 2050. This is because fuel consumption is projected to decline.

Learn from pilot programs and implementation in other states

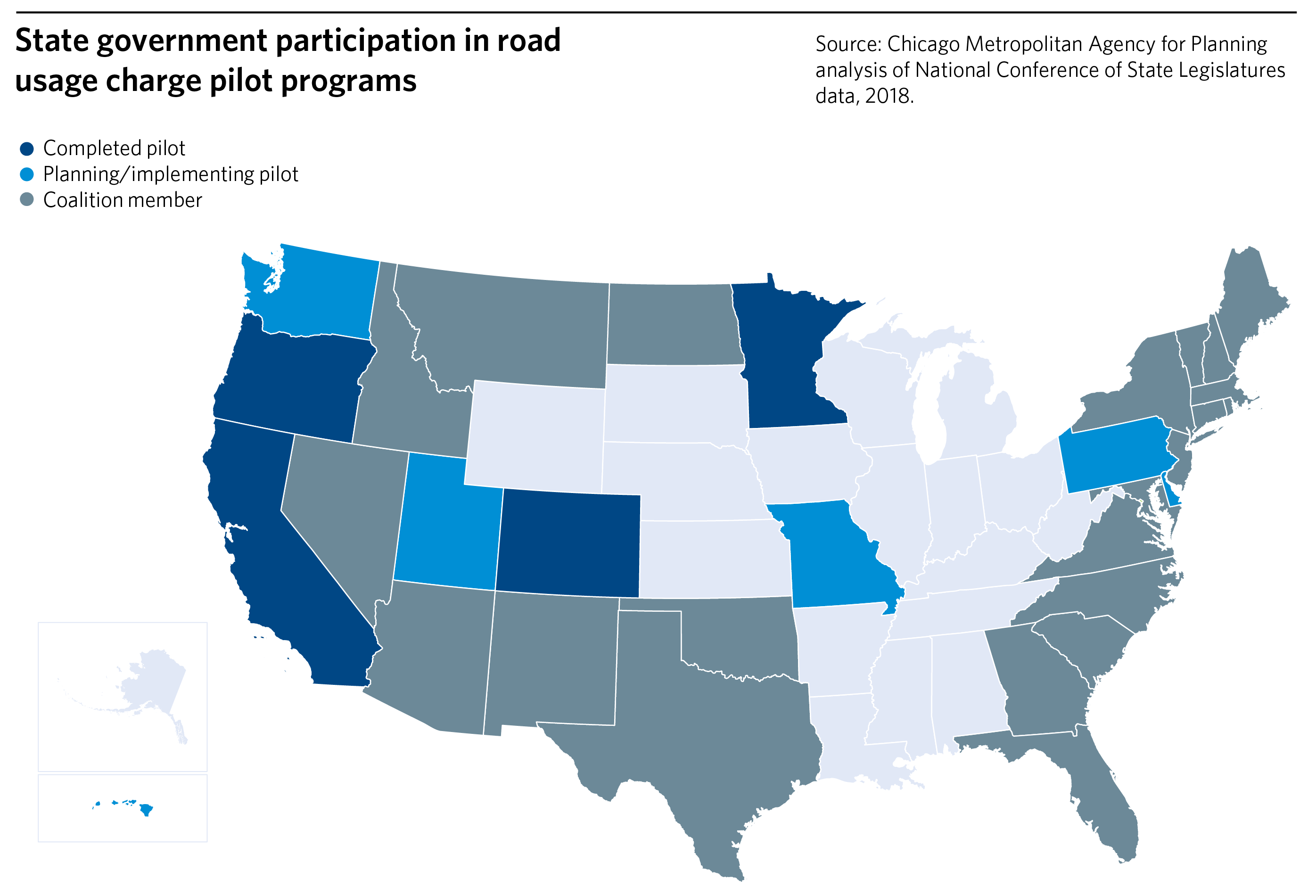

To evaluate options and test processes and administrative mechanisms with residents, numerous states have already implemented RUC pilot programs. The most recent federal surface transportation authorization bill, the Fixing America’s Surface Transportation Act, acknowledged the importance of further study by establishing a $20 million per year program to help state governments conduct demonstration activities. The map below shows states that have completed RUC pilots, are planning or implementing RUC pilots, or are participating in RUC West or the I-95 Corridor Coalition to conduct analysis and share best practices.

The pilot programs have been considered largely successful in demonstrating that mileage-based RUC systems work. While issues related to administration, cost, and technology were identified, post-pilot program evaluations in California, Colorado, and Oregon revealed that most participants were satisfied with their participation and now support modern RUC systems. Oregon, which had previously conducted multiple pilots, now has a voluntary permanent RUC program.

Implementation of a RUC must address trade-offs

Under a RUC program, mileage traveled by each vehicle must be reported. Mileage reporting options considered in other states include flat fee permits that drivers purchase for unlimited road use over a specified time period, odometer readings through self-reporting or at a test location, plug-in devices to record mileage (either non-location-based or location-based using GPS), and smartphone applications.

A modern RUC program in Illinois must balance goals such as reducing congestion and ensuring drivers pay for the value of the roads they use with concerns about privacy and administrative cost. An Illinois program could vary charges for different zones or different roads, for example, in conjunction with congestion pricing efforts to improve traffic management. Programs in other states have been structured to provide multiple options for drivers. Location-based reporting, for example, allows different rates for travel in urban or suburban areas. However, this type of reporting requires more sophisticated tracking of a driver’s location. While more sophisticated methods can allow the fee to be calculated in a more targeted manner, they also may raise privacy concerns for some drivers. Therefore, a pilot program should include multiple options for reporting mileage, allowing their relative benefits to be evaluated. The following chart shows the trade-offs of certain mileage reporting methods.

As policymakers consider the specifics of implementing a RUC, they face numerous other decisions on program structure and policy priorities. Decisions about which agencies or third parties manage accounts and collect data might affect how the public accepts the program. Ensuring privacy and data security will be paramount. Collection of charges from out-of-state drivers must be considered. And establishing sustainable rates will be key to ensuring that revenues from a RUC are adequate to maintain and improve the system. Over the long term, changes to federal law would help to implement a RUC across states.

Policy makers may also be asked to consider the impact on different categories of drivers, such as those who live in rural, suburban, and urban areas. While more study of this is warranted, research conducted for eight Western states indicates that, on average, rural households were expected to save money under a RUC system relative to what they currently pay in state motor fuel tax. Further study should assess impacts on low-income drivers, as well as whether a RUC system could and should charge rates that differ by vehicle weight to address impacts on roadways. A report from the National Cooperative Highway Research Program discusses numerous other issues for consideration, including implementation costs, ease of enforcement, administrative complexity, and user acceptability.

Moving forward

Given the complexity and potential uncertainties of implementing a RUC program -- and the increasing needs of the transportation system -- it is important that Illinois begin detailed study of the issue. Knowledge gained from pilot programs in other states can shape the questions that an Illinois RUC pilot program should seek to answer. Participant feedback can help Illinois policymakers develop a modern RUC that is fair and provides sustainable revenues for the transportation system.

Our state’s current approach to funding transportation will not provide the revenues needed to operate and maintain a high-quality system. Given the significant revenue shortfall projected under the status quo, a modern approach is needed. A short-term increase in the MFT to be replaced by a RUC based on miles driven will provide more sustainable revenues. When invested using performance-based approaches, this revenue can be used to build a modern, efficient transportation system.