Tax Policies and Land Use Trends Strategy Paper

Tax Policies and Land Use Trends

Update: The Tax Policies and Land Use Trends ON TO 2050 strategy paper is now available, and your feedback is welcome. Send your thoughts, ideas, or questions to ONTO2050@cmap.illinois.gov. See our Partner Toolkit to share the report with colleagues.

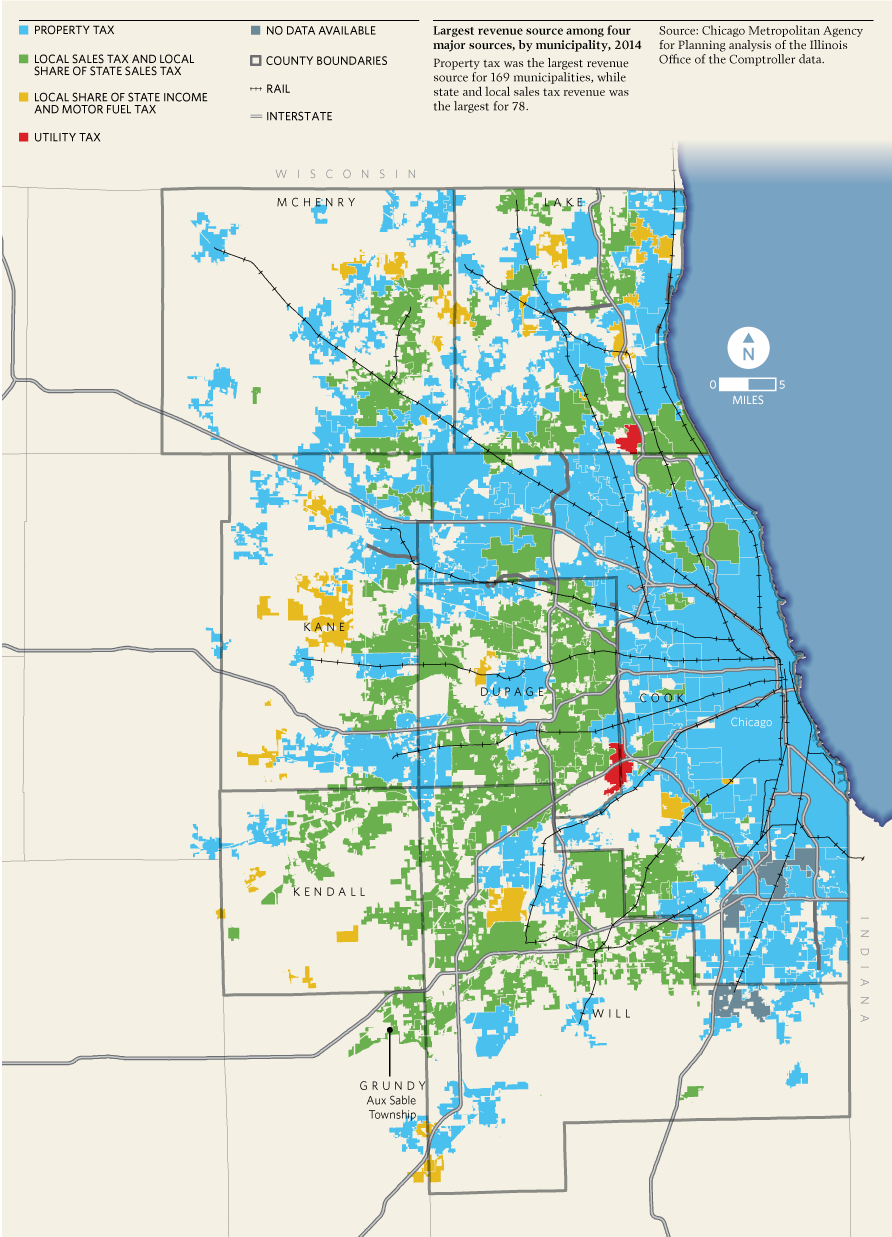

A mix of revenue sources fund local communities in the region.

Communities depend on local revenues to fund the public service and infrastructure investments that attract and retain residents and businesses. The amount of tax revenue municipalities collect depends on the composition of the tax structure. In Illinois, municipalities receive state funds through a variety of statutory means used to share revenue with local governments. In addition, municipalities have several mechanisms to raise revenues, including fees, fines, licenses, and taxation. Municipalities in the region vary in their degree of reliance on these revenue sources.

There is a connection between tax policy and land use.

It is important to ensure that all communities in the region have the ability to generate revenue that supports the land uses that those communities have identified as important to their economic, quality-of-life, and other goals. The structure of municipal tax revenues — and the potential for revenues that can be generated from these taxes — can influence land use decisions and development projects that municipalities pursue. Moreover, because local tax revenue is based to some extent on land use, development decisions have budgetary implications. The connection between tax policy and land use means that a balanced tax structure is integral to support a wide array of land uses.

Ongoing analysis will determine if and how ON TO 2050 addresses the connection between tax policy and land use.

CMAP plans to expand its research on the connection between tax structures and land use and development to determine whether policy recommendations or strategies in this area should be developed for ON TO 2050.

This is your plan.

Continual input by stakeholder organizations and individuals was vital to the development and implementation of GO TO 2040. From now through the next plan's adoption in October 2018 and beyond, CMAP will be engaging a broad cross-section of partners from across the region.

Take a moment to fill out the questions below, and for more information on CMAP's public engagement efforts, please visit www.cmap.illinois.gov/get-involved.